Zillow has hit the pause button on buying homes in the U.S. Zillow reportedly has halted cash purchases of homes through the remainder of the year. Citing labor and supply shortages, the company says it just can’t keep up with demand as it works through a backlog of homes it has to close on, renovate and sell. Zillow’s chief operating officer phrased it like this.

“We’re operating within a labor-and supply-constrained economy inside a competitive real estate market, especially in the construction, renovation and closing spaces.”

Interestingly, other iBuyers like Opendoor, Offerpad and Redfin have announced they will continue with cash offers for homes. While making the transition to a real estate broker, Zillow has also made a large push into flipping homes in the past few years. Zillow reportedly bought 3800 homes in the 2nd quarter alone. Zillow’s cash offers for homes business involves buying properties, making light repairs and re-listing the homes for sale.

You would think that involves buying homes and selling them for a profit, but flipping is harder than it looks. It’s certainly more difficult than the NOT-reality-TV version of get-rich-quick you often see presented on cable media outlets. Zillow’s second quarter earnings report highlighted how difficult it really is. In what was arguably one of the hottest real estate markets in history, Zillow racked up a pre-tax $59 million loss in its homes segment. Through the first six months of 2021 Zillow’s earnings statement shows a pre-tax loss of $117,820,000.

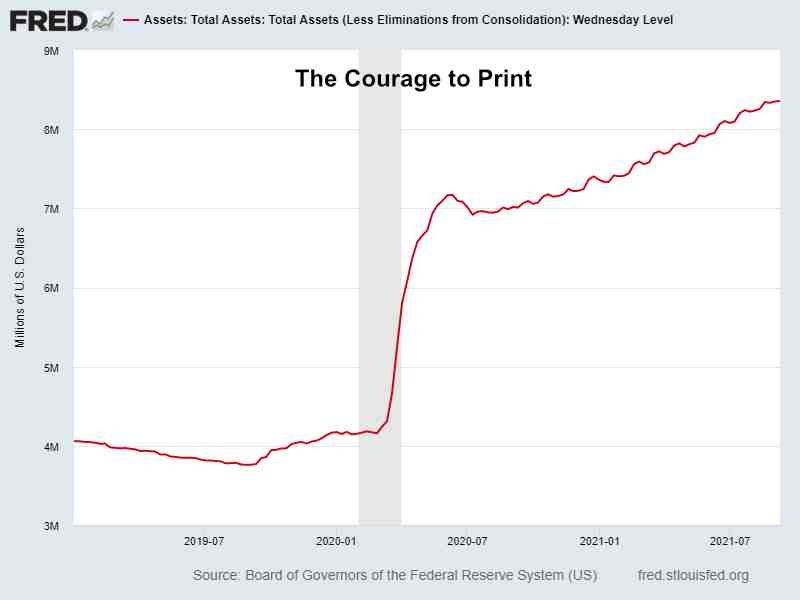

Those numbers were actually an improvement from 2020, but Zillow had a lot of help from the Fed along the way. It should be relatively easy to flip a home for a profit when prices are rising close to 20 percent annually, but Zillow was still racking up losses in its home’s segment. This speaks to the hyperfinancialization of the housing market in general and the copious amounts of liquidity sloshing around Wall Street.

According to comments on articles on Inman, many agents aren’t buying Zillow’s excuse of supply and labor constraints. I’m not either. I think there’s a very obvious explanation why Zillow has temporarily halted making cash offers for homes in the U.S. It doesn’t take a rocket scientist to realize a lot of people overpaid for homes this year as the Federal Reserve was pumping asset prices to record highs. Now that the Fed is poised to remove that excess liquidity, real estate prices are at risk of correcting. Agents from other parts of the country have highlighted examples where Zillow overpaid for homes with its cash offers program. I located multiple examples here in the DFW area where Zillow demonstrated irrational exuberance.

The first is a home in Allen Texas which apparently sold to Zillow for around $480,000 in July. It was re-listed by Zillow for $485,100 in August. Three price reductions later it’s still listed on the market today at $444,900.

As second example shows a Dallas Texas home sold to Zillow for around $400,000 in June. Zillow re-listed the property for $471,900 the same month. With no apparent takers, it hit the MLS a week later. Seven price cuts later it’s now listed on the market for $359,900.

A home in Aubrey Texas was apparently bought by Zillow for around $450,000 this June. This home was re-listed for $483,100. Five price reductions later, it’s still listed for sale at $429,900. The home shows to have been under contract three times before busting out each time. I can see why. The lot on this particular listing is a glorified train wreck, centered smack dab on a large electrical transmission tower.

Now that the Fed is poised to taper that $120 billion per month in asset purchases, a lot of reckless speculative behavior is going to be exposed. I’m not surprised to see Zillow overpaying for homes this year. A lot of people did, because the Federal Reserve was actively encouraging it. It will be interesting to see if the other iBuyer platforms ratchet down their actual cash offers for homes while they keep buying. Losing money at scale is not exactly a sustainable business model.

Before you get all teary-eyed on Zillow’s cash offers predicament, it’s probably worth noting that Zillow is still raking in $millions by selling advertising to agents. Zillow’s IMT segment (which includes the online advertising revenue) shows a pre-tax income of $133,573,000 for the second quarter. Through the first half of 2021, the segment including online ads generated $277 million in pre-tax income.

Leave A Comment