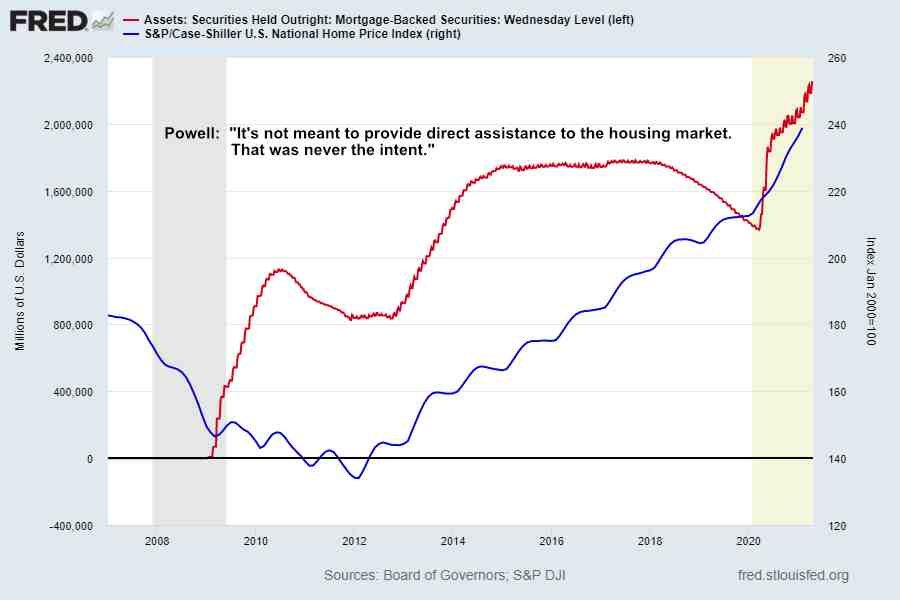

Pinocchio Powell has no answer as to why the Federal Reserve is still inflating the housing market with MBS purchases to the tune of $40 billion per month. Despite a ridiculously overheated housing market with no inventory and double-digit price increases the Federal Reserve is going to continue the purchase of mortgage-backed-securities. The latest FOMC statement and press conference just confirmed more of the same from the Powell Fed.

“Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus, including progress on vaccinations. The ongoing public health crisis continues to weigh on the economy, and risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.”

The press statement language was totally predictable. Powell’s press conference afterward was completely comical, particularly his garbled answer to the question on the continued purchase of mortgage-backed securities at the rate of $40 billion per month.

Powell: “We started buying MBS because the mortgage-backed security market was really experiencing severe dysfunction…It’s not meant to provide direct assistance to the housing market. That was never the intent.”

If that wasn’t the intent, then why bother in the first place. Any idiot can see the direct benefit to the housing market caused by the artificial suppression of mortgage interest rates. This was the Fed’s response to the Great Recession, so the Fed decided to do it again. The housing market is doing fine now, so why not taper the MBS purchases? The mortgage-backed securities market is functioning as intended while home prices are spiking to the moon.

The goons at the Fed (including and particularly Jerome) know the artificial suppression of interest rates via the purchase of MBS provides direct assistance to the housing market. If Powell was being truthful, the Fed would already be tapering its MBS holdings. That’s NOT what is happening. There’s never been a better time to sell a home in America because the Fed is fueling a housing market frenzy and FOMO among home buyers.

The last time the Federal Reserve tried to normalize the balance sheet chaos quickly followed. The Dallas-Fort Worth real estate market was close to rolling over in terms of prices in the second half of 2018 before the Fed capitulated. Rising mortgage rates and a 20 percent nosedive in the S&P forced the Fed’s hand. The housing market could not withstand a rise in mortgage rates to just 5 percent. That threshold is certainly lower now, likely somewhere in the neighborhood of 4.5%. The con artists at the Fed know rates have to be ultra low to keep this show going, and so they are. This is how the Fed causes spiraling wealth inequality within the U.S. economy and the housing market.

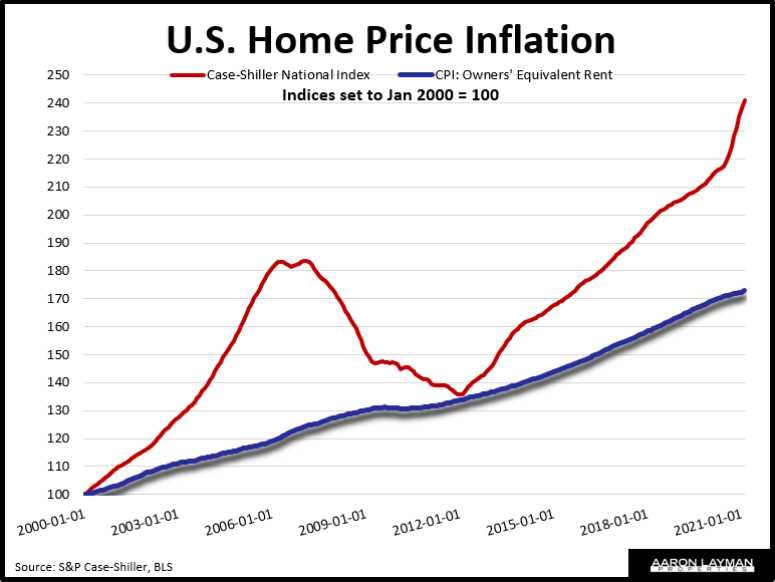

Powell and the Federal Reserve board of governors, who are all multi-millionaires, are sticking to their script of muted or transitory inflation, like the fake CPI metric of owners’ equivalent rent.

It is amazing Congress is still allowing the insanity to continue, but this is what happens when you have policy created by and for the benefit of the privileged few in the American economy. Boomers and existing asset owners are laughing all the way to the bank in the Covid housing bubble, the one the Fed keeps pretending does not exist.

Leave A Comment