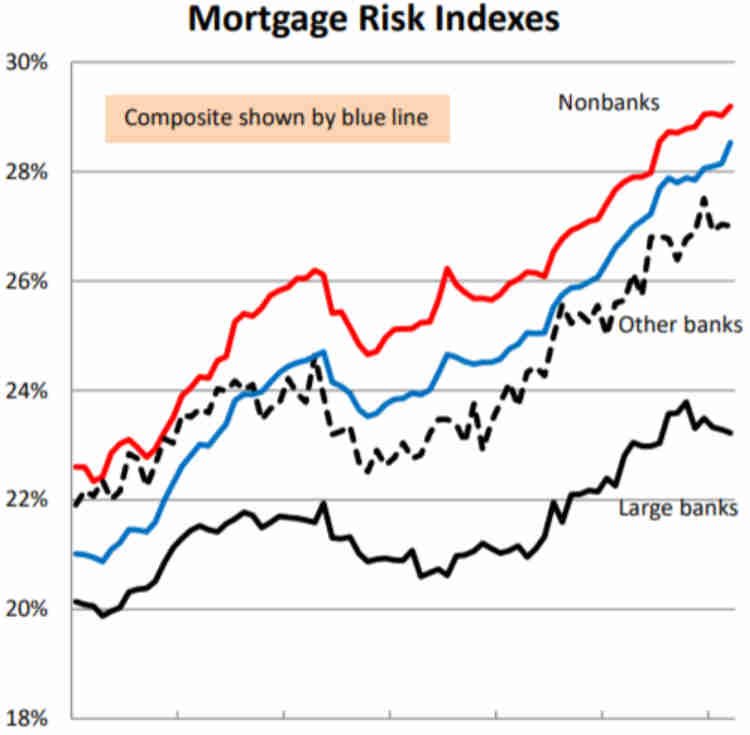

Shadow banks, or nonbanks as they are often called, continue to dominate the mortgage space in the real estate echo bubble. This is the case in Denton County Texas and all across the country. Since 2008 the share of mortgage originations by nonbanks has more than doubled, rising from 24% in 2008 to 54% in 0217. The share of mortgages issued by traditional large banks continue to decline.

As home prices rose throughout Denton County, the quality of the mortgages originated during this boom began deteriorating. Last year the deterioration in mortgage quality was pronounced. This is reminiscent of the last housing bust when borrowers were leveraging themselves to extremes to keep with up with rapidly rising home prices. The AEI Center on Housing Markets and Finance issued a detailed 184-page report on demonstrating how shadow banks have taken on increasing risks. The rising role of FHA-insured mortgages backstopping these increasingly risky loans certainly warrants concern.

The American Enterprise Institute report paints a rather bleak picture of home affordability in the United States. It also highlights how market share is shifting from banks to nonbanks due to the higher risk tolerance of nonbank lenders. Nonbanks virtually dominate the space for FHA purchase mortgages, with traditional large banks taking less than 10 percent of that business. More concerning is the deteriorating risk profile of these FHA-guaranteed mortgages…

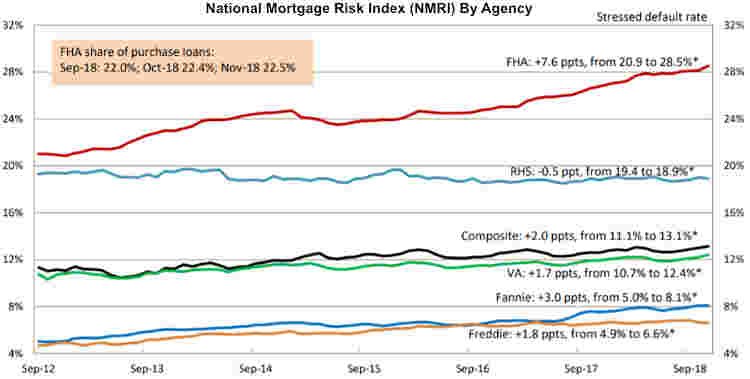

The AEI also uses a National Mortgage Risk Index for mortgage default risk based on performance of older vintage loans. The NMRI shows a big jump in the stressed default rate of FHA-insured mortgages…

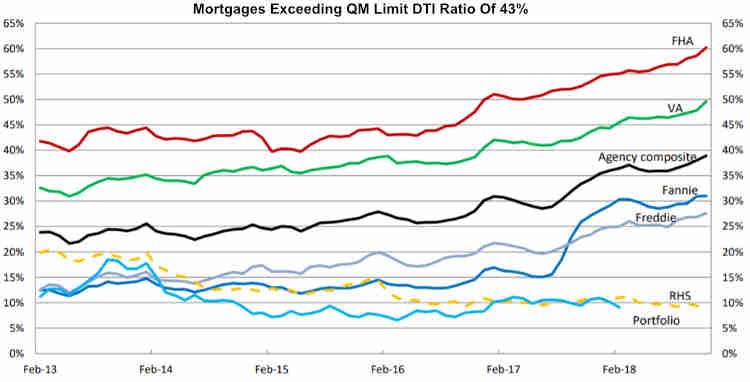

The debt-to-income DTI ratios of recent FHA loans are simply disturbing. More than half of the FHA-insured loans now carry DTI ratios exceeding the QM limit of 43%. Nearly half of VA mortgages also exceeded the QM limit.

Obviously these trends are not sustainable. The question is what can be done to solve the problem. AEI suggests we need accelerated household incomes or further increases in leverage if we are going to support the housing market. Unfortunately the Fed is adamantly opposed to wage inflation of any significance. Paying the slaves actual living wages is not part of the profit-driven business plan. Higher leverage is just another accident waiting to happen. Sadly it is the most vulnerable borrowers in the market who are most likely to leverage beyond their means in order to buy a home. There are some new home builders who cater to these types of vulnerable borrowers. The picture looks fine as long as home prices continue to rise. It’s only when the market turns south that we see the longer-term consequences of risky mortgage lending.

Leave A Comment