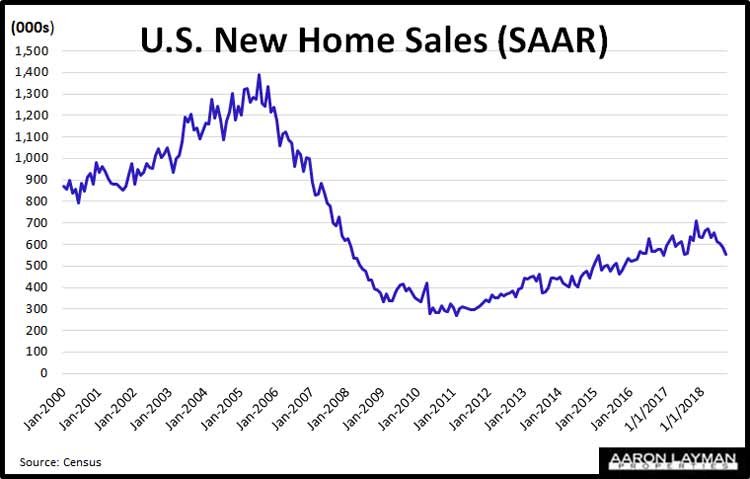

The Census Bureau reported new home sales for September this morning at a seasonally adjusted annual rate of 553,000. This was 5.5 percent below revised August numbers and a 13.2% drop from September last year. The numbers for September new home sales were well below estimates, and they came on top of big downward revisions for previous months as well. Both the median price ($320,000) and the average price ($377,200) were below prices seen last year. The supply of new homes on the market swelled to 7.1 months in September. That translates to a 34% increase in the supply of new homes on the market compared to September of last year!

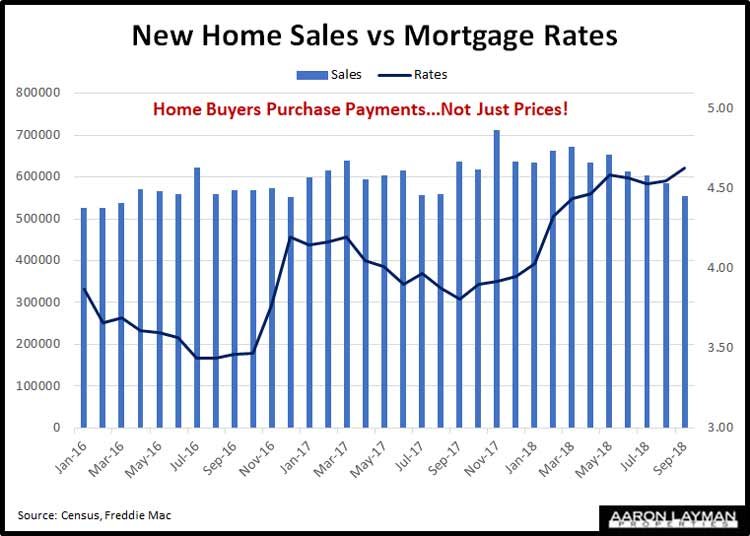

It would appear that higher mortgage interest rates have diminished home buyers’ appetites for new homes. As I have been saying all along, people buy payments, not just end prices. This is why one of the major home construction indexes has been flashing giant warning signs all year. Stagnating buyer demand is probably behind the decision of one major builder to slight owner-occupant buyers in favor of the deep pockets of a Wall Street landlord. Softening demand for credit is also likely why Fair Issac just announced a new UltraFICO credit score formula which could potentially improve the credit scores of millions of Americans. When the going gets tough, leave it to Wall Street to break out tried and tested schemes like more subprime lending.

Interestingly enough, I had a local builder call me yesterday to get my opinion on where they should be pricing a new section of homes in the Denton County area. The attached chart of new vs existing sales should provide a hint as to what I told this sales representative. In the attached chart of new home sales vs mortgage interest rates, the detachment of buyer demand is clearly visible. Rates didn’t even have to hit 5% before demand started falling off this year. That’s because home prices have been artificially inflated across the board by Fed policy. With the Fed pulling away the punch bowl and raising interest rates, it is not surprising to see demand for expensive assets cooling. This is why I trust the economists working for real estate industry trade groups about as far as I can throw them. Virtually no one in the real estate industry wants to talk about the artificial nature of current home prices, something I have been warning about for years.

New home sales in the Dallas-Fort Worth area were still higher year-over-year in September, with pending new home sales showing an 8.2% rise compared to last year on basically flat prices. Pending sales of new construction in Denton County are currently showing a 2% decline compared to last year, with new home prices that were 1.3% lower than September 2017. As a reminder, the Census Bureau counts a new home sale at the time of contract signing, so pending MLS sales would be the best comparison.

Leave A Comment