The Federal Reserve increased the Federal Funds rate to a range of 0.75-1.00 percent. The 50 basis-point rate hike was largely expected. Powell shot down any talk of a 75 basis-point hike. Jerome Powell also announced that balance sheet reduction would begin June 1st. The FOMC statement.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in conjunction with this statement.”

Balance sheet reduction was punted to June 1st. Here’s the Fed statement on balance sheet normalization.

“The Committee intends to reduce the Federal Reserve’s securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

Over time, the Committee intends to maintain securities holdings in amounts needed to implement monetary policy efficiently and effectively in its ample reserves regime.

To ensure a smooth transition, the Committee intends to slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level it judges to be consistent with ample reserves.

Once balance sheet runoff has ceased, reserve balances will likely continue to decline for a time, reflecting growth in other Federal Reserve liabilities, until the Committee judges that reserve balances are at an ample level.

Thereafter, the Committee will manage securities holdings as needed to maintain ample reserves over time.

The Committee is prepared to adjust any of the details of its approach to reducing the size of the balance sheet in light of economic and financial developments.”

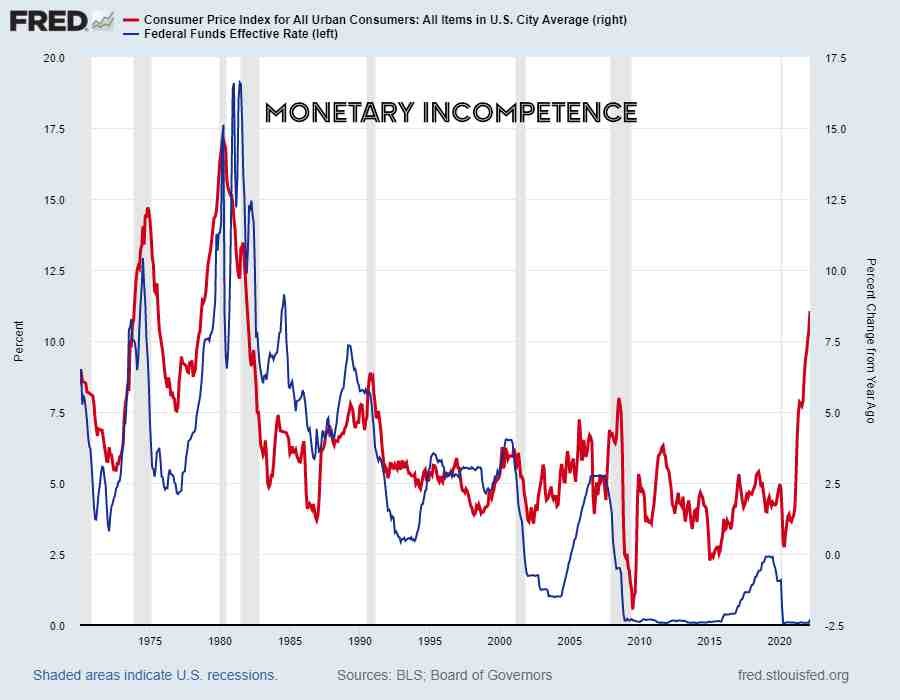

After dumping $trillions in trickle-down liquidity into the financial system creating an embedded wage-price spiral, Powell had the nerve to say that it was the Fed’s job to prevent such a wage-price spiral. That’s why the Federal Funds Rate is still parked below one percent on the lower bound when inflation is ripping above 8 percent. As Powell put it, the Fed is acting “expeditiously” to prevent the kind of problems which have already happened.

You have to admit it’s pretty comical for a former private equity ghoul like Powell to suggest the Fed really understands how American consumers are getting pinched by rampant inflation. For a guy worth close to $100 million, Powell must have a really sensitive empathetic side to his private equity underpinnings.

For their part the lapdog financial media played their normal routine. There was really only one decent question during the post-FOMC press briefing. That video is here. Someone asked Powell if the Fed had a credibility problem. Powell answered that rhetorical question with a simple “no”. Strangely, the reporters at the press briefing had no questions for Powell relating to the largest trading scandal in Fed history, and the subsequent lack of any outside investigation. 7 months after multiple FOMC officials took early resignations, there are still no investigative findings. Powell still hasn’t made the exact dates of Robert Kaplan’s personal trades available for public information.

You may recall that Kaplan, the former head of the Dallas Federal Reserve branch was knee deep in the S&P futures markets.

“The strange thing about Derby’s reporting on Kaplan is that it didn’t capture the most scandalous aspect of Kaplan’s trading. According to Kaplan’s financial disclosure forms, he was trading in and out of S&P 500 futures in lots of “over $1 million.””

Considering Powell himself was also involved in the trading mess, one can imagine that Powell is certainly relieved no one at yesterday’s press briefing even brought up the subject. We’ve apparently moved on to more important things like expeditiously enabling the most reckless central bank in U.S. history.

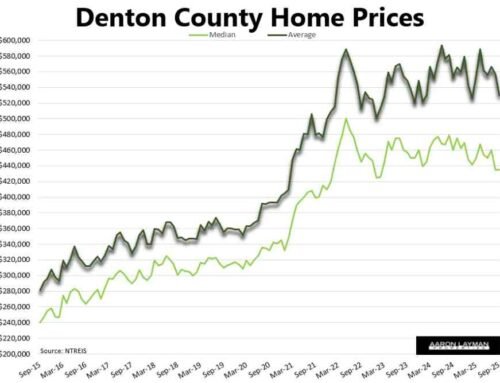

Next week’s Consumer Price Index will show that inflation is still raging and the Powell Fed is still behind the curve. Home prices have been ripping to new highs while the Fed tries to achieve the elusive soft landing. For his part, Powell still believes a soft landing is possible. Apparently no one showed him the memo on the Fed’s track record for achieving soft landings. NGMI (Not Gonna Make It)

By punting balance sheet normalization for another month, Powell has guaranteed that inflation remains firmly entrenched while he and his FOMC cronies dither about how to extricate themselves from the mess they have made. We may get a week or two of stabilization on the mortgage rate front, but any relief will likely be short-lived. A correction in the housing market is inevitable at this point.

The Federal Reserve spent the last two years pretending inflation was transitory, when it obviously was not. Jerome continued to gaslight the American people he pretends to work for. Powell stated that Fed policy has little to do with supply chains so the Fed was focused on demand. The lapdog media of course took this statement in stride pretending the two are not intricately related. What Powell should have said if he were being truthful is that Fed policy can seriously screw up supply chains by having too much liquidity chasing a finite amount of goods. Jerome, unfortunately, has a loose attachment with the truth.

It’s going to be interesting if all of the genius economists end up eating crow regarding the current housing inventory problem. Industry pundits and economists continue to pretend we have to build our way back to reasonable levels of inventory. In truth, all it would take for inventory to get back to more historical levels is an end to the speculation and overt financialization of the U.S. housing stock, the same financialization which has been encouraged by reckless central bank monetary policy.

We shouldn’t be surprised. The Fed is quick to pull the trigger and go all-in when it comes to those trickle-down bailouts enriching existing asset owners. They demonstrate much more restraint when it comes to pulling away the punch bowl and inflicting any pain on the markets. A recent survey from Moody’s Analytics shows that home prices in the DFW area are 33 percent overvalued. “Of the 392 metropolitan statistical areas it looked at, 96% are “overvalued.” Among those 392 markets, 149 are overvalued by at least 25%.”

Best monetary policy money can buy.

Leave A Comment