The North Texas housing market continued correcting in July. Closed sales were 15 percent lower for the DFW compared to July of last year. Pending contracts also slid lower by a corresponding amount. The median price of a home in the Dallas-Fort Worth market slipped to $389,000, up 16.1 percent year-over-year. Average prices in DFW dropped even more, sliding over $25,000 from the high in June. That may be the high for North Texas home prices for a few years depending on how this cycle plays out.

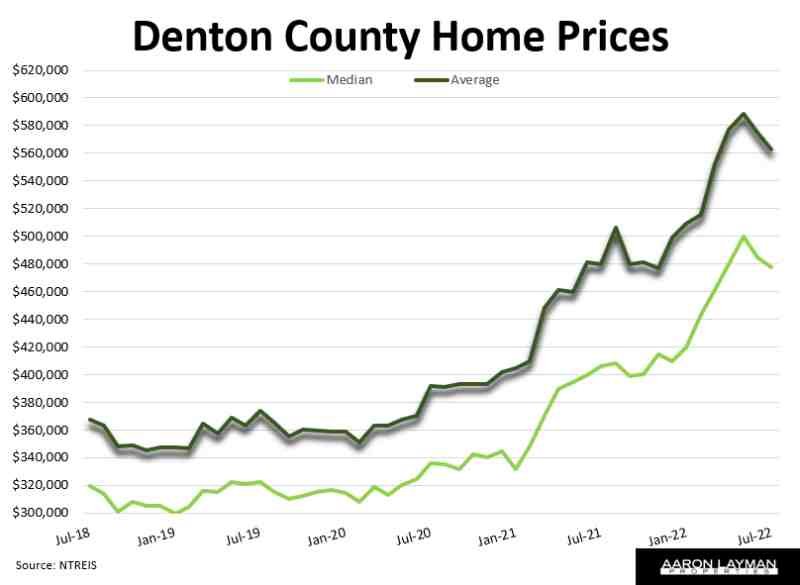

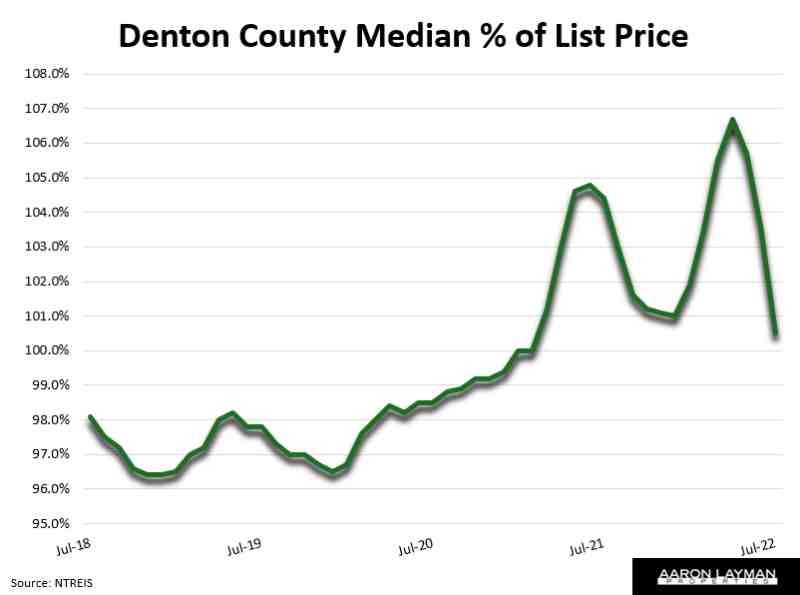

The housing market correction has definitely been noticeable in the North Texas suburbs this summer. Denton County saw a 17 percent drop in sales last month, along with a 13 percent slide in pending contracts. The median price of a Denton County home slid to $478,000. The average price fell to $562,841. Spot the trend? If not, this should help. The median percent of list for homes sold in Denton County dropped to 100.5 percent. Preliminary stats for the first week of August show it slipping to parity at 100 percent.

In Layman’s terms, the bidding wars and FOMO mania that drove North Texas home prices to dizzying heights is over. This is why you are seeing those “for sale” signs lingering longer than they were earlier in the year. Many North Texas home sellers and agents have been in complete denial of what’s happening this summer. This has resulted in numerous price reductions for listings the past few months.

The attached chart of Denton County home prices doesn’t capture the whole story of the summer of denial. Pricing and stagnating demand have been moving against sellers all summer. That’s not what you would typically see during the summer selling season. Sellers mistakenly assumed buyers would keep bidding prices up even though the Fed made it clear they wanted and needed home prices to fall. This is a post-pandemic housing market in the beginning stages of a correction. That reality is finally sinking in.

We have a full week of closing data for August, so let’s take a look. Median closed home prices so far in August are over $20,000 lower than July. That puts local home prices $42,500 lower than the peak in May. Six percent mortgage rates were a serious roadblock for inflated local home values, so it wasn’t a surprise to see prices cool. It was interesting to see so many agents and home sellers pretending it wasn’t happening.

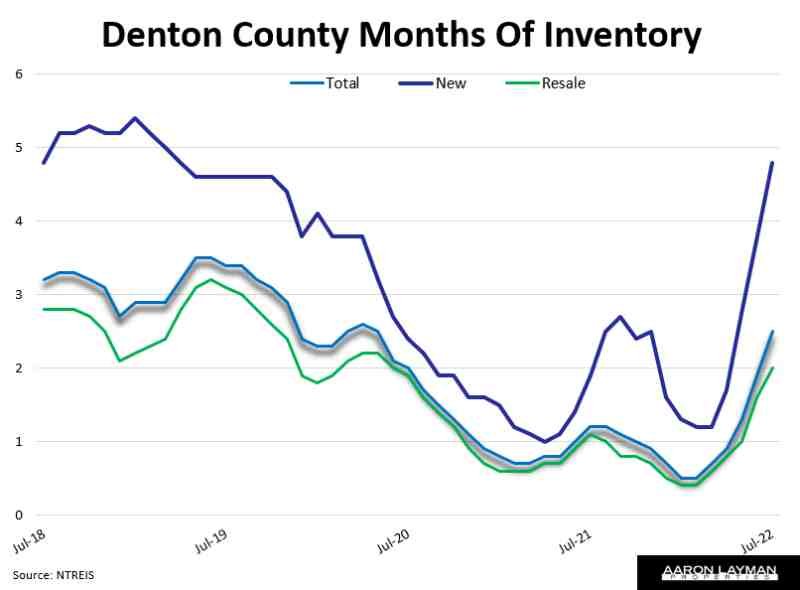

Behind the headlines there’s a more interesting dynamic taking place. New home prices in Denton County hit record highs last month, but the market has turned sharply. Denton County is now sitting on 4.8 months of supply for new construction inventory. That’s a 152 percent increase from last year. There are thousands of developed lots in the area, many with homes under construction or already permitted for construction.

A good portion of these new homes have still not been listed in the MLS, so they are not yet showing up in official inventory stats. With new home sales volumes falling sharply for virtually every major U.S. home builder this summer, builders are dropping average prices and bringing more affordable options to the table to maintain pipeline flow. New supply will keep coming.

I spoke to one local builder representative who said they have already lowered pricing twice this year on a brand new community just breaking ground, and these are for homes in the $400k-$500k price range. Higher end new homes which are completed and sitting on the ground have seen price cuts of 10 to 20 percent or more after buyers realized FOMO purchases of artificially inflated homes didn’t make sense with rates above 5 percent.

Competition has come back to the housing market. That’s a good thing when there is still a shortage of affordable housing. It’s not so great for prospective home sellers, but there are still sizeable equity gains to be captured for those who want or need to move. Properly priced homes are still selling well. Getting out with a nice profit may not be as rewarding as selling at the top, but it’s still a nice position to be in.

The summer of denial will now be shifting into the fall of regret for those who wanted to cash in at record high prices but missed the opportunity. Time will tell, but this economic cycle has a ways to go before we can consider the prospect of a soft landing. That hasn’t stopped many in the real estate industry from their perennial optimism and spin. As they say, never let the facts get in the way of a good narrative.

Home prices are still historically expensive no matter which metric you choose to look at. Rents are through the roof too. Rent for a median single-family home in Denton County was $300 more expensive in July compared to last year. That’s an increase of 13.6 percent for local rents. Local apartment rents are still ripping at double-digit percentage increases as well.

The July Consumer Price Index came in at 8.5 percent. The core index showed a 5.9 percent increase. That was slightly lower than projections, so of course the market cheered that inflation has been tamed. If only it were that easy. Shelter components for inflation are still rising. Here are the 12-month changes for shelter in July:

- Shelter up 5.7%

- Rent of primary residence up 6.3%

- Owners’ Equivalent Rent (OER) up 5.8%

There’s still a huge disconnect between official shelter inflation estimates vs actual shelter inflation. There’s also the nasty dose of embedded wage-price inflation we saw in the July employment report. The Fed is still a long way from a 2 percent inflation target, so don’t expect a pivot any time soon. This pandemic housing market boom and bubble was several years in the making. It will take a while for the correction to play out.

A recent study from the United Way of Denton County shows how challenging the housing market is for many families. Homelessness in Denton has basically doubled in just the last few years with spiraling local home costs.

The National Low Income Housing Coalition paints a similar picture across the U.S. Housing prices and rents have skyrocketed as a result of responses to the Covid pandemic. Wages have not kept pace. That has left many families living in poverty in dire straights when it comes to shelter. ‘NLIHC Releases Out of Reach 2022: The High Cost of Housing‘

Texas doesn’t fare too well when it comes to affordable housing. The typical Texan would have to work 104 hours per week just to afford a market-rate 1-bedroom rental while earning the U.S. minimum wage. Texas has 1.4 million renter households living below the 50% AMI (area median income) threshold. Of the 3.7 million total renter households in Texas, over 860,000 live below 30% AMI.

When I see statistics like these, you can understand why it makes my blood boil hearing developers, private equity rentiers and other real estate industry apologists talking up the merits of build-to-rent housing. These are products catering to those who already have a roof over their head. It should go without saying that the overt financialization of housing and spiraling shelter costs have put even more Americans at risk.

There is a hefty price to pay for allowing a companies like DFW-based Invitation Homes gobble up 80,000 houses so they can monetize the cash flows and line their pockets. Every time a wealthy (or comfortable) American family rents out their 2nd, 3rd or 4th home for an Airbnb rental, they are taking more shelter out of the stock of U.S. housing. This just widens the housing divide, putting more strain on the economy.

Some new home builders are getting the picture and building more affordable housing products. I have viewed a number of new developments recently where builders are trying to bring affordability back into the equation. They can only do so much. If we’re really going to solve the fake “housing shortage” problem in the U.S. we’re going to need better policy. The inevitable solution involves more housing for those who need it, and less financialization for those who already have plenty.

Leave A Comment