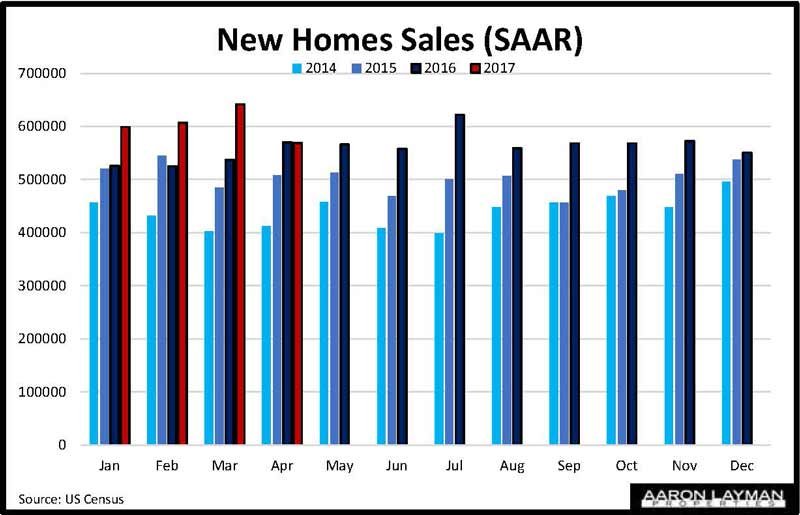

So much for the Trump bump euphoria. New home sales tumbled in April, posting at a seasonally adjusted annual rate of 569,000. This was 73,000 below the revised March figure and far below analysts expectations. Then again analysts haven’t been paying attention to the real economy, so this latest data is not a surprise to anyone who doesn’t have their head in the sand.

Year-over-year, new home sales for April are back to unchanged according to the latest Census figures. And just like that, the “pent up demand” that pundits have been talking about has been vaporized.

The median price of a new home contracted in April was $309,200, down over $12,000 from last year. The average price of a new home contracted in April 2017 was $368,300, a drop of $11,700 from April 2016. The sharp reversion of new home sales suggests the animal spirits percolating in the first quarter of the year have given way to the continued theme of stagflation and weak economic growth. Even with relatively tame interest rates, new home sales for April exhibited a rather pronounced correction in volume and pricing.

I am not surprised at all by the latest reading on new home sales. I think the mean reversion was built into the cake. It was only a matter of time before the election cycle euphoria ran into the headwinds of reality. That reality here in Houston Texas is certainly not conducive to higher home prices, or higher sales volume unless builders can put more affordably-priced product on the ground.

If the Fed was looking for an excuse not to hike rates in June they just received it. Mr. Market’s bull run is looking long in the tooth. Ditto for the housing market “recovery”. It will be interesting to see if Janet and her merry band of tone deaf bankers have the guts to follow their crony capitalist script. Does the Fed really believe their flawed models and their warped sense of economic stability that only exacerbates wealth and income inequality? We will find out soon enough.

Leave A Comment