Fannie Mae and Freddie Mac conforming loan limits will jump to over a $million in January 2023. American taxpayers will be backstopping loans in expensive coastal counties for up to $1,089,300. That’s up from the limit of $970,800 this year. Most conforming loans will be subject to the new loan limit of $726,200 in 2023. That’s a 12.2 percent increase from the current limit of $647,200.

Fannie Mae’s Lender Letter (LL-2022-06) explains the nuts and bolts of the new changes. The new tables have the loan limit for single-unit structures in Denton County Texas at $726,200 in 2023.

For those not familiar with the GSE’s (government-sponsored enterprises), the conforming loan limits simply outline the maximum amounts which will be guaranteed by Fannie and Freddie (aka U.S. taxpayers). The limits do not mean everyone will be able to get a loan for these amounts. The limits are important, however, because we saw what happens in the Great Recession when loans go bad. Taxpayers had to step in and bail Fannie and Freddie out.

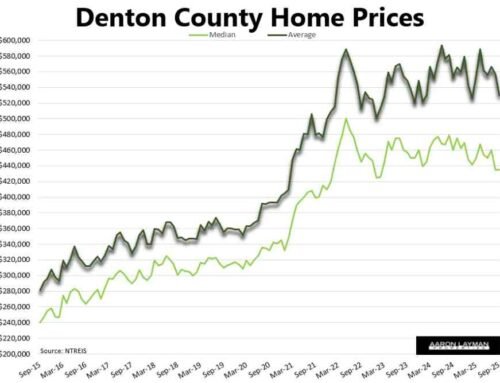

The loan limits change from year to year when the The Federal Housing Finance Agency (FHFA) has home price data for the 3rd quarter of the year. The housing regulator compares data to the 3rd quarter of the previous year and adjusts home prices accordingly. It may come as no surprise that the loan limits do not fall. They just don’t rise again until home prices move back up again to levels in line with the previous limit.

It is a well known fact that home prices tend to rise the amount of credit capacity. Why is this important? The Federal Reserve is active working to curb demand and lower home prices after the spectacular pandemic era housing bubble sent inflation skyrocketing. If it sounds foolish (aka stupid) for the GSE’s to facilitate higher home prices (and therefore more inflation) when inflation is wreaking havoc on the U.S. economy, that’s because it is. The higher loan limits are also placing more risk on the backs of taxpayers when the U.S. economy could be spinning into another recession.

FIRE sector participants are no doubt pleased with the new 2023 loan limits because more is always the answer. More risk, more debt, more government (taxpayer) guarantees. As Upton Sinclair famously said “It’s difficult to get a man to understand something when his salary depends upon his not understanding it.”

2023 is shaping up to be a battle of two competing forces. Fannie and Freddie will be working to raise home prices even higher, while Jerome Powell and the Federal Reserve will be trying to tame the inflationary fires they ignited with $trillions in trickle-down stimulus. This should be an entertaining cage match. Pass the popcorn.

The latest Case-Shiller home price index data shows the North Texas housing bubble still has a lot of air in it. It remains to be seen where we end up at the end of this market cycle.

Leave A Comment