Denton County’s new home market is headed for another slowdown. High prices and a rebound in interest rates to that critical seven percent mark are just part of the problem. There’s also a pending recession on deck.

The Census Bureau reported April new home sales at a seasonally adjusted annual rate of 683,000 units. That was better than expected, but previous months were revised lower. Cancellation rates for builders have come back down, but new home affordability remains an issue. There is still a large backlog of homes under construction. Any softness in the economy will likely cause an increase in completed inventory.

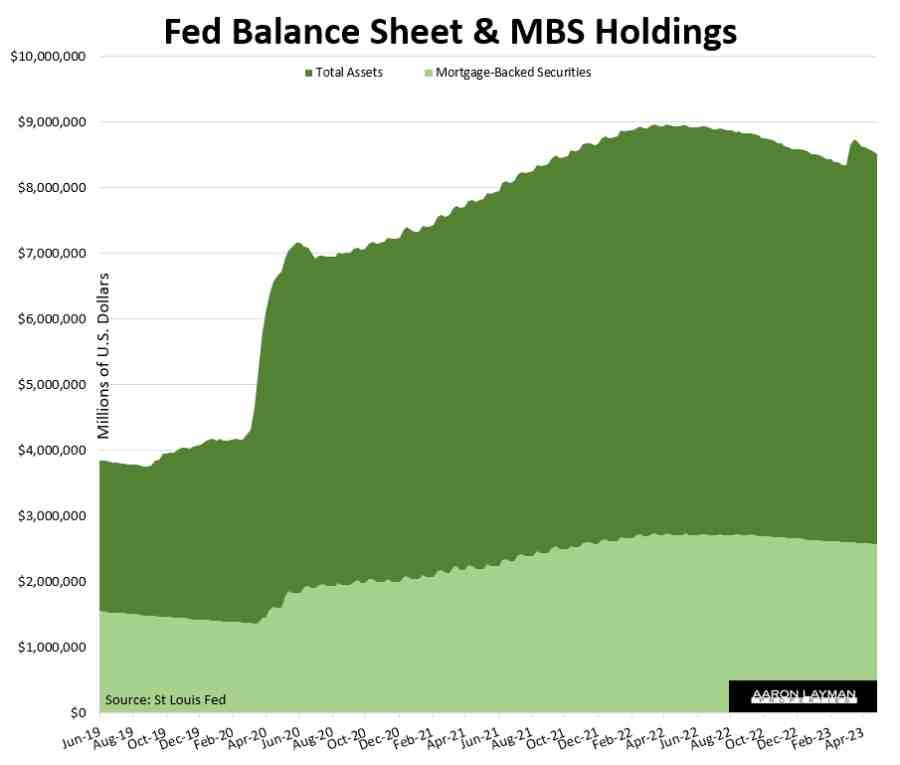

New home supply decreased to 7.6 months of inventory in April. Builders were able to sell many of their completed new homes in the first quarter of the year, but they had some unusually favorable tailwinds in doing so. Mortgage rates had stabilized and resale inventory remained stubbornly low. The Fed also helped by temporarily pausing quantitative tightening with the mini banking crisis.

The median price of a new home in the U.S. fell to $420,800 in April. Those were the lowest prices in over a year. The average price of a new home slid to $501,000 in April. Builders have done a pretty good job so far in 2023 in terms of finding the “market” to get buyers off the fence and to the closing table. That equilibrium point in many cases has involved rate buydowns and price concessions. Resale home sellers should be taking note if they also want to be successful with their relocation plans.

With rates back at seven percent it’s no surprise that mortgage activity and sales remain sluggish. The most recent report from the Mortgage Bankers Association shows the purchase application index down 30 percent from the same week a year ago.

Many pundits have cheered the rebound in the new construction market this spring, particularly since home builder stocks were back near all-time highs. Many agents and other industry cheerleaders have seized on this spring rebound to call an all-clear for the housing market. These early calls for a bottom in the housing market are premature since we haven’t even seen the front end of the recession. Housing typically bottoms AFTER the recession not before it. That would suggest the softness in the fourth quarter of 2022 was just a dress rehearsal.

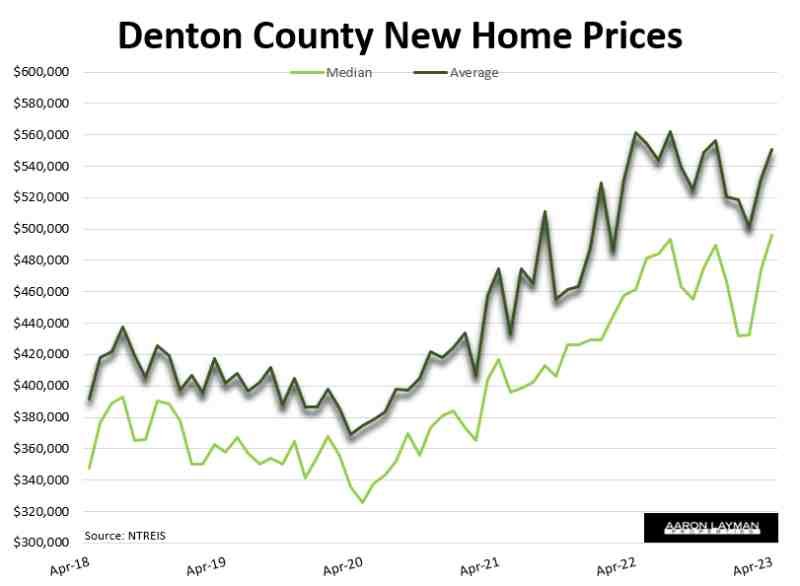

The chart for new home prices certainly looks like it has more room to revert. It’s pretty hard to imagine new home prices bottoming when the U.S. unemployment rate is still near a record low and the recession hasn’t even started yet. A closer inspection of new home prices in Denton County also indicates the correction for the housing market is probably still in the early innings.

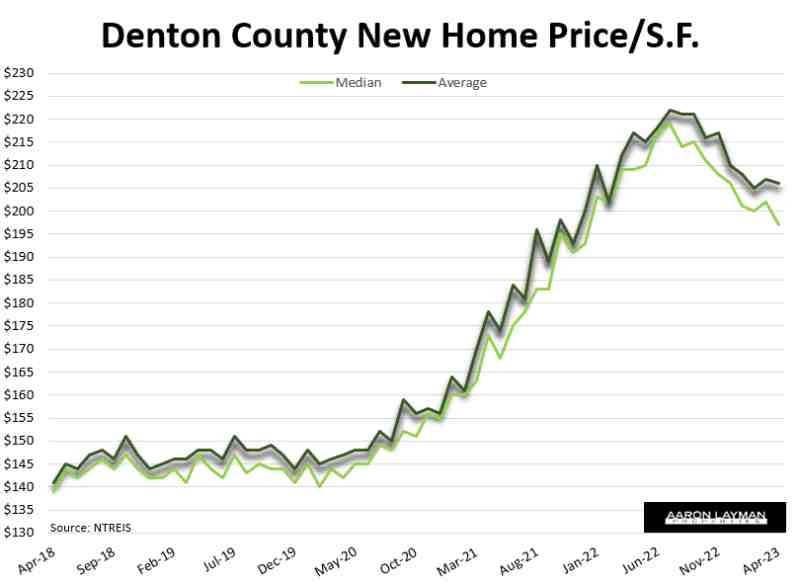

At first glance it would appear new home prices in Denton County have completely recovered to their bubbly top. In reality builders have been selling off larger homes in that backlog as real price per square foot has continued to soften. If you look behind the surface pricing power is not as strong as the headline hype.

Adjusting for home size median and average new home prices in Denton County Texas actually fell more than 5 percent year-over-year in April. It’s also worth noting that many of the reported new construction prices do not reflect the rate buydowns and incentives which were required to get to the closing table. If we had real prices adjusted to include incentives and seller contributions, I have no doubt that headline prices would be even lower.

If you are in the market for a new home in North Texas patience and flexibility are still in order. There’s no need to rush into a purchase if you don’t have to, particularly with a large pipeline of homes and developments still coming to market. Every day is not a great day to buy a home. Some days are better than others. Prospective new home buyers will probably be rewarded if they wait for that completed new home inventory to grow again.

The Fed still has a lot of tightening left to do. That remains a major headwind for the real estate market.

Leave A Comment