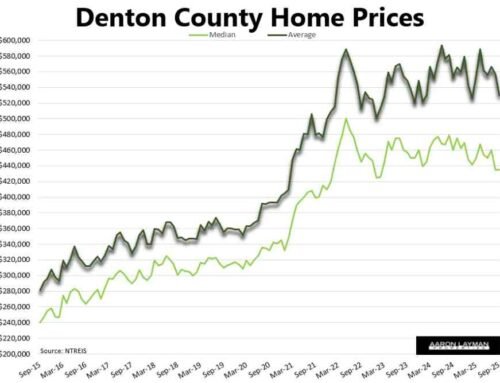

Denton County existing home sales declined 11 percent in the month of October. Sales of existing single-family homes were a bit softer still. Pending sales of existing resale single-family properties in Denton County currently show an 18 percent decline for October. These updated NTREIS figures for Denton County Texas show that the correction in the North Texas real estate market is still in play. We are nearing the end of the month following the official press release, so don’t expect any significant improvements to the numbers. As I mentioned in my October housing market report, sales continue to stagnate in the Dallas Fort Worth area under the pressure of higher interest rates and inflated home prices.

The National Association of Realtors reported an existing sales decline of 5.1 percent for the month. While the business media was trying to salvage the latest reading from NAR by touting the month-over-month increase of 1.4%, the underlying data show that the U.S. housing market is still getting pinched from a reversal of fortunes in terms of asset inflation and the Fed’s policy failures. Prices for existing homes sold in the U.S. posted at $255,400, up 3.8% from last year. Months of inventory for existing homes stood at 4.3, up from the 3.9 months of supply seen last year. Let me repeat that data point again in cased you missed it. According to NAR, there were 50,000 more homes for sale in October yet sales declined 5.1% year-over-year.

Interestingly enough, NAR is now begging the Fed to halt those interest rate increases…

“Rising interest rates and increasing home prices continue to suppress the rate of first-time homebuyers. Home sales could further decline before stabilizing. The Federal Reserve should, therefore, re-evaluate its monetary policy of tightening credit, especially in light of softening inflationary pressures, to help ease the financial burden on potential first-time buyers and assure a slump in the market causes no lasting damage to the economy.” Lawrence Yun – Chief Economist, National Association of Realtors.

Of course Yun, many Realtors, and various real estate industry mouthpieces were completely silent on the issue of artificial asset inflation during the last several years, the period in which we saw rampant, artificial home price inflation. Higher prices generally mean higher commission checks. Go figure! Hypocrisy knows no bounds, and as proof of that I will offer up Mr. Yun’s take on the “autumn revival” of October existing home sales in 2016, a period not too long ago where the Fed was still holding down rates with that massive balance sheet.

“October’s strong sales gain was widespread throughout the country and can be attributed to the release of the unrealized pent-up demand that held back many would-be buyers over the summer because of tight supply.” Lawrence Yun, October 2016

As we are finding out in the North Texas real estate market, a bubble that was created by central bank intervention can most certainly deflate when that intervention reverses course. Following the last housing crash, the Fed blew another, larger bubble spread among multiple asset classes rather than just a real estate bubble. As the bills on the debt keep piling up, the evidence of the Fed’s policy failures will likely continue to accumulate as well. The latest weekly reading on mortgage purchase applications showed a 5% year-over-year decline. New housing starts and permits for October were also down. These readings should not be surprising…at least not for anyone who has been paying attention.

Leave A Comment