America’s home builders are having a difficult time meeting housing demand, or so they say. While access to credit is cited as a factor that is holding back builders, that’s only a partial cause of builders’ reluctance to put their money where their optimism index mouth is. As NAHB chief economist, Robert Dietz, explains it builders are finding it more difficult and expensive to develop land. Home builders should be thanking the The Federal Reserve for this warped, manipulated landscape, but most builders will likely avoid the discussion. The first rule of fight club is that you don’t talk about fight club.

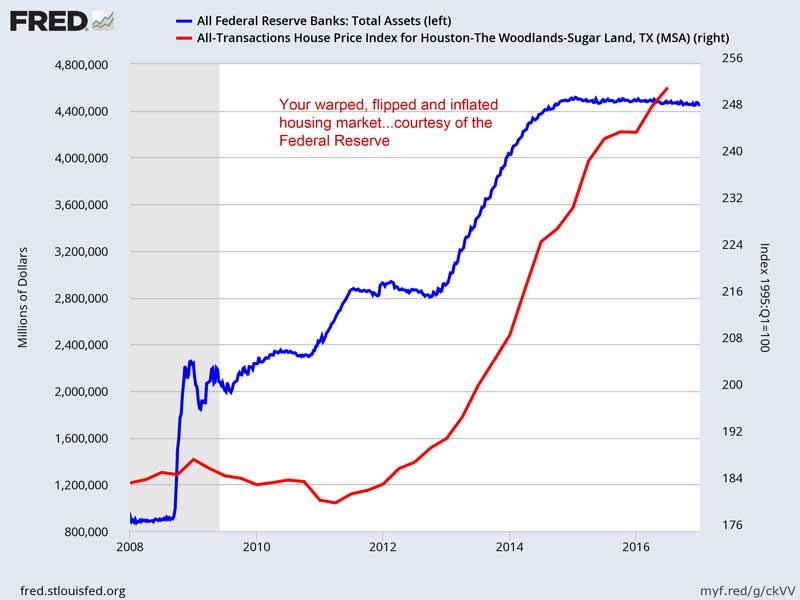

The unfortunate truth is that real demand (at least in the organic sense we are familiar with) no longer exists. When the Fed’s balance sheet is still hovering around $4.4 trillion and M1 money stock is still going parabolic you can safely assume that the financial gurus in the Marriner Eccles building have an agenda. That agenda entails keeping a heavy coat of lipstick on this pig to avoid any unsightly appearances of actual markets.

The U.S. housing market is looking more and more like a paranoid schizophrenic with each passing month. After blowing up spectacularly in 2008 (taking most of the world economy along with it), we now have a housing market that has been reflated to new nominal highs. By most appearances things are back to normal, unless you really start to look beneath the headline statistics. Once you peel back the curtain you find a bi-polar housing market riddled with distortions and dislocations, all of which were facilitated by the Fed’s monetary shell game.

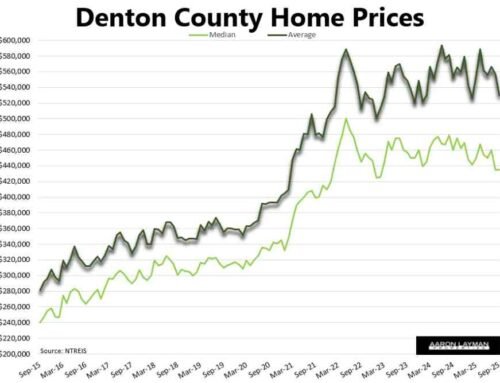

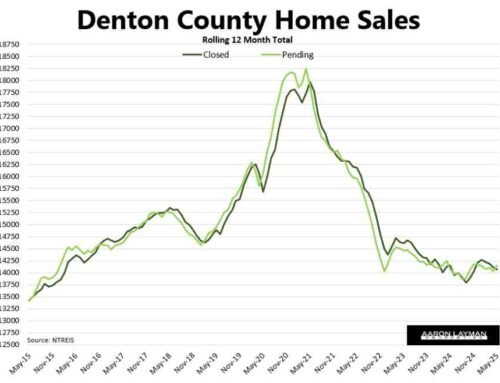

Here in Houston Texas we are seeing the fruit that the Fed and its member institutions have wrought. Behind the headline numbers that show record sales and higher home prices you have a backdrop of stagnation and prices that are actually rolling over from the top down. Builders are having a difficult time meeting demand for affordable homes because the Fed spent the last 8 years tossing real markets and any semblance of affordability out the window.

U.S homes are now just another financialized asset detached from traditional supply and demand forces. Mark Dietz said the housing industry will be in good shape when it hits 1.3 million single-family starts a year. Unfortunately I think it’s going to take longer than the 3-4 years he mentions to get back to those levels. America’s new landlord is kicking citizens to the curb with the rental empire constructed out of the Fed’s largesse.

As we closed out 2016 interest rates were spiking north of 4 percent. That caused more than a few palpitations in the home building industry. A few days ago the FHA responded to the scene by lowering FHA mortgage insurance premiums by 31%. This should help cushion the blow to some rate-sensitive new home buyers. It won’t, however, fix what’s ailing the housing market. The elephant in the room is not going to be discussed among those who are charged with feeding the elephant.

It looks as though America’s premier financial parasites will again be wrapping their tentacles around yet another White House administration. It remains to be seen how the new administration will deal with housing. Monday the Government Accountability Office (GAO) showing that only $22 billion of the $37 billion TARP funds had been disbursed. That stands in stark contrast to the $7.8 Trillion in virtually zero-interest loans handed to just 4 large U.S. banks to make them whole and then some.

The last 8 years have been interesting to say the least. By all accounts it was a virtual fraud fest among America’s largest financial institutions, yet no U.S. bank executives were ever called to personally account for their sins. The Fed was AWOL in its role as a regulator of those same banks.

It’s rather laughable that an executive at a foreign automaker (VW) was just arrested for fraud charges. This theatrical appearance of justice was completely absent when it really mattered back in 2009. The next four years could be equally challenging, if not more so. With the Trump administration basking in the warm embrace of the vampire squid, it’s probably a good time to hold on to your wallet.

As long as the Fed continues to prevent real price discovery, any “recovery” in the housing market will succumb to the natural forces of gravity. We are already seeing that gravitational pull exert itself on home builders. There are only so many people you can sell a new $500,000 home to. If home builders want to pick up more sales they will have to build more affordable homes. That is a difficult proposition indeed, and virtually impossible now in many markets thanks to the efforts of the Fed.

U.S. consumers are already stretching beyond their breaking point. Home builders could find the market more challenging than they think…

Very nice article, the housing market has many parts and should not be considered as one piece or sector. The housing picture is not brightening and most likely will not because the benefits of historically low interest rates are mainly behind us. The future of the housing market is a topic that has been subject to a great deal of debate and confusing with those controlling the narrative, big builders and realtor associations wishing to drive sales.

A major issue is that huge discrepancies exist in the cost of housing in the various markets across America and while price variations are not uncommon they should be seen as a red flag and reason for caution.