A few days ago a friend of mine sent me a link to some “insight” on the coming economic developments that we should be preparing for in terms of debts and deficits. The company providing this research piece has over a $trillion in assets under management. Since I have a healthy skepticism of anything the financial “services” industry is selling I decided to give it a read. It was very informative, partly due to a complete fundamental ignorance of basic economics, but also because of an obvious contradiction with the author’s stated assumptions.

As I mentioned to my friend in a private message, I see the same fallacious arguments repeatedly within the housing industry. America is great, deficits and debt don’t matter. Rah, Rah, Rah! I get it. It’s a sales oriented business. What concerns me is when people put their hard-earned money into housing or any other supposed store of value thinking that the sky is the limit. We are living in an age of epic distortions, misinformation and outright fraud. Apparently we learned absolutely nothing from the Great Recession, save for the government and Federal Reserve’s determination/ability to cover it up and pretend like nothing ever happened.

As I was writing about the shortage of affordable new homes this morning, I couldn’t help but think about how we arrived here and how the transgressions leading to the last housing crash have been completely swept under the rug. This is not to say that the responses after the housing crash have been any better. We are now surrounded by banks which are larger than ever even as they continue to break the law racking up huge fines that amount to nothing but a slap on the wrist while the CEO reaps a huge payday. Criminality within the U.S. banking system is now a feature, not a bug. This should not be surprising considering the events of the last decade.

Getting back to the issue of affordable homes, one of the long cons on the American public continues to be the epic policy failures of the Federal Reserve that facilitated the destruction of the U.S. housing market as they buried the idea of “affordable” homes for the sake of their Wall Street roots. When a smallish, aging 3-bedroom, 2-bath detached home in need of repairs becomes a bidding war for the next young couple who just wants a decent roof over their head, that’s not exactly a healthy housing market or a healthy economy. It’s a sign that something is seriously out of whack with our priorities.

Back in January money manager James Stack was making a prescient warning about an overheated housing market, pointing out the excesses and irrational exuberance that were driving home prices and valuations of many builder stocks to extremes. He also keyed in on one of the most critical factors igniting the last housing downturn…The Fed.

“The last downturn came about when economic growth slowed after a series of rate increases, exposing the “rot in the woodwork” and prompting loan defaults.”

While the Federal Reserve continues to claim the U.S. economy is at or near “full employment”, many Americans know different. They know a con when they see one.

“Based on their analysis of the labor market, our economists continue to believe that, while improvements can be made in increasing employment, we are likely at or already past “full employment” in the U.S.” Robert Kaplan

For Kaplan and other Goldman Sachs alumni I’m sure the U.S. economy is pretty close to full employment. Working for the Vampire Squid pays pretty well. For middle America and anybody not in the top 10 percent of wage earners, there is a whole other story to discuss. It’s a conversation the Fed would rather not have of course. The first rule of fight club is that you do not talk about fight club.

The Federal Reserve is now embarking on a policy “normalization” to reduce it’s huge balance sheet. This quantitative tightening is already spooking markets and causing ripples within the housing market itself. Now that the Fed is finally pulling back the punch bowl, after nearly a decade of fueling Wall Street’s greed, interest rates are beginning to rise and new U.S. homes are now more UNaffordable than they have ever been compared to median U.S. wages.

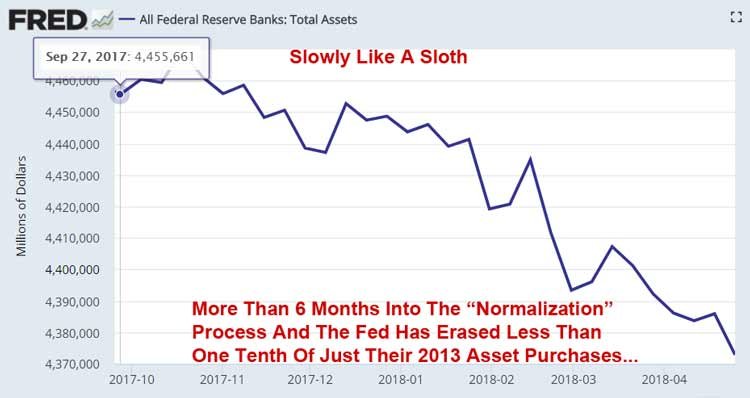

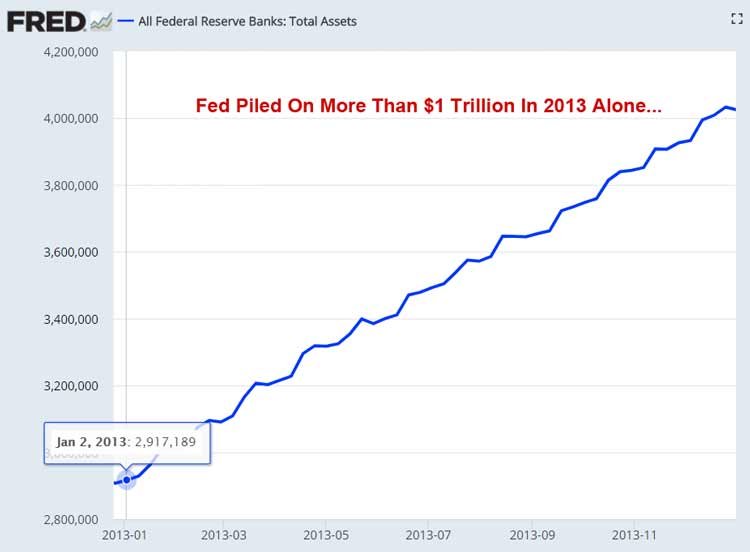

Of course the Federal Reserve’s army of economists will summarily dismiss the Fed’s culpability for the wreckage they have caused, but the Devil is in the details. There’s a reason the Fed is taking a sloth-like pace with their balance sheet reduction. We are now more than 6 months into this monetary adventure and the Fed hasn’t even drained off $100 billion from their balance sheet…

If the U.S. economy were really that healthy and we were truly at or near full employment, the Fed would have no problem at all draining off $85 billion per month, the same amount they were adding back in 2013 with QE-3!

While the Federal Reserve and other central banks have been busy inflating their balance sheets and virtually every asset under the sun, they have also been accelerating wealth and income inequality in the process as asset price inflation has far outpaced wage inflation…

It should go without saying that Federal Reserve officials are somewhat lacking in the credibility department. This should come as no surprise. If they were completely honest with the American public, I suspect Congress would be forced to revoke their charter. Author and Wall Street veteran Nomi Prins expounds on the collusion among central bankers…

“Two months later, I found myself sitting in front of a room filled with central bankers from around the world, listening to Fed Chair Janet Yellen proclaim that the worst of the crisis and its causes were behind us. In response, the first thing I asked that distinguished crowd was this: “Do you want to know why big Wall Street banks aren’t helping Main Street as much as they could?” The room was silent. I paused before answering, “Because you never required them to.” Nomi Prins

If you are out shopping for a home during this summer selling season and you are having a difficult time finding a good property at a reasonable price, be sure to thank the folks at the Fed for their fine work. Destroying a market takes some effort, particularly if you account for all of the PR necessary to cover your tracks. The Federal Reserve and their army of economists have created another fine mess in the U.S. housing market, destroying real price discovery and distorting the real value of a home which is end-user shelter.

When the government had the power to print money with no backing, the currency will always go to it’s intrinsic value of zero. My disbelief that an army of PhD economists don’t recognize this simple fact forces me to the conclusion that they know they’re destroying the currency but they and the elites are able to profit from it, while leaving everyone else destitute. With their money they control the politicians, so as long as we as countries allow central banks to exist, this will recur indefinitely. Andrew Jackson knew it and they tried at least to kill him, JFK knew it and they DID kill him. Central bankers are immoral, evil leeches.

Trickle-down monetary policy is just as destructive as trickle-down fiscal policy…

https://www.truthdig.com/articles/the-fed-the-bad-and-the-inequality/

Good stuff. Trying to find a home and can’t because of the FED. People are slowing learning how destructive they are. When do the masses see it and end the fed?

RE: “The Fed Has Successfully Destroyed The U.S. Housing Market”

Thank you for your excellent article, with a good measure of supporting data. This viewpoint is not available in the MSM. Too bad, but not surprising. Unfortunately only a tiny number of people will read this, and fewer will understand it. That is as intended.

Central Banks are not a new problem, or as Mark Twain said:

“History doesn’t repeat itself, but it does rhyme.”

“When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes. Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.” – Napoleon Bonaparte

“Permit me to issue and control the money of a nation, and I care not who makes its laws.” – Mayer Amschel Rothschild, International Banker

“History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control of governments by controlling money and its issuance.” – James Madison

“I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank. … You are a den of vipers and thieves.” – Andrew Jackson, 1834, on closing the Second Bank of the United States; (unabridged form, extended citation)

“The money power preys upon the nation in times of peace and conspires against it in times of adversity. It is more despotic than monarchy, more insolent than autocracy, more selfish than bureaucracy.” – Abraham Lincoln

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world, no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of a small group of dominant men.” – Woodrow Wilson

“Whoever controls the volume of money in our country is absolute master of all industry and commerce…and when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.” – James A. Garfield, assassinated president of the United States

http://www.stockhouse.com/news/newswire/2018/04/17/early-fall-out-from-toronto-s-burst-housing-bubble

Early Fall-out From Toronto’s Burst Housing Bubble

Jeff Nielson, Stockhouse

April 17, 2018

“As has been explained to readers in previous articles on this subject, the real estate equation is a simple one. Over the long term, housing prices must remain parallel to income levels. Period. No exceptions, ever.”

“Extended low interest rates always cause housing/real estate bubbles, and every central banker knows this. In 2008; these rapacious money-printers took Western interest rates to the lowest level in history – and just left them there, permanently. These housing bubbles were deliberately manufactured by Western central banks.”

And finally,

https://thefelderreport.com/2018/03/09/goldilocks-and-the-liquidity-bears/

Goldilocks And The Liquidity Bears

Jesse Felder

March 9, 2018

“Earnings don’t move the overall market; it’s the Federal Reserve Board… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.” – Stan Druckenmiller

See you on the other side of the bubble.

Layman says “Of course the Federal Reserve’s army of economists will summarily dismiss the Fed’s culpability for the wreckage they have caused, but the Devil is in the details. There’s a reason the Fed is taking a sloth-like pace with their balance sheet reduction….”- but he never states the reason. And the reason is that the banks that own the Fed would like nothing so much as to pay savers virtually notning forever while obtaining funds, to the extent the national debt can be expanded, for virtually nothing forever. This is the reason for the miniscule rate of balance sheet reduction.

The first step in dealing with the monster is to recognize it: whenever you hear “The Fed,” think “The banks that own the Fed.”

Excellent point. Ultimately the Fed is a creature of born of Wall Street banks. Congress opened Pandora’s box by issuing the charter. When you consider that our major U.S. banks are now essentially criminal organizations, everything else makes sense.

Wow, a 4 year-old article and still spot on. The Fed has STILL practically done NOTHING to stop their problem of destroying the housing market. They caused this problem after the last crash in ‘08 and apparently still have no desire to fix it. It is truly mind-boggling and depressing. What happened to the government working for the PEOPLE in this country? One of the biggest scams ever apparently. The government works for Wall Street now. I pray for our future (and the children that are inheriting such a horrible greed-driven mess in almost every category of life nowadays). May God have mercy on our souls (and this is coming from an Agnostic)..