The North Texas housing market started off the year with renewed animal spirits. It appears the Powell Fed made a colossal mistake by taking their foot off the breaks before inflation has been vanquished. We can already see signs of inflation percolating again in the housing market.

The Fed Back to Where it Started

The first FOMC meeting of 2023 revealed a huge blunder by the Powell Fed. As the markets ramped higher for the last month asset owners cheered that inflation had been conquered. Housing market participants reveled in the headlines of a coming soft landing. Reality is a bit more sobering. Reality suggest Jerome made a huge error by not squashing those animal spirits looking to cash in on years of unearned gains.

The Bloomberg Financial Conditions Index shows that Jerome is right back where he started. In fact, financial conditions are currently looser then when the Fed first started hiking rates last year. If your stated goal is to curb rampant inflation in the economy and bring it down toward a 2 percent target, that’s a HUGE problem.

“According to Bloomberg’s broad US model, financial conditions are now looser than they were on the eve of the Ukraine invasion. Remarkably, they are even more relaxed than when the fed funds rate was still effectively zero last March, and easier than the average for the last decade.”

This has some serious implications for the real estate market. It also helps to explain the boost in activity we saw during December and January as many of the supposed experts in the real estate sector proclaimed the housing market had likely bottomed. Anything is possible. Most of the asset owners holding onto inflated real estate are undoubtedly hoping the rate hikes are done so they can hold on to the bulk of the unearned asset inflation since January 2020.

The data says soft landing island is looking really crowded and terminal rates are not here yet. This column isn’t long enough for the nuances of how the fiscal and monetary plumbing work. What’s important for the purposes of the Denton area real estate market is that higher rates aren’t going anywhere anytime soon, not with financial conditions so loose.

The Powell Fed could be forced to keep hiking well into 2023 with a higher terminal rate than they originally anticipated. All of the real estate pundits chomping at the bit for lower rates could be waiting a while as the Fed is forced to continue chopping away at the inflationary monster they created.

U.S. house prices decelerated rapidly in the second half of 2022. The problem for the Fed is those prices are still 37 percent above the level where they ended 2019 before the pandemic started. We’re still dealing with grossly inflated home prices and car prices by any metric you choose. U.S. homeowners are still sitting on close to 10 years of normal price appreciation crammed into a 2-year period. That’s serious inflation which has embedded itself into the U.S. economy.

When mortgage rates are back above 7 percent and inflation is still roaring, remember that Jerome Powell was busy spiking the football on the 50-yard line, having some good laughs with his friends at the Economic Club of Washington in February. If 2023’s first FOMC meeting was the worst policy error of the last 50 years, Jerome’s glib attitude toward the task at hand was the icing on the cake.

Pop Before the Drop

Denton County home prices continued their slide in January. More aggressive price cutting from builders during the holidays is working its way through the closings data. Denton County home prices are now 15 percent lower compared to the blow-off peak in May of 2022. That still leaves them well above pre-pandemic trend.

While area home prices were dropping, average rents continued their climb. Average prices on single-family leases in Denton County posted a 6.2 percent year-over-year gain. That’s the opposite of disinflation. Renters are still getting squeezed.

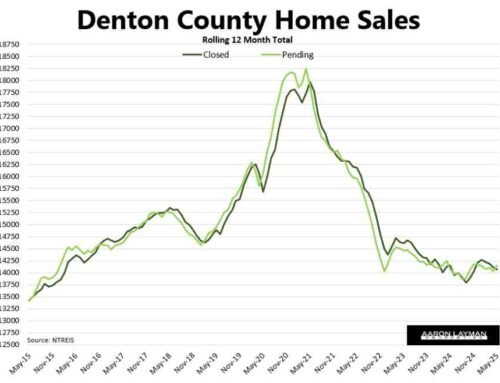

Area home sales were down 13 percent compared to January of last year. Pending sales managed a comeback with the help of loose financial conditions and lower mortgage rates. Pending sales jumped 14 percent in January. Those animal spirits are far from dead, and there are still plenty of investors looking for homes.

Most of the action in the Denton County market was in the more affordable price bands in December and January. What’s interesting is that the recent pending data shows a bigger spike in activity in the higher price ranges. One reason for that is the depletion of inventory at the lower end. Looser financial conditions also likely lured some buyers off the fence for the higher priced inventory still available. This should provide a bounce in the reported prices for the next month or two…until the reality of higher for longer sinks in again.

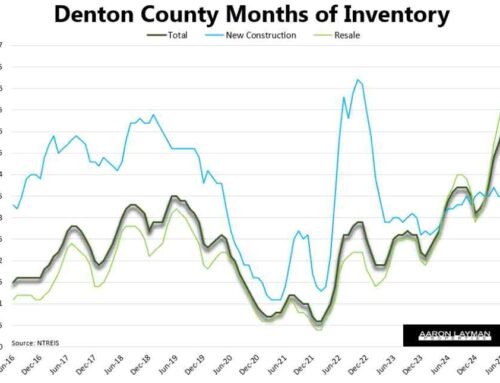

Denton County home sellers have been given a window of opportunity before inventory spikes again. Months of supply stood at 2.8 in November, before falling to just 2 months in January. Low inventory levels to start the year will also provide some fuel for a temporary bounce in prices.

Even with the recent dip in mortgage rates to six percent it’s taking longer to sell a home. Average days on market for Denton County home is now almost 2 months. That’s a more normal figure for a reasonably priced home. It’s crazy to think that average days on market was only two weeks in the FOMO mania last spring.

Median percent of list in Denton County stood at 95.3 percent in January. Average percent of list edged up to 93.8 percent. There are still plenty of sellers shooting for the moon even when it’s not warranted. Reasonably priced homes are selling pretty well. The current crop of inventory looks like it was picked through during the holiday shopping season. It will be interesting to see how much inventory hits the market this spring.

For prospective buyers and sellers, this the situation is still volatile. If you are in the market to buy a home inventory should rebounding soon. It may pay to wait until that inventory materializes. If you are a prospective seller there’s no time like the present.

After briefly flirting with a five handle a week ago, mortgage interest rates bounced back up to 6.5 percent this week. What will prospective buyers and sellers do when they are staring at a seven handle again? We’ll find out soon enough.

Here’s a riddle (rhetorical question actually) for those sellers still fishing for last year’s bubblicious prices. If your house is really worth what you think it is, why do you suppose, is the Federal Reserve still sitting on $2.62 trillion in mortgage-backed securities?

Leave A Comment