In a Q&A session and virtual chat covering monetary policy and the U.S. economy Jerome Powell floated another laughable statement regarding the strength and soundness of the U.S. financial system. Just like his predecessors before him, Powell is apparently willing to feed the financial media whatever it wants to hear, even it has no affiliation with the truth.

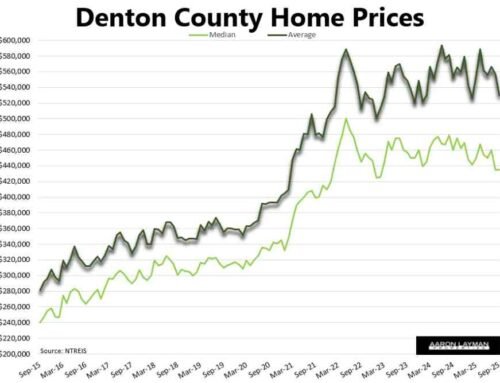

Federal Reserve Chairman Jerome Powell said the Fed will maintain the current course of printing money like there’s no tomorrow until it sees substantial progress towards its goals of 2 percent inflation and maximum employment. It is well-established among many outside the Fed that the 2 percent inflation target the Fed keeps chattering about is a laughable ruse. When it comes to real inflation Americans really experience in the things they really need (see housing, healthcare, education, take your pick), inflation well above a 2 percent annual rate. Real housing inflation is three or four times the Fed’s magical goal post.

The real kicker in the Thursday chat with Jerome Powell came when he said there were no real imbalances in the financial system leading up to the Covid pandemic. With a completely straight face, Powell performed an encore Pinocchio special as he delivered this gem into his webcam:

“I would say there were no obvious imbalances that threatened the long, ongoing expansion. You really can’t identify something that looked like, if this blows up, it could blow up the expansion. The banking system, as I mentioned, was much better capitalized, had much more liquidity, a far greater appreciation of its risks, through banks stress testing and such.”

Of course everything in that statement is a pile of horse manure. If Powell really believed what he was saying, he and his colleagues would not have been throwing tens of billions of dollars every night into the repo markets for consecutive months to prop up the house of cards because of the “imbalances” Powell apparently can’t see. Hind sight is apparently really good if you are wearing beer goggles.

It is becoming increasingly obvious that Federal Reserve mouthpieces have no shame. Powell seems to believe the internet never existed. Why else would he would make such an incredibly ridiculous statement which is clearly not true?

The evidence of those “imbalances” is readily available. This piece in January 2020 lays out the problem very clearly, and this was a month before the pandemic had reached U.S. shores. By this time the Federal Reserve had already performed $500 billion in overnight emergency surgeries to keep the U.S. financial system stitched together.

‘The Fed Has Pumped $500 Billion Into the Repo Market. Where Does It End?’

“When the Federal Reserve began offering these daily agreements in late September 2019 it was the first time it has intervened in repo markets since the Great Recession. The United States’ central bank has funneled roughly $500 billion into the repo market since then in what was originally pitched as temporary operations that would end on October 10, 2019 — but the daily repo bids are still coming. Currently, there is $229 billion in outstanding repos on the Fed’s balance sheet.”

‘Why the Repo Market Is Such a Big Deal—and Why Its $400 Billion Bailout Is So Unnerving’

“It’s suddenly in the news again, and for all the wrong reasons. The repo market is looking a lot like it did on the precipice of the 2007 housing market crash.”

‘The repo market is ‘broken’ and Fed injections are not a lasting solution, market pros warn’

“The New York Federal Reserve has spent hundreds of billions of dollars to keep credit flowing through short term money markets since mid-September when a shortage of liquidity caused a spike in overnight borrowing rates.”

I guess Powell wants us to all sleep soundly knowing that his millions in Blackrock holdings are doing just fine. Nothing to see here; move along. The waffle house will remain open until the roof comes crashing down.

Leave A Comment