Denton County new home prices broke new records last month, responding to the Fed’s massive $7.92 trillion bubble-blowing balance sheet. While the Federal Reserve continues $120 billion per month in asset purchases ($80 billion in Treasuries and $40 billion in MBS), average new home prices in Denton County hit $477,587. That was a 27.4% jump from the same time a year ago.

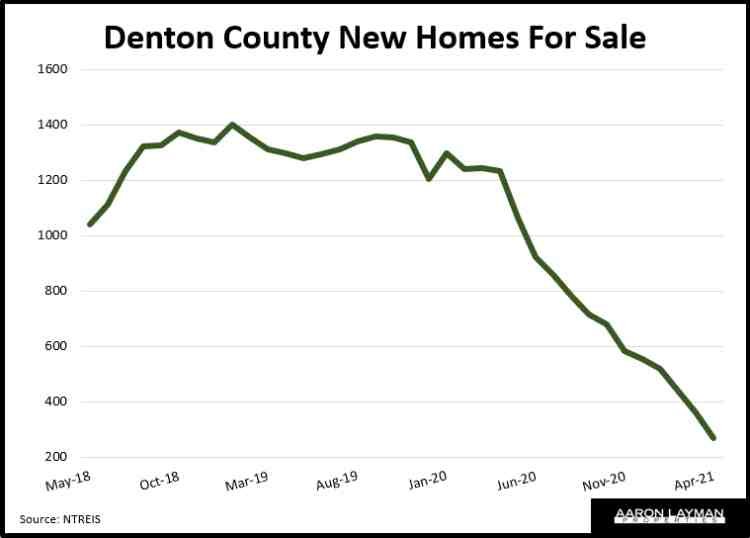

New home prices have been skyrocketing higher this year as available new home inventory has all but vanished. Closed sales of new construction in Denton County plummeted 30 percent in April. Pending sales of new construction were down 28.5% from last year. You can’t sell what’s not available.

NTREIS figures show 269 new construction homes for sale in a county of roughly a million people. That translates to about 3 weeks of inventory for new homes in Denton County. With no resale inventory available, new construction has been the only game in town this spring. Even that well is running dry now, and prices have hit the roof. Builders are sitting on long waiting lists. You’re lucky if you can get a builder to open a model home or answer a phone call.

This is the state of the current housing market heading into the summer, and once again the Fed is woefully behind the curve. There’s a huge cohort of buyers being forced to lock into ridiculously inflated prices. Jerome Powell and various FOMC officials are still babbling about 2 percent inflation targets and a potential taper of those huge asset purchases some time in the future.

Today’s S&P Case-Shiller numbers showed the national index for home prices up 13.2 percent in March. The index was up 13.4 percent for Dallas. While Dallas Texas did not see a huge ramp in prices during the last housing crisis, North Texas has made up for lost time with the Federal Reserve’s balance sheet expansion. Average new home prices in the DFW area are up 19.5 percent from April of last year to a record $421,473. Hedonic quality adjustments don’t make the picture look any better.

U.S. new home sales for April came in much lighter than expected according to Census estimates. The March figures were revised sharply lower as well. Prices were sharply higher and inventory remains extremely low. It’s not surprising to see some buyers finally walking away from this carnival show created by the Federal Reserve. There are still plenty of buyers flush with cash willing to brave the markets, but the clock is ticking. Real estate prices are always formed at the margin, and those margins can turn on a dime.

There is some hope on the inventory front. Foreclosure moratoriums are coming to an end. The Texas legislature is also trying put an end to eviction moratoriums as well. The inflation Powell and his colleagues have been pushing for has reaped a bountiful harvest. Homes and land prices are through the roof. Builders can’t keep up with demand, but a lot of that demand is fickle. Let’s just call it speculative stimulus-induced demand. It remains to be seen how the housing market will hold up on its own merits.

The home building industry is enjoying healthy profits with the ability to push home price increase onto customers. Texas-based D.R. Horton’s press release shows they spent $350 million in the second quarter of fiscal 2021 on share buybacks. The country’s largest builder is also getting in on the buy-to-rent craze. While major U.S. home builders are complaining about escalating material costs as they struggle to keep pace with consumer demand for affordable homes, they apparently have plenty of cash for share buybacks and new rentals.

“During fiscal 2020, the company began constructing and leasing homes as single-family rental communities. After these rental communities are constructed and achieve a stabilized level of leased occupancy, the company generally expects to market each community for a bulk sale of homes.”

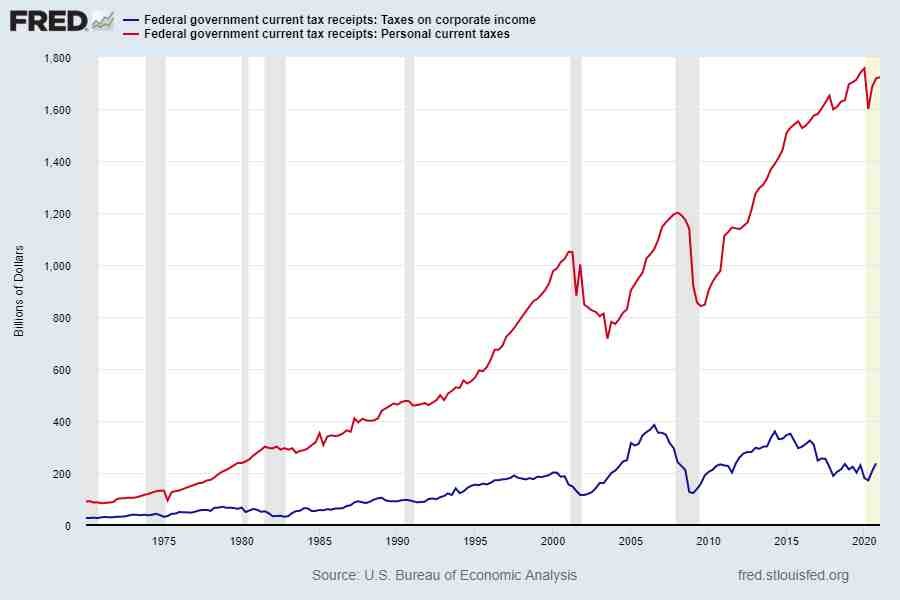

This is the hyper-financialized housing market the Fed has facilitated during Covid. As the debts continue to mount and the bills come due, big business is frantically trying to shift the debate about who is going to pay for all of the bailouts.

What could they possibly be concerned about?

Leave A Comment