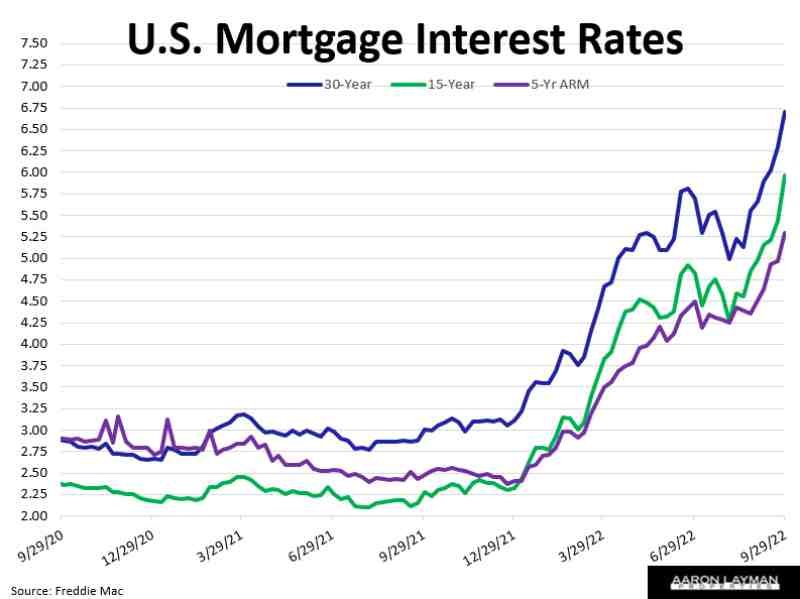

The North Texas housing market is now in full-blown correction mode. The Federal Reserve’s housing market “reset” message is finally sinking in. Home sales volumes continue to slide. Home prices in the Dallas-Fort Worth area continue to drop from their blow-off peaks earlier this year. Mortgage interest rates have spiked to seven percent, while the Fed puts the balance sheet roll-off into high gear.

The correction in real estate prices has caused many of the larger asset owners, particularly those in the private equity space and the consultants who serve them, to lose their minds. Cries for a Fed pivot continue to grow as inflated home prices and rents begin to mean revert. It has been particularly amusing to see some professional economists try to run cover for their employers (or more specifically their employer’s clients) attempting to distract the public from blatantly inflated home prices and rents.

There are apparently a lot of crony capitalists in the real estate industry. Not exactly shocking. They loved the cheap liquidity when prices were ripping to the moon. Now that the Fed is draining that same liquidity from the financial system, real estate speculators and rentiers can’t get another bailout fast enough. For some context on just how absurd things have become in the field of economics, Ben Bernanke has just been awarded a Nobel Prize. Yes, that Ben Bernanke! You can’t make this stuff up.

Back in the land of reality where economists like Ben spent the last 14 years helping to turn the U.S. housing market into a warped, flipped speculative mess, another housing bubble is deflating. This everything bubble isn’t exactly like the housing bubble that blew up in Ben’s face, but it shares some similarities. The outsized investor and speculative activity has been particularly noticeable coming out of the pandemic. A recent survey showed Dallas Texas as the top market in the country for home flippers. Roughly 12 percent of the resale volume in the past 12 months has been home flippers. Hooray for speculation and financialization!

Now that many of those “investors” are getting their heads handed to them by the Fed’s housing reset, real estate prices have begun to cool rather quickly. This is why we’re seeing prices fall even without a dramatic rise in inventory levels. Available homes for sale are still below pre-pandemic levels, but prices are falling anyway. This blows a giant hole in the narrative floated by many real estate agents other clueless sell-side pundits who pretended the DFW housing boom was simple supply and demand driven by organic growth.

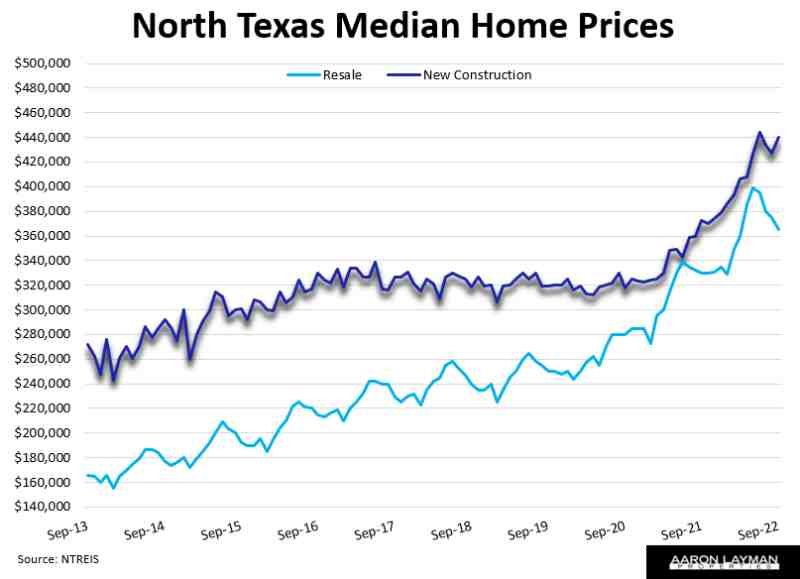

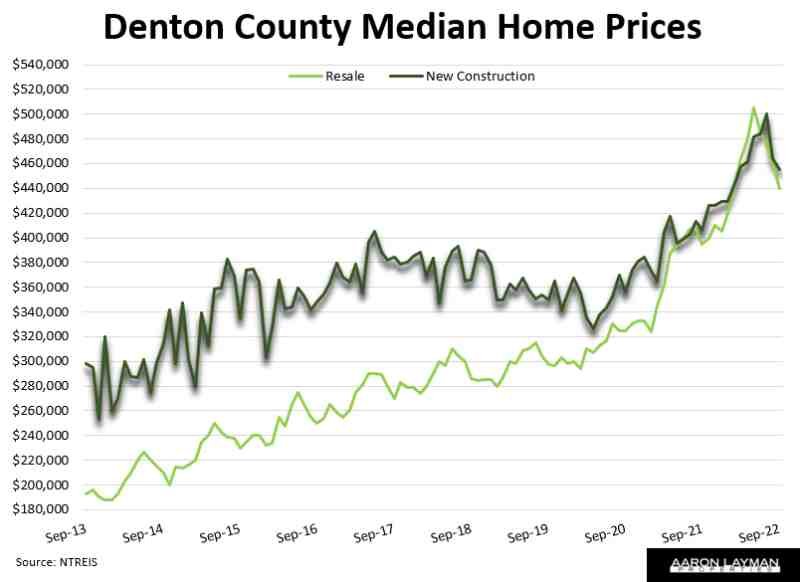

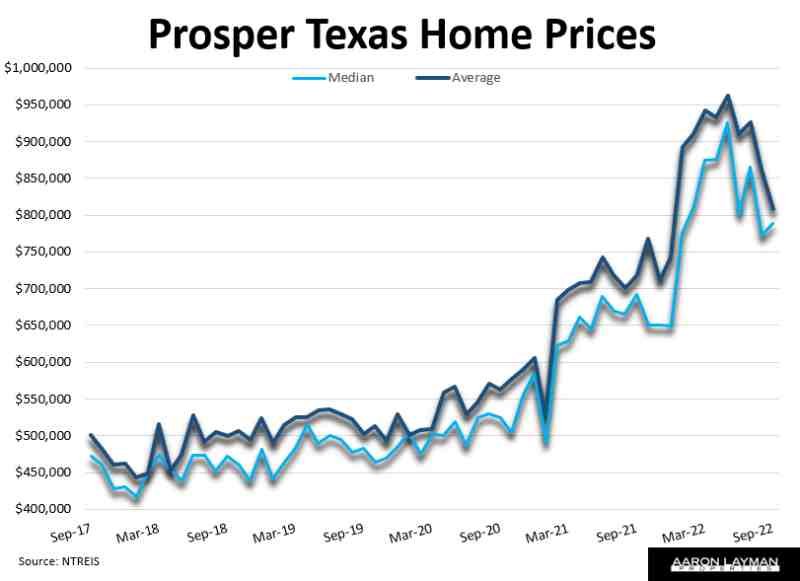

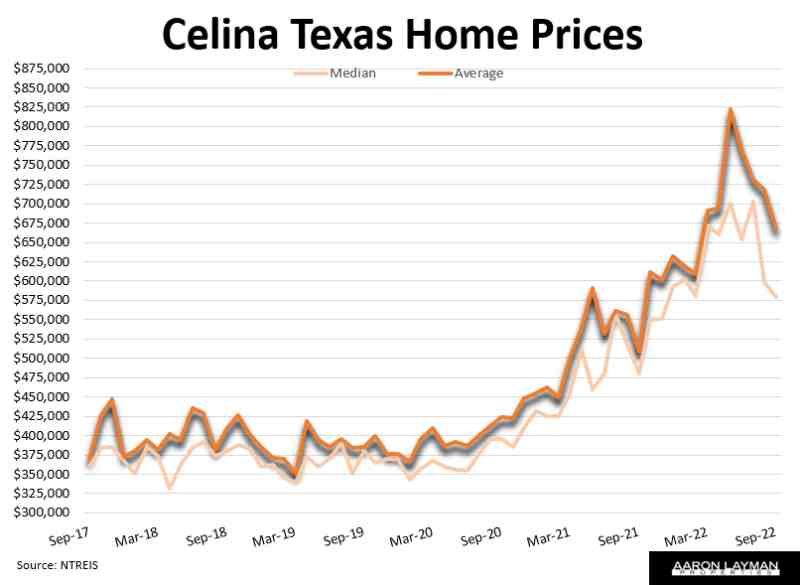

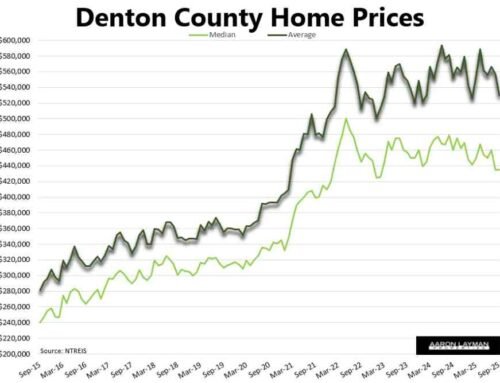

To put things into perspective on just how crazy the DFW real estate bubble grew during the pandemic, I put together some 10-year charts showing both new and resale home prices. This provides some context in terms of the supply and demand distortions. As inventory evaporated, builders and existing sellers ramped prices to the moon. It helps to remember that prices are formed at the margins. Liquidity provided the fuel on the way up, and it is becoming a huge drag on the way down.

After trending down for several years prior to the pandemic, new home prices in North Texas went parabolic. Builders took advantage of what is probably a once-in-a-lifetime opportunity to exert some serious pricing leverage. That leverage is fading now that inventory is finally coming back to the market.

As you can see from the charts, the price corrections in Denton County Texas have been more noticeable so far this year. Median home prices in Denton County are still up 11.6 percent from last year, but they have already fallen $55,000 from the May 2022 peak. Average prices are only up 6.7% year-over-year. Average home prices in Denton County have fallen $77,000 from the May blow-off top.

Inventory has begun to climb again after a brief dip at the end of the summer. Now that mortgage interest rates are up to fresh highs for the year, demand has been crushed. New listings in Denton County are up about 14 percent from last year. The absolute number of homes for sale has been relatively stable for the past few months at roughly 3200 homes.

As demand gets crushed even further, months of inventory has grown. Days on market have jumped significantly in the past few months, approaching 3 weeks on the median sale. That’s still far below historical trend, but you can see the correction taking shape. Percent of original list price has fallen well below 100 percent now. It’s hard to believe that FOMO activity early in the year drove the average percent of list to 107. 2 percent. It’s now back to 96.6 percent in Denton County. That puts it more in line with historical trend.

Families are finally getting more opportunities to purchase more affordable homes as prices come down. The flip side is that mortgage rates are sharply higher, putting a damper on overall affordability if buyers don’t have a significant down payment. It should be readily apparent at this point the Fed’s “wealth effect” is really just a back-door stimulus for boomers and existing asset owners. The Fed specializes in trickle-down economics and fiscal policy.

Prospective home buyers and sellers are waking up to the reality of the housing reset. Some sellers being dragged kicking and screaming back to reality. Many buyers are patiently waiting for the Fed to do what they should have done over a year ago. Better late than never I suppose.

U.S. mortgage interest rates are hitting fresh highs as the Fed works to tame embedded inflation.

A friendly reminder that the Federal Reserve has a long way to go on that balance sheet “normalization” process. This chart doesn’t even begin to capture the monetary insanity that took place during the pandemic. It simply shows the beginning of the Fed’s balance sheet tapering process.

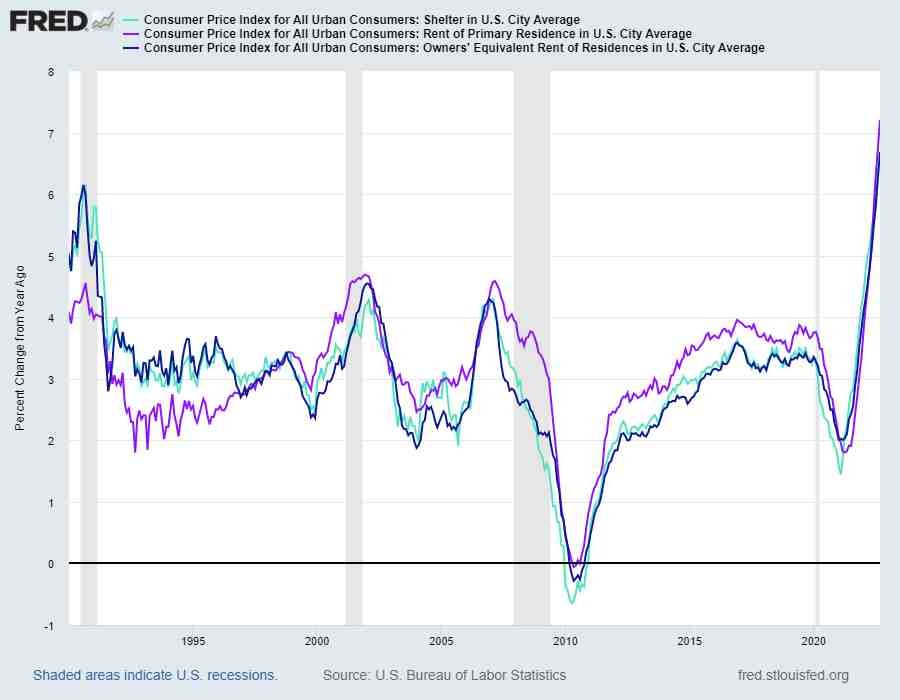

The Bureau of Labor Statistics reported consumer price inflation (CPI) for September at 8.2%. That was a bit higher than analysts expected. CPI for core inflation was also higher. The updated 12-month change for shelter inflation looked like this:

- Shelter – up 6.6%

- Rent of Primary Residence – up 7.2%

- Owners’ Equivalent Rent – up 6.7%

Those were the highest readings of the cycle so far. Shelter inflation is the highest it has been in decades. Not surprisingly bond yields spiked higher on the news. Mortgage rates will respond in kind. Market participants are finally beginning to see the recklessness of letting inflation rip higher while the Fed pretended it was all just transitory pandemic-related noise.

There are some property owners who pushed rents to the limit the past few years. It appears some may have ignored the limits altogether. DFW-based RealPage, a company which provides rent-setting software for some of the largest landlords in the U.S., has been sued by renters for alleged collusion. The lawsuit was filed just days after a detailed investigation by ProPublica.

““Never before have we seen these numbers,” said Jay Parsons, a vice president of RealPage, as conventiongoers wandered by. Apartment rents had recently shot up by as much as 14.5%, he said in a video touting the company’s services. Turning to his colleague, Parsons asked: What role had the software played?

“I think it’s driving it, quite honestly,” answered Andrew Bowen, another RealPage executive. “As a property manager, very few of us would be willing to actually raise rents double digits within a single month by doing it manually.””

The lawsuit was filed on October 18 in the Southern District of California. RealPage and 9 multi-family landlords are named as defendants. The landlords include Dallas-based Lincoln Property Co, Greystar Real Estate Partners, Mid-America Apartment Communities, FPI Management, Equity Residential, Essex Property Trust, Avenue5 Residential, Thrive Communities Management, and Security Properties.

The 29-point complaint is very interesting. Number 7 is a real eye-opener.

“While Lessors are able reject the RealPage pricing through an onerous process, RealPage emphasizes the need for “discipline” among participating Lessors. To encourage adherence to its common scheme, RealPage explains that for its services to be most effective in increasing rents, Lessors must accept the pricing at least eighty percent of the time. These efforts are successful, with a RealPage employee explaining that as many as 90 percent (and at least 80 percent) of prices are adopted by participating Lessors without any deviation. As one Lessor explains, while “we are all technically competitors,” RealPage “helps us work together,” “to work with a community in pricing strategies, not to work separately.””

It will be fascinating to see how this plays out. As Eric Horowitz explains rather well, wealthy landlords have been shielded for years by some very clever and often dubious media narratives. I have personally watched some of the ridiculous spin Eric is talking about. The real estate industry is full of narrative. What has been surprising is the lengths some in the industry will go to to deflect attention from a simple fact. The asset owners who control the industry are making a ton of money.

“By pushing these narratives, corporate media are engaging in a strategy of misdirection. This shields the propertied class from scrutiny regarding a crisis of its own making—from which it derives immense profits—while blame is assigned to over-burdened renters and people who are unhoused.”

I won’t be shedding too many tears for the millionaires and billionaires who own all of those multi-family apartment units. As far as I am concerned the Airbnbust can’t happen soon enough. There are way too many leveraged speculators in the U.S. housing market. There was (and still is) too much liquidity chasing housing. The crisis of our own making has resulted in the mess we are currently calling a housing market.

It’s a market where single mothers like the one I recently spoke with are struggling to get by after her landlord just jacked her rent up by 21 percent. It’s a market where affluent buyers drove prices to ridiculous levels earlier in the year, and now reality is sinking in.

To put the absurdity of the liquidity-fueled pandemic housing boom into context consider this. Average home prices in the North Texas suburbs of Prosper Texas and Celina Texas have already dropped over $150,000 from their spring peak. The would still need to fall another $150,000 before they get back to pre-pandemic trend.

Paper “wealth” has a funny way of disappearing when faced with a true cost of capital. It’s sad that many agents spent the last two years hyping low inventory levels and pent-up demand, confusing unprecedented (and unsustainable) liquidity with organic growth. Many did it because it fit the narrative they were selling. Now many of those fake narratives are getting exposed for what they always were. 2022 is apparently going to be the year that loan officers, real estate agents and leveraged speculators receive their crash course in market fundamentals. So be it.

You can listen to the podcast version of this post here…

Leave A Comment