The Federal Housing Finance Agency (FHFA) just poured cold water on the refi party with an Adverse Market Refinance Fee. Although rates may still be near record lows, come September 1st refinance mortgages will incur an additional 0.5% fee. Both Fannie Mae and Freddie Mac will be raising their fees for refinance mortgages as part of an effort to shore up capital reserve buffers. Apparently FHFA is worried about increasing risk of the GSEs loan portfolios. There are still close to 4 million American borrowers on mortgage forbearance programs. What happens when those programs end is still a big question mark.

For consumers the new half point fee for a refinance mortgage of $300,000 would equate to a $1500 penalty tacked on to the loan. While rates are still spectacularly low, those looking to refinance are probably not going to be amused. The mortgage industry and their lobbyists are already crying foul. The good news is that the new fee will not apply to purchase mortgages.

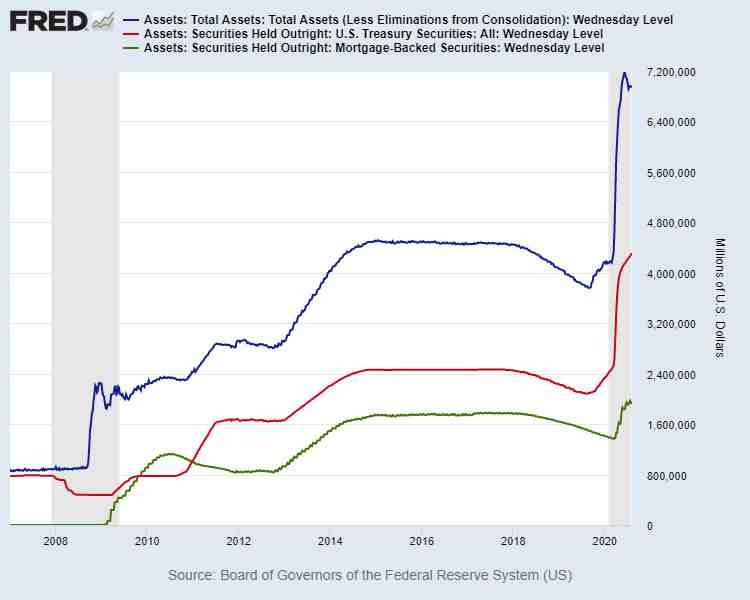

The FHFA’s timing with this Adverse Market Refinance Fee is still a bit ironic. The Federal Reserve has been buying $billions of agency mortgage backed securities (MBS) every month to drive interest rates down and help stimulate the housing market. It kind of makes you wonder what FHFA is seeing with the loan level data that they aren’t talking about.

Refinance mortgages are inherently more risky than purchase mortgages for the simple fact there is no arms-length transaction to validate the real value of the property. This is particularly the case since many recent refinance mortgages have been performed with appraisal waivers. So you really have two factors of risk added to the pool of loans underwritten this year. We saw what happened when Americans had a cash-out refi party prior to the Great Recession with everyone assuming home prices could never fall. Those untested assumptions generally don’t fare too well.

Fannie Mae’s letter is calling the new fee an “Adverse Market Refinance Fee”

“In light of market and economic uncertainty resulting in higher risk and costs incurred by Fannie Mae, we are implementing a

new loan-level price adjustment (LLPA).” The new fee is effective for “whole loans purchased on or after Sep. 1, 2020, and loans delivered into MBS pools with issue dates on or after Sep. 1, 2020.”

Freddie Mac’s statement on the Adverse Market Refinance Fee reads as follows:

“Effective for Mortgages with Settlement Dates on or after September 1, 2020 a 50 basis point Market Condition Credit Fee in Price will be assessed for cash-out and no cash-out refinance Mortgages except for Construction Conversion Mortgages that qualify for single-closing Interim Construction Financing and Permanent Financing as described in Guide Sections 4602.3 and 4602.5. For cash-out refinance Mortgages, this Credit Fee in Price will be assessed in addition to the existing Cash-out Refinance Indicator Score / Loan-to-Value Credit Fee in Price.”

Leave A Comment