Housing inflation in North Texas is much worse than official statistics would have you believe. This is a feature, not a bug of the financial system we live in. The Federal Reserve’s preferred measure of housing inflation, owners’ equivalent rent, is a comical joke which is purposely used to provide the appearance of tame, measured inflation in the U.S. economy. Many government officials use the official CPI measure of housing inflation despite its inherent flaws in capturing actual home price inflation experienced by consumers and home buyers.

The CPI measure of owners equivalent rent is essentially a convoluted mess designed to distract from actual housing inflation. Here’s how the Bureau of Labor and Statistics explains the calculations for officially accepted measures of U.S. housing inflation.

“The expenditure weight in the CPI market basket for Owners’ equivalent rent of primary residence (OER) is based on the following question that the Consumer

Expenditure Survey asks of consumers who own their primary residence:

“If someone were to rent your home today, how much do you think it

would rent for monthly, unfurnished and without utilities?”

The following questions, asked of consumers who rent their primary residence, are

the basis of the weight for Rent:

“What is the rental charge to your [household] for this unit including any extra charges for garage and parking facilities? Do not include direct payments by local, state or federal agencies. What period of time does this cover?”

So after some survey questions and some formulas manipulating those estimates you get a CPI measure that by its own admission does not take into account property taxes and home maintenance costs.

“Why doesn’t the CPI include the cost of buying and financing houses as well as property taxes and home maintenance and improvement?” Great question!

From there, we get an even better question, to which the BLS has no credible answer.

“Why does the CPI use Owners’ equivalent rent for owner-occupied shelter?

The consumption item that residences provide is the shelter service that their occupants receive. For renter-occupied dwellings the cost of this service is the rent

the occupants pay for its use for a period of time. The most efficient way to measure the price of the shelter service owner occupants receive from their homes is to estimate the rent that the residence would command.”

No Virginia. The most efficient way to measure the price of shelter is to actually measure the real price of shelter. Your official estimates aren’t worth the paper they’re printed on. Here’s a chart showing the Case-Shiller national home price index compared to the government’s official measure of housing inflation, owners’ equivalent rent. Taking the longer view, you can see why OER is the official gauge of inflation. It makes it appear as though there is little housing inflation, when the reality consumers are experiencing is quite different. The truth is that constant tinkering in the housing market creates imbalances along with boom and bust cycles. The latest reading for the Case-Shiller national index showed an 8.4 percent increase in U.S. home prices. That’s nearly 4 times the 2.3 percent reading we get from the latest reading of owners’ equivalent rent.

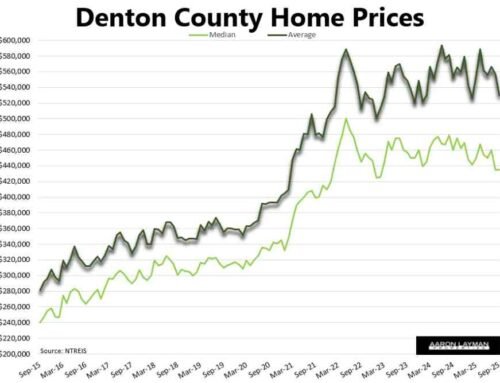

Real housing inflation in the Dallas-Fort Worth area is much higher than those expert economists would have you believe. The price per square foot of a DFW home has been shooting through the roof even as the official metric of housing inflation has been falling in recent months. OER for the DFW area fell from 5.4 percent in May down to 3.2 percent in November. North Texas home prices are increasing three times as fast as the official CPI measure when you look at prices on a per square foot basis. Total average prices are rising four times as fast as the official CPI measure of housing inflation.

To put it in Layman’s terms, the official CPI measure of housing inflation is a piece of trash. It’s the equivalent of scrap lumber reconstituted and used to frame your new home on a foundation of quicksand if that quicksand was also part of a tar pit.

The CPI’s measure of housing inflation makes for polite dinner conversation among economists and government officials, particularly those working at the Federal Reserve. While they are busy trying to inflate away massive piles of debt, some of these same officials are also lining their pockets as the banking system embraces reckless endangerment on multiple fronts. This is all happening while executives running America’s largest banks continue to receive endless taxpayer bailouts.

As fate would have it we learned the new incoming Treasury Secretary, Janet Yellen, has earned over $7 million the past three years from speaking engagements to Wall Street. It’s a rather long list of lucrative engagements for the labor economist and former Fed chair. After maintaining the liquidity lifelines (bailouts) to Wall Street banks from 2014 to 2018 at the Federal Reserve, Janet apparently had a lot of valuable advice to many of those same banks and hedge funds. Janet earned over $800,000 on just three engagements with Citadel (Ben Bernanke’s current employer). It would be really interesting to see the transcripts of what Janet said to those Citadel execs that was worth $200,000 per hour. I’m sure they’ll be releasing the transcript for everyone to read, right after you get your $2000 stimulus check. It would also be fascinating to see what Janet said to the executives at Citigroup. The investment bank doled out $1.1 million to Yellen for six speeches between March 2019 and October 2020. If these companies and others are lobbying Treasury and Congress, which they are or have done in the recent past, that’s a huge conflict of interest for grandma Yellen.

I’m sure Janet is a nice person and everything she’s done is above board. That doesn’t mean it’s not a glaring conflict of interest to be taking huge sums of money from corporations she could be charged with regulating. Many neoliberal pundits are quick to play the female scrutiny card. Spare me the bullshit. It doesn’t make a difference whether it’s Janet, Jerome or Ben. The current financial system has devolved into a revolving door of Wall Street-DC insiders ripe for the picking. Pay for play is on full display. Filing an ethics disclosure revealing significant conflicts of interest, doesn’t remove the significant conflicts of interest. It just makes the lies of the establishment elite more socially acceptable so they can look themselves in the mirror without vomiting.

When you’re out shopping for a home this spring remember that housing inflation is muted. That’s the lie, and they’re sticking to it.

Leave A Comment