Yesterday I was musing about the expected rise in inflation and bond yields that so many professional pundits and talking heads are expecting in 2018. That’s the story being bantered about on various mainstream cable news puppet shows. Today we received another reality check on that “pent up demand” and overheating labor market story as the December Jobs Report painted a rather lackluster finish to 2017.

The BLS Employment Situation showed an increase of 148,000 jobs in December. That’s the good news from the establishment survey. The Household survey (Table A) showed an increase of only 104,000 jobs in December. Not surprisingly, wage growth continues to be weak. Although the “official” unemployment rate was 4.1 percent in December, wage growth has apparently stalled during the last year as the Fed’s “wealth effect” has failed to translate into increased wages sufficient to keep pace with the Fed’s asset inflation prowess.

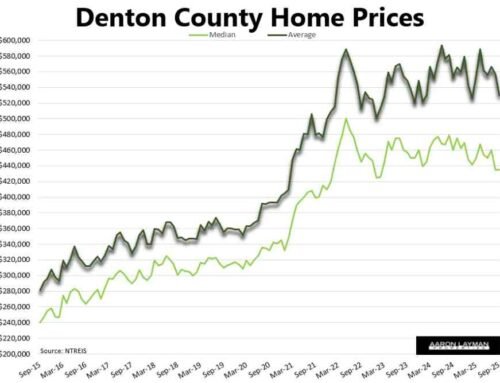

As the charts above show, home price inflation continues to outpace wage inflation for American workers by a large measure. Housing inflation is almost 3 times the pace of wage increases for millions of working Americans yet the Federal Reserve wants you to believe we need more inflation, not less. It almost makes you wonder which constituents the Fed is really serving.

As fate would have it, today is one of those days where we get to see the full text of those 2012 Federal Reserve transcripts (albeit with a 5 year delay) so we can peer into the minds of those conflicted Fed governors. Apparently there was a bit of self-congratulation going on as the Fed launched QE3 to enrich their most favored constituents, also known as Wall Street and America’s too-big-to-fail banks.

We have to be very careful. I sensed—let me try to state this politely—a little bit of self-congratulation that QE3 had had such a great impact on the market. Richard Fisher – Former Dallas Fed President

Perhaps more interesting is the revelation that the Fed has also been intervening in markets to artificially suppress volatility. As many market participants understand, higher volatility usually translates into declines (or much smaller gains) in the stock market. With the Fed’s duration mismatch in their securities portfolio, risk has been beaten down to abnormally low levels. Amusingly enough it was incoming Fed chair, Jerome Powell, who revealed the extent of the Fed’s market volatility manipulation:

When it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response. So there are a couple of ways to look at it. It is about $1.2 trillion in sales; you take 60 months, you get about $20 billion a month. That is a very doable thing, it sounds like, in a market where the norm by the middle of next year is $80 billion a month. Another way to look at it, though, is that it’s not so much the sale, the duration; it’s also unloading our short volatility position.

This certainly helps to explain the Fed’s tepid start to their balance sheet normalization. We can’t have any nasty things like reality upsetting the stock market. Here’s a depiction of Janet Yellen and Jerome Powell unwinding that $4.4 trillion balance sheet…

Today’s BLS employment report for December is just another stark reminder that there is one economy for the American public, the real economy. Then there is the other, “official” economy that fits within the Federal Reserve’s narrative of cognitive dissonance and political double-speak where they work behind the scenes to inflate stock prices and home prices through the roof, willfully ignorant of the long term damage they are inflicting on American workers and markets in general.

Here is a reprise of the former Dallas Fed head hamming it up with CNBC media mouthpieces explaining how the Fed injected cocaine and heroin into the markets…

Leave A Comment