Denton County home prices have so far failed to recapture their 2022 highs. Official NTREIS stats show median home prices in Denton County Texas were 7 percent ($35,000) lower than May of last year. Average prices were down 6.8 percent ($40,000) year-over year.

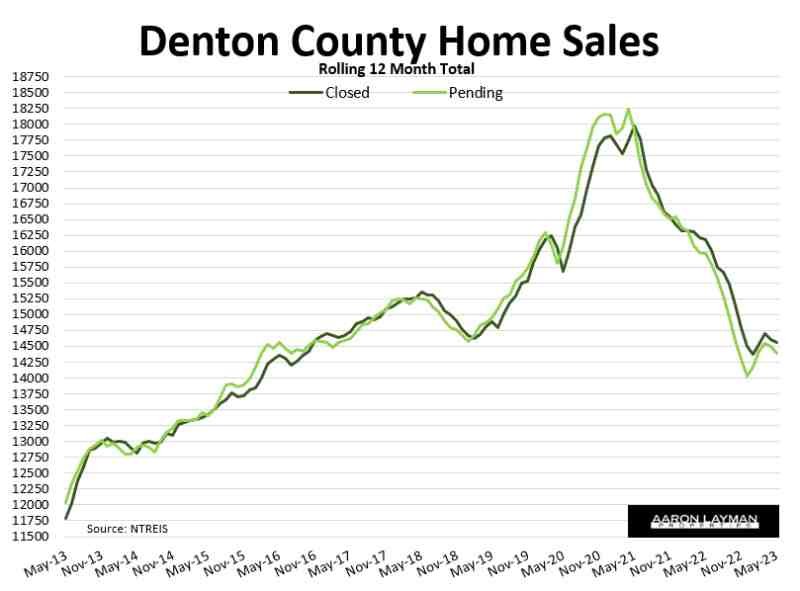

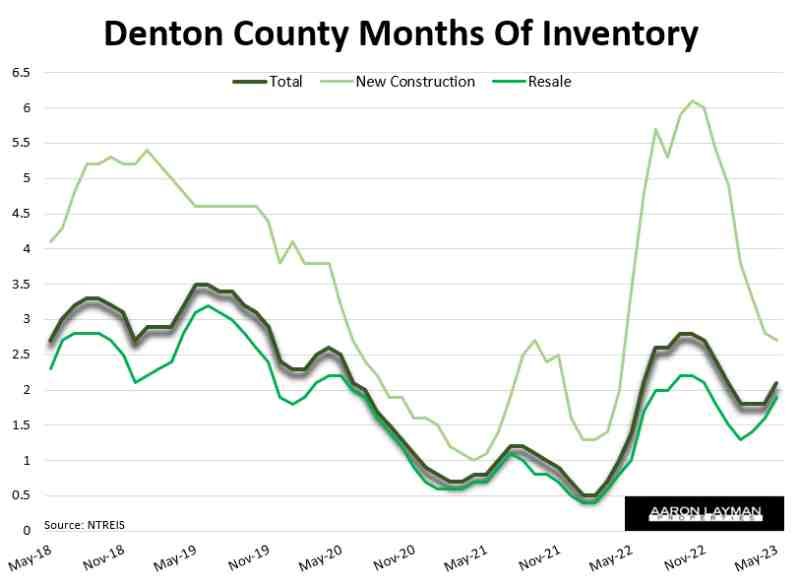

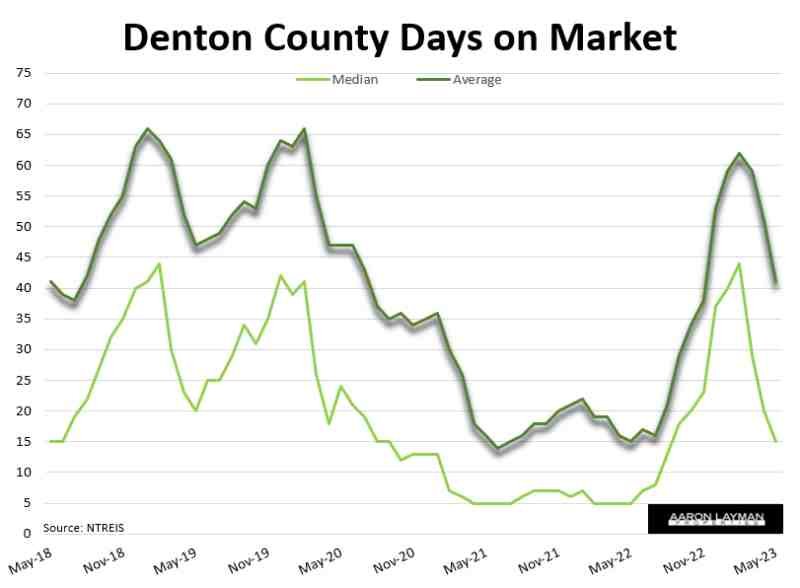

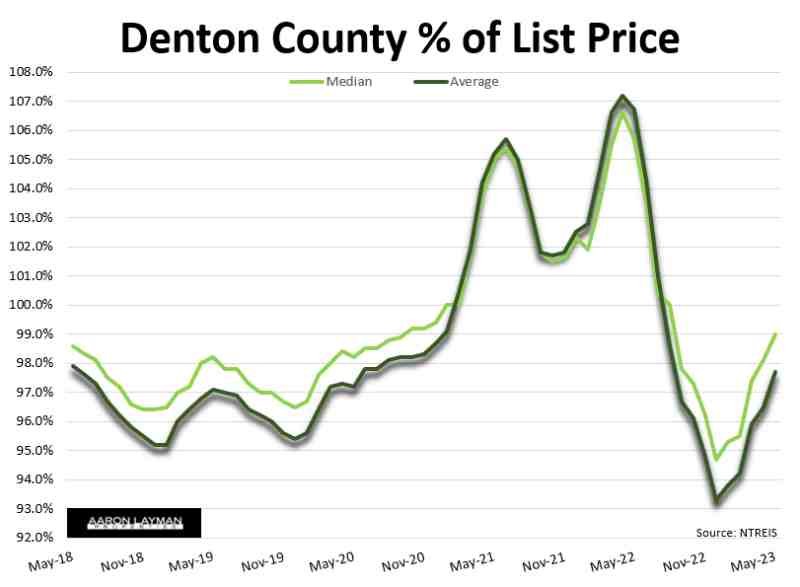

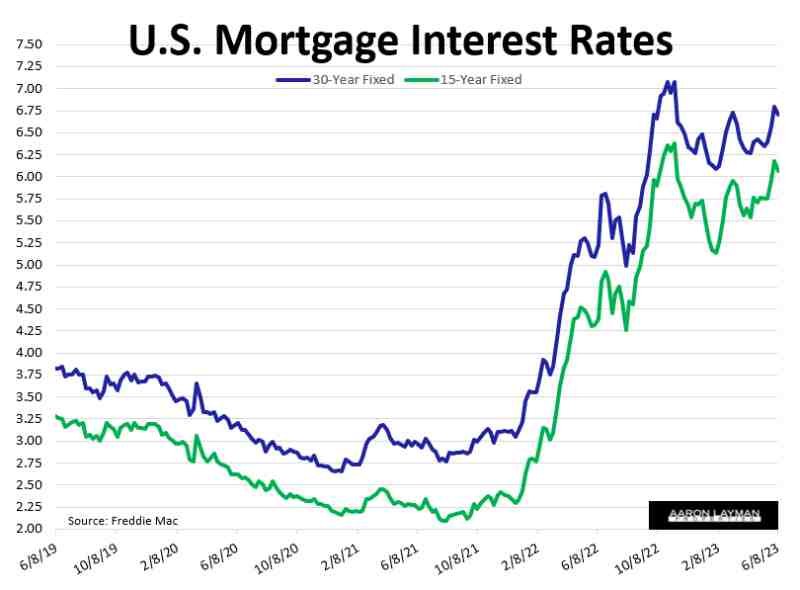

Home sales in the area were down 3.9 percent from this time last year. Stagnant sales volumes remain a theme with 6 and 7 percent interest rates taking a bite out of affordability for many prospective buyers. Pending contracts in Denton County were 7 percent lower year-over-year in May. Available home inventory edged up to 2.1 months of supply. Average days on market fell, while percent of list price rose to 97.7 percent in May.

There is no denying that we have seen a solid rebound in real estate prices this spring heading into the peak of the summer selling season. The spring rebound has many agents and industry figures talking about a soft landing. Many hope that the real estate market has bottomed because the want prices to resume climbing higher. Who doesn’t love higher home prices, right?

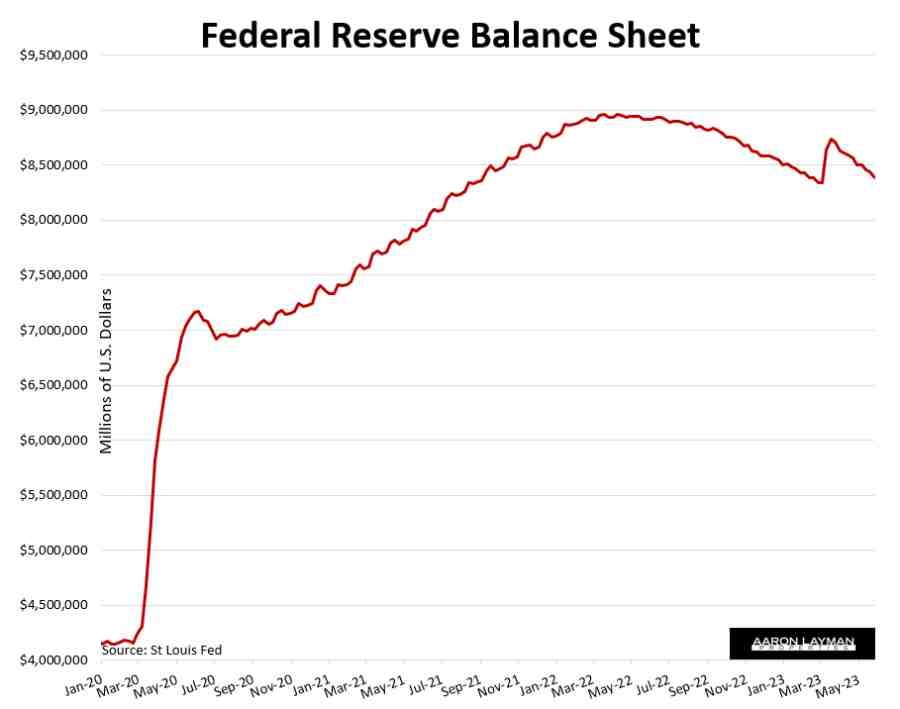

The spring rebound for the housing market is not really surprising if you have been paying attention. The Fed has done a miserable job of shrinking that bubble-blowing balance sheet. There is still a massive amount of artificial stimulus (and household spending power) courtesy of the $trillions in market interventions/supports during the pandemic. Now that the debt ceiling standoff has been resolved, the liquidity drain will again become more noticeable.

It is worth noting the Fed’s balance sheet runoff (aka QT) hasn’t been nearly has sharp as the buildup. This helps to explain why asset prices have remained elevated even in the face of rising interest rates. The White House and the Federal Reserve have been working overtime to keep the illusion going. Net liquidity to the markets actually increased this spring. They are working on borrowed time.

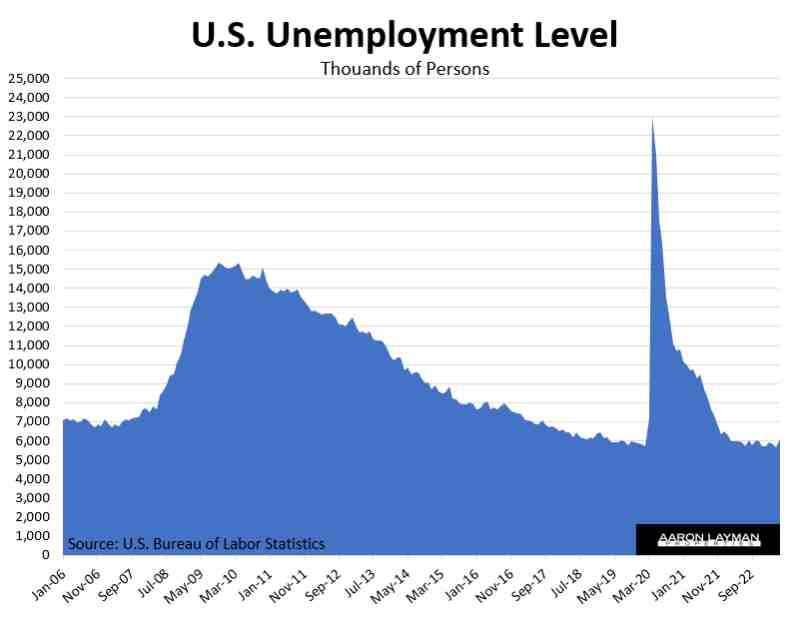

Solid employment growth through the first half of 2023 has kept a recession at bay. The employment engine of the U.S. has been firing on all cylinders for most of 2023. That has kept wage growth elevated while keeping unemployment near record lows. It also means the Federal Reserve has to keep rates higher than they originally planned. Once you let the inflation genie out of the bottle, it doesn’t like to go back without an extended battle.

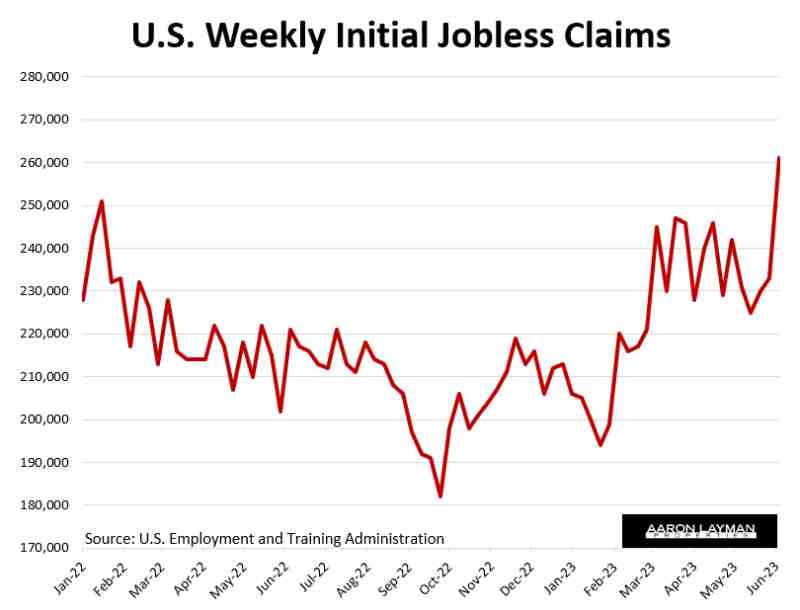

Behind the veneer of low unemployment initial weekly jobless claims are trending higher.

Mortgage interest rates are back near the seven percent mark for many prospective buyers.

The second half of 2023 is shaping up to be similar to last year in terms of the real estate market. The fourth quarter of 2022 was marked by the shock of the pronounced rise in rates. This year we’re looking at another decrease in consumer purchasing power and demand, but for different reasons. The jobs engine is starting to show some cracks. Initial weekly unemployment claims are rising as companies run into roadblocks in terms of how much they can push the envelope on prices. Companies begin cutting hours, and then they start cutting employees. That’s just how the cycle works.

Student loan payments are scheduled to resume in September…just as the economy and employment sector are softening. That’s going to curb demand for homes in the fourth quarter of the year.

Still No Property Tax Relief from Austin

As I predicted at the start of the year, the Texas legislature has produced a big donut on property tax relief. The market value of your home is likely lower than last year while your property tax bill is still going to be higher. Isn’t it ironic? The miscreants in Austin have actually done worse than I expected. They have managed to shaft teachers, students and Texas homeowners in one legislative session. As I predicted would happen, Abbott and his colleagues tried to ram school vouchers down the throats of voters while holding actual property tax reform hostage. Abbott managed to throw teachers and students under the bus in the process.

It’s beyond entertaining that Abbott went so far as stating that he wanted to end property taxes in Texas. The Houston Chronicle was smart enough to catch that delusional fantasy for what it is. What Abbott really meant was that he wanted to end property taxes for his wealthiest donors, or at least keep the generous loopholes in place which allow them to avoid paying property taxes in the system experienced by most Texas homeowners.

Austin leadership wants to avoid a state income tax at all costs because that would upset the virtuous cycle of corporate welfare dispensed in the name of economic development. Abbott isn’t going to end the gravy train for the property tax consultants, attorneys and real estate industry players any time soon because they help to keep the campaign coffers filled.

Change can be slow, but people will eventually catch on when you show them the cold hard facts. Many Denton County homeowners are waking up to how the system is rigged at the expense of the many in favor of the few. With property taxes on homes hitting record highs again this year, some residents are beginning to question if it’s all really worth it.

The reality is that many Denton County property owners pay little to nothing when it comes to property taxes. In a county with a huge number of agricultural exemptions on the books this puts significant pressure on local services and schools. The funding has to come from from somewhere, and when many property owners are allowed to opt out of taxes that puts more pressure on appraisal districts to make for the revenue shortfall. Local homeowners are often left picking up the tab for many of those exemptions.

An inquiry with the Denton Central Appraisal District confirmed there are 11,421 properties in Denton County with an agricultural exemption of one form or another. Some of the most valuable properties in the area are the recipients of generous exemptions allowing the owners to pay little to nothing in property taxes while average homes are getting hit with property tax bills of $10,000 per year or more.

There are valid reasons for property owners in legitimate agricultural business to receive exemptions. Real farmers and ranchers in Texas often depend on these important exemptions to make a living. That’s what makes it so sad to see many property owners taking advantage of the system so they can avoid paying property taxes and/or speculate on rising property prices.

That $5 million parcel down the road paying little to nothing in annual property taxes is a great deal for a corporation, private equity group or family trust sitting on the land for future development or just accumulating wealth. It’s a blight to the non-exempt property owners and real farmers and ranchers in the area.

You won’t here Abbott or Patrick mention these inconvenient facts in any special session. They have other agendas they are pushing. Neither one of them wants real property tax reform or actual uniform and equal appraisal in Texas. They just want their friends and donors to have the best outcomes in a comically dysfunctional system.

It’s not just the abuse of exemptions which make the Texas property tax system a charade. We still have a system in Texas where the comptroller tells residents we have uniform and equal appraisal when some of the most valuable property in the state is “appraised” and taxed at lest than half of market value.

While Abbott & Patrick were busy with fake political posturing the JW Marriott resort in San Antonio sold for $800 million. The Bexar County Appraisal District shows the resort was “appraised” with a 2023 market value of $370 million (a 53 percent discount to market).

Imagine what would happen to Abbott and Patrick’s property tax “relief” discussion if the state constitution mandated every home with a residential homestead exemption was required to be assessed and taxed at less than half of market value.

Leave A Comment