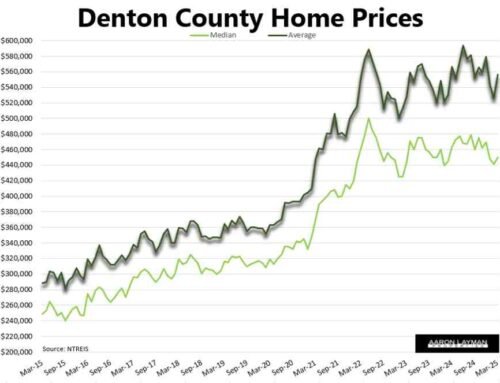

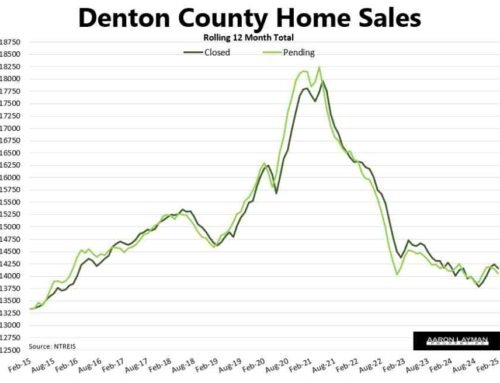

Denton County home sales rose 3 percent compared to the same month last year, driven by a the precipitous drop in mortgage rates which are now back below a 4-handle. The increase in home sales this spring has offset the weak start to the year during the first quarter. The average price of a Denton County home was roughly $368,525 in May, up 4 percent from prices last year. The inventory of homes for sale in Denton County rose 25 percent, hitting 3.4 months of supply.

New home sales continued to fare better than the resale market in May, as existing homeowners try to adapt to the shifting market. Average new home prices were down about 1 percent in Denton County during the month, while prices for resale properties were more than 5 percent higher. With resale homes constituting the bulk of sales, it is easy to see why the overall market is stagnating. This week I came across a VA short sale right here in Denton Texas which is on the market for $31,000 less than its new purchase price a year ago. Ain’t that a kick in the head!

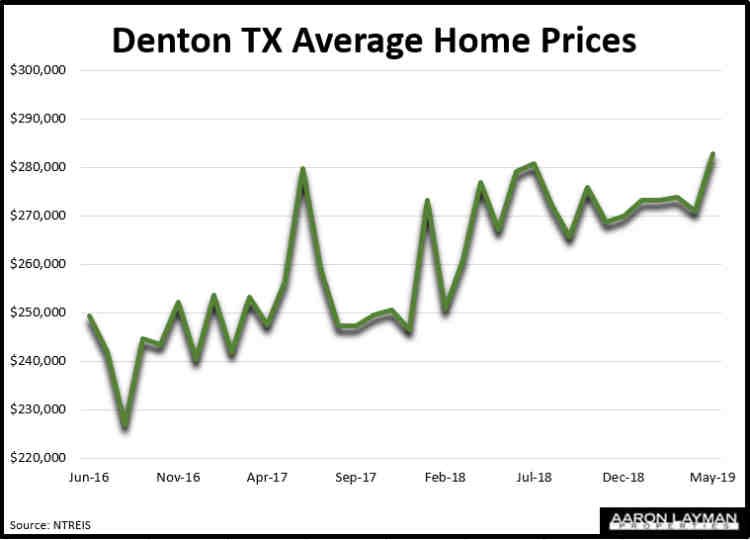

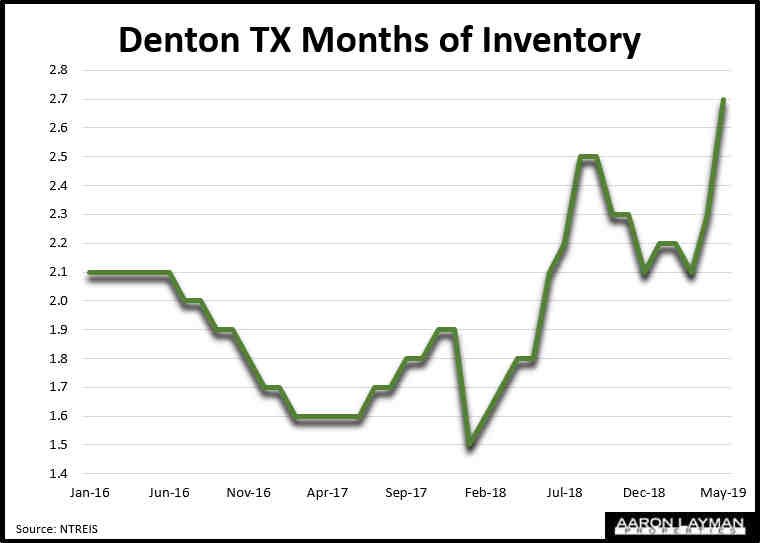

Home prices in the City of Denton hit a new all-time in May at roughly $283,392. This translated to a price gain of 6 percent compared to last year. While prices hit a new record in Denton, the Denton real estate market paid dearly for the privilege. Sales volume tanked in May, falling 15 percent year-over-year, and the supply of homes for sale jumped 50 percent to 2.7 months of supply. Forward looking contract activity in Denton fell about 16 percent in May, another indicator that high prices are taking a toll on home buyer demand.

The Dallas Fort Worth real estate is still in the midst of a top-down correction. This is an unfortunate truth that most real estate practitioners in the area are loathe to discuss. The Dallas Morning News real estate desk is still out to lunch in terms of what is actually happening. Steve Brown is floating the myth that 3.4 months of inventory is “about half of what is considered a balanced market”. Apparently Mr. Brown didn’t get the memo. Or maybe he just doesn’t care in reporting the truth? The fact that he continues to conflate total sales volume with “preowned single-family home sales” is simply unconscionable for someone calling themselves a real estate editor.

For the record, the 6 percent DFW sales increase quoted in the major news media is pure fiction, a statistical estimation of what the economic hack jobs at the Texas A&M Real Estate Center have produced for the local association. NTREIS Trends data show point to a 3 percent sales increase for DFW in May, about half of the increase reported in the media. Even allowing for late closings, that 6 percent algorithm miscue suggests that A&M’s RECenter is still cooking the books.

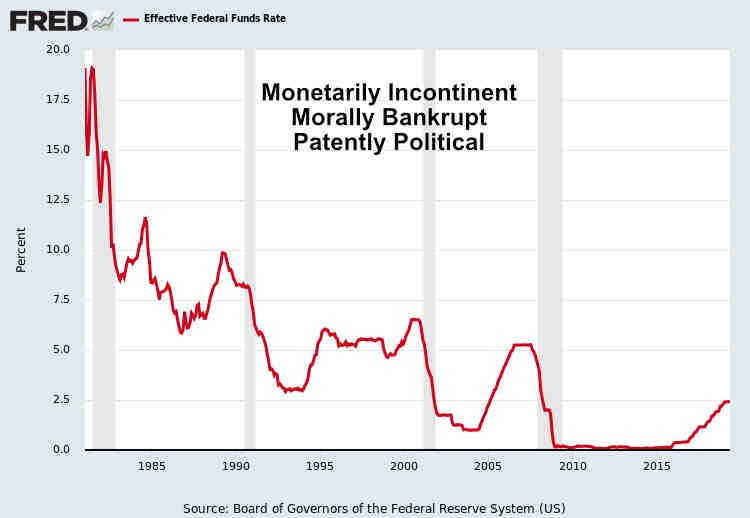

Job growth continues to slow in the DFW area. Consumers are still strapped, and the only real thing that’s helping at this point is artificially lower interest rates. There is a reason Trump is hounding the Fed for rate cuts from the Federal Reserve. There is a reason you had 13 FOMC officials hitting the airwaves last week attempting to talk up the stock market. The establishment needs ultra-low interest rates and an inflated stock market to keep the trickle-down narrative from falling apart.

Despite their best efforts, it probably won’t make any difference. There is only so much low rates can do at this point to stimulate home sales, or automobile sales for that matter. Pending home sales are already stagnating again with interest rates below 4 percent. Few of the real estate “experts” saw this coming, because very few of the “experts” are giving you a picture of the real economy.

The truth is that home prices (like auto prices) have been artificially inflated to record levels, and it takes more and more stimulus to maintain any growth in sales volumes. This is the economic environment created by years of central bank intervention and trickle-down policies. Keep this in mind the next time you are visiting a restaurant and wondering why senior citizens are waiting on you. These folks aren’t there by choice. They are simply trying to survive in an economy which is fundamentally broken.

Home prices in Denton Texas are at an all-time high…

But fewer people can now afford the homes available for sale. Inventory has spiked higher during the last year…

Leave A Comment