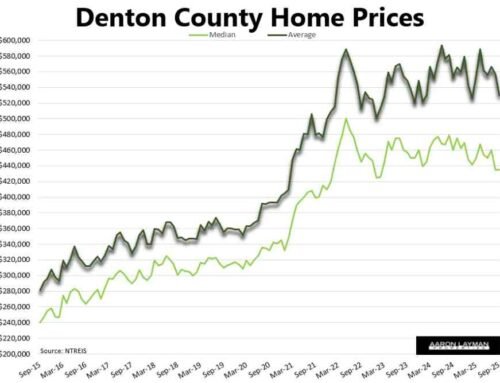

Denton County home prices and sales volume have remained strong into the holiday season. After experiencing a soft patch in September home sales in Denton County resumed their march higher. It would appear that home prices in the Denton area are poised to hit new highs at the end of the year if momentum continues. Median home prices in Denton were about 3 percent higher through November, while median prices in Denton County jumped 11 percent compared to a year ago. Average prices in Denton County also reflect a 10 percent increase through November.

Denton Texas home prices continue to climb higher, defying the customary seasonal cooling trend that often accompanies the holiday season. Mortgage interest rates continue to be subdued, so that is helping to stabilize the market to some degree. With a potential tax overhaul in the mix for next year, many prospective home buyers could be looking to lock down their purchases before year’s end.

It remains to be seen whether any proposed tax “reform” gets done before the current session expires. If we see current draft legislation approved, thousands of DFW area homeowners will end up losing some itemized deductions. Unless there are revisions to the final bill, many Denton County property owners could be affected. This could set the stage for some of that top-down compression in area home prices that I have been anticipating in the DFW housing market.

Under the currently-drafted tax overhaul legislation, the deduction for state and local taxes is capped at $10,000 and this is inclusive of property taxes. For homeowners residing in Denton County Texas, the property tax bill on an average price home can eat up that entire $10,000 cap. The caps for mortgage interest deductions appear to be a moving target, but expect those to be trimmed from current levels pending any last-minute surprises.

As far as mortgage interest rates are concerned, rates continue to be stuck in a trading range with this week’s Freddie Mac Primary Mortgage Market Survey showing virtually no change. The interest rate on the 30-year fixed rate mortgage stood at 3.93 percent with 0.5 points in fees.

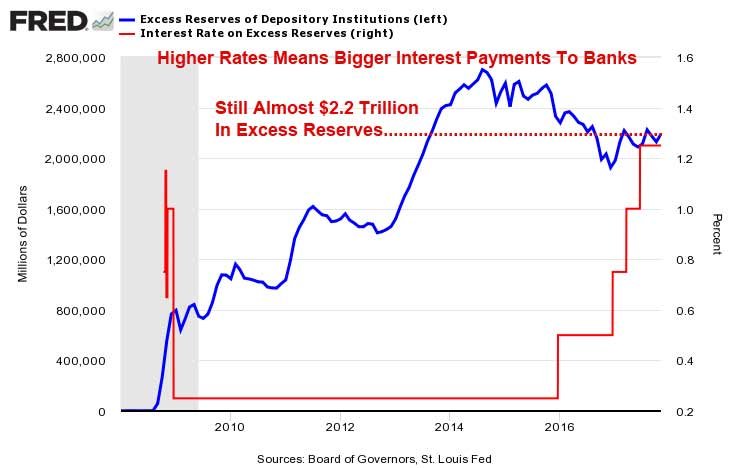

With this week’s announcement of another Fed rate hike, I keep running into people who are expecting higher rates next year. I wouldn’t be so sure about that. The reason is rather simple, but let me explain it to you in Layman’s Terms. The Fed is flying blind. Yes, that’s right. You heard me say it, so I’ll say it again. The Fed is talking their book, and playing the majority of the American public for fools. If you don’t believe me, just read this wonderful primer on that huge pile of mortgage backed securities the Fed is still holding, and why they are very reluctant to unwind it.

2018 is sure to bring plenty of surprises. Higher home prices in Denton County Texas could certainly be in the cards. As far as mortgage rates are concerned, I’m still going with the lower for longer theme. While the Fed may be able to pay more interest to banks so they can sit on that pile of excess reserves, they have done little for the real economy, particularly when you are talking about the bottom 90 percent of the U.S. population. One of the nasty side-effects of ignoring (or should I say burying) the majority of the middle class is that the Fed has now lost control of longer term yields. It is those longer-term yields and real demand in the economy that set real market interest rates, not the Fed.

Apparently the knaves at the Fed want you to believe they are stimulating economic growth by paying banks $billions in interest NOT to lend money…

Leave A Comment