The National Association of Realtors (NAR) says existing home sales in the U.S. decreased in May to a seasonally adjusted annual rate of 5.43 million. This is down from a downwardly revised April figure, and the third consecutive month of declining year-over-year sales.

NAR chief economist, Lawrence Yun, seems to be puzzled by the stagnation of sales citing a solid economy and job market:

Lawrence Yun, NAR chief economist, says a solid economy and job market should be generating a much stronger sales pace than what has been seen so far this year. “Closings were down in a majority of the country last month and declined on an annual basis in each major region,” he said. “Incredibly low supply continues to be the primary impediment to more sales, but there’s no question the combination of higher prices and mortgage rates are pinching the budgets of prospective buyers, and ultimately keeping some from reaching the market.”

Since Mr. Yun seems to be perplexed by recent developments, perhaps I can explain it in Layman’s terms. The prices are too damn high! This is not rocket science. There is a major disconnect between what’s currently available in the market for sale and what MOST buyers are willing, able to afford. It’s really that simple, but most real estate industry puppets don’t like to discuss inconvenient truths. That “solid economy and job market” only exist for the top 10 percent of the American population. Everyone else is just trying to get by or not be left behind.

NAR reported that the median price of an existing home in May was $264,800, an all-time high and a rise of 4.9 percent from last year. It was the 75th straight month of year-over-year home price gains. Does anyone with a brain seriously think that average American workers’ real incomes have increased for 75 consecutive months? The truth is that the median home buyer in the U.S. is looking at paying close to 15% more each month to buy a home vs last year if you take into account higher mortgage rates and the higher prices of homes. Wage gains are not keeping up with this type of inflation.

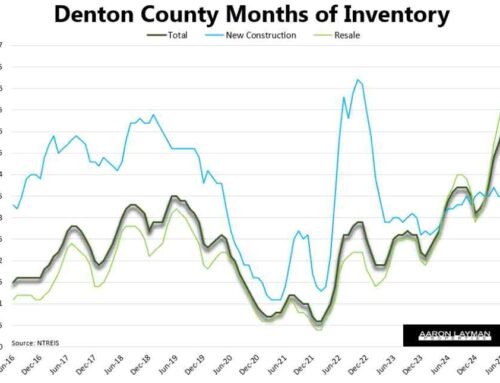

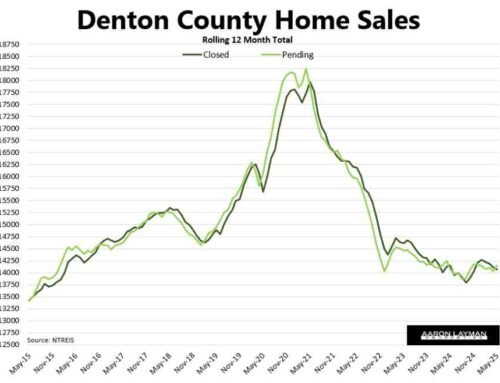

May figures for housing starts and permits showed a continued upward trend of new home construction, but new homes are much smaller percentage of the market compared to existing home sales. Lagging permits data show that even those numbers are stagnating due to the lack of affordable homes being constructed. Current (updated) data on existing (resale) home sales in the DFW area show a 0.8 percent decline for the DFW area as of today’s NTREIS trends numbers. The resale single-family category currently shows a 0.1% decline for May. Even accounting for late closings in the next few weeks, there’s NO WAY you will see that ridiculous 9 percent increase in sales the Dallas Morning News regurgitated as fact. As I uncovered and explained in that previous post, the Real Estate Center at Texas A&M has been inflating (overstating) the number of real sales in the DFW housing market. Their estimation for late closings was way over the top, and has been for a while.

The real irony in this situation is that the Federal Reserve wants to get in two more rate hikes this year. Hooray! That should certainly make homes more affordable. It’s enough to make your head spin…unless you stop and look at the collusion among the major central banks to see what’s really going on. The truth is that your modern central bank doesn’t give a damn whether the median American family can afford a decent home. For all of there empty lip service about “price stability” and “full employment” it’s painfully obvious that modern central bankers are simply doing the bidding of their real constituents, namely Wall Street and our too-big-to-jail banks that feed from the carnage they leave in their wake. This is a feature, not a bug in the system.

“The private control of credit is the modern form of slavery.” Upton Sinclair

Leave A Comment