The current media narrative on the U.S. housing shortage is comically absurd misdirection. Numerous experts in the industry continue to float the same tired narratives and misdirection while media mouthpieces nod in agreement. It’s truly sad to watch. News segments offering up explanations of our housing affordability crisis look more like industry infomercials. According the Wall Street arm of the housing industry renting is the new American dream. Wall Street predators are just filling the gap, providing much-needed housing in a time of need.

Just a few days ago our local CBS affiliate ran this puff piece on the build-to-rent plague. Reporter Ken Molestina talked to Doug Ressler of Yardi Matrix, discussing how developers and customers are benefitting by not owning the homes they would really want to buy. According to Yardi’s Ressler, accelerating the shift of ownership in to the hands of corporations and hedge funds is a good solution for American families who are struggling to find an affordable home. Feeding the rentier class is now somehow considered a win for consumers. I can see Orwell rolling over in his grave.

Apparently it didn’t dawn on Mr. Ressler that if these developers can bring these entry-type single-family homes to market there are plenty of American families who would line up to buy them instead of renting them. Instead we get the ridiculous narrative that families are craving rentals as a solution to their housing search nightmare. This is preposterous industry spin.

Not to be outdone, 60 Minutes and Lesley Stahl offered up another dose of misdirection surrounding spiraling rents across the U.S. and what can be done to solve the problem. The narrative here is that renting the American dream is somehow a foregone conclusion. There’s just not much we can do about it, outside of building our way out of the hole. Wall Street mega landlord Tricon Residential is offered up as a deserving punching bag in this 60 Minutes segment, but it’s basically a wasted opportunity to address the larger problem.

Tricon has amassed a portfolio of over 30,000 single-family rentals across the U.S. mostly in the sunbelt states. They have plenty of company. They are joining other Wall Street opportunists like Invitation Homes and American Homes 4 Rent who own even more of the country’s affordable housing stock. Airbnb millionaires and mom & pop investors have played a huge role in this mess too. In the search for yield, investors big and small have gobbled up affordable homes like crazy in recent years.

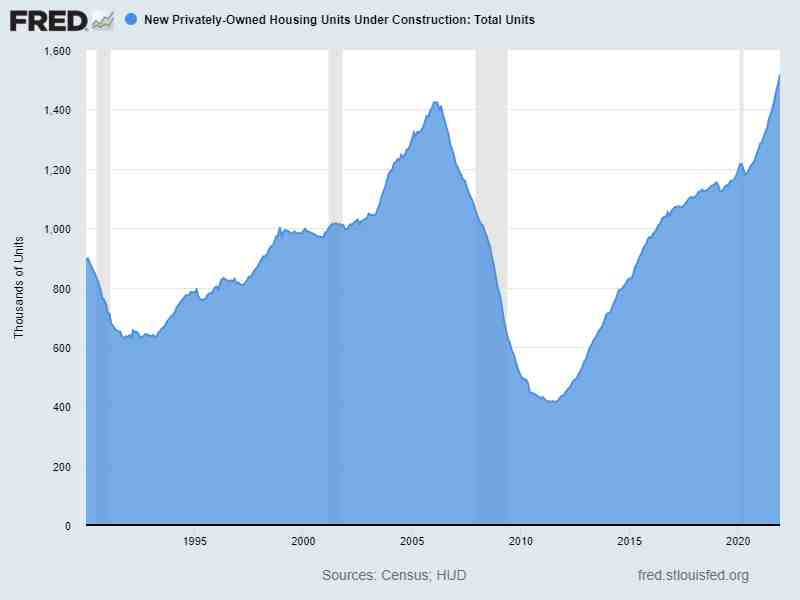

Real estate industry economist Daryl Fairweather tells Stahl and her audience that the U.S. is short some 4 million homes. According to Fairweather we just haven’t invested enough in U.S. housing during the past decade and we need to build more homes. Ms. Fairweather’s LinkedIn profile shows a short stint working as a research assistant at the Boston Fed back in 2009. I wonder what she learned there?

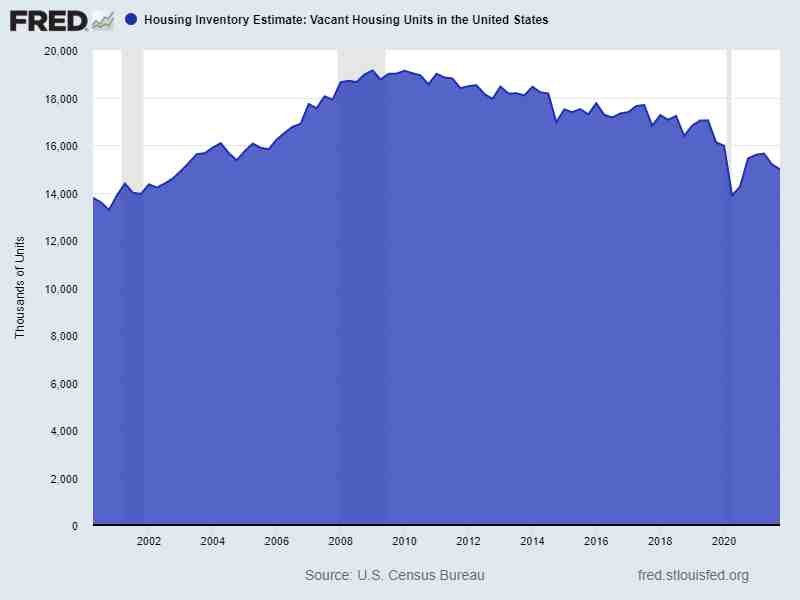

While there is certainly a shortage of homes currently available in the market, construction is only a part of the larger problem. If 60 Minutes were still interested in investigative journalism, Stahl would have quickly pointed out there are currently 15 million vacant homes in the United States. It’s really disappointing that 60 Minutes would waste valuable air time without even mentioning the elephant in the room.

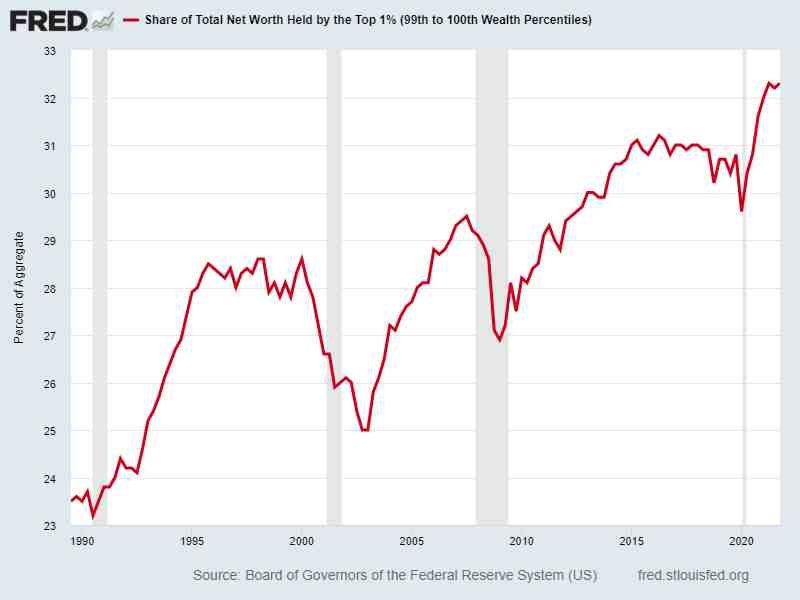

It’s not like Tricon and the rentier class are some new development infecting the U.S. housing market. The spiraling rents and home prices Americans are currently experiencing are the consequences of years of horrific housing policy in the making. I’m old enough to remember the National Mortgage Settlement, that wonderful fiasco where mountains of mortgage fraud was airbrushed out the memories of American home buyers.

Apparently Stahl and Fairweather forgot the Great Recession and the policy responses coming out of it. It would have been laugh-out-loud entertainment if Stahl had pointed out how then president Barack Obama bulldozed millions of American families to “foam the runway” for Wall Street parasites who gobbled up affordable homes across America for pennies on the dollar. It’s funny how Stahl conveniently omitted mentioning this sad fact of modern American history.

After Obama turned U.S. residential real estate into a new asset class, Trump poured gasoline onto the flames with ridiculous tax cuts and more Wall Street largesse. Throw in years of trickle-down monetary policy and a global pandemic, and you had all the ingredients for the financialization of homes on steroids.

Make no mistake. The current housing affordability crisis and the inventory shortage are no accident. They are direct consequences of bad policy. Building more homes is only a part of what is needed to fix the current crisis. The core problem facing the U.S. housing market goes far beyond inventory. The key problem for the housing market is the overt financialization of our housing stock and the rentier class who want to continue plundering the wealth that should be going into the pockets of American families.

Wall Street and the rentier class love talking up America’s demand for rental homes as they grow their portfolios and drive more American families into the ditch. Main street’s demise means more money in their pockets.

Leave A Comment