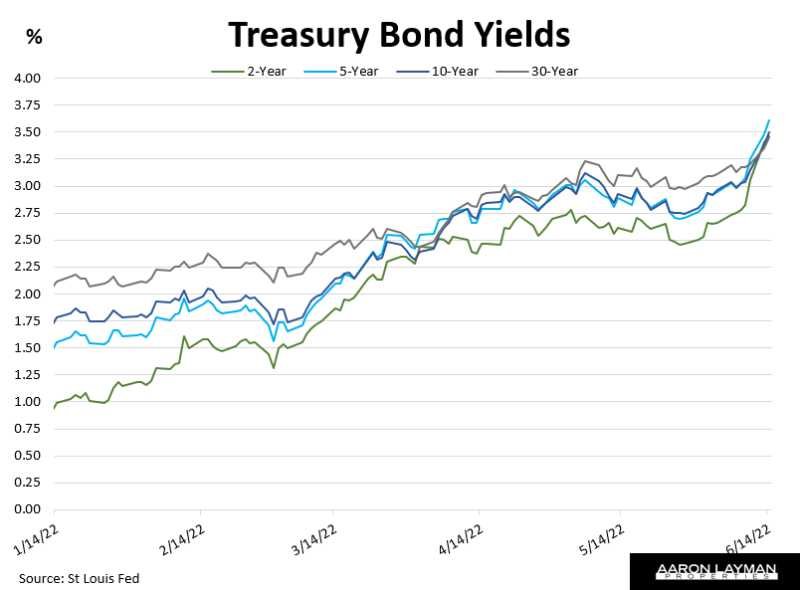

Here are 7 tips for Denton County home buyers as the post-pandemic housing bubble pops. We’ve seen some epic moves in the bond markets the last few days. The yield on the 10-year treasury bond spiked to 3.5% on Tuesday, pushing mortgage rates to yearly highs. The rate on 30-year fixed-rate mortgage jumped to 6.28% according to Mortgage News Daily.

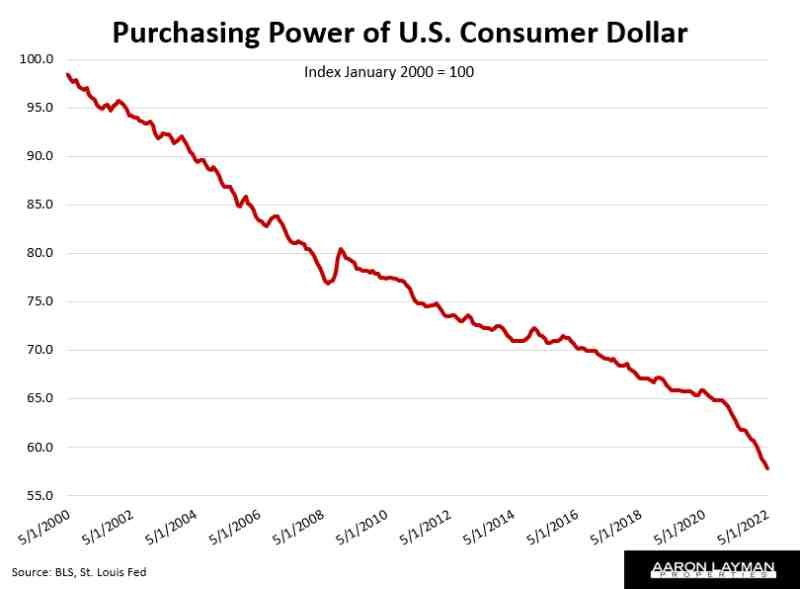

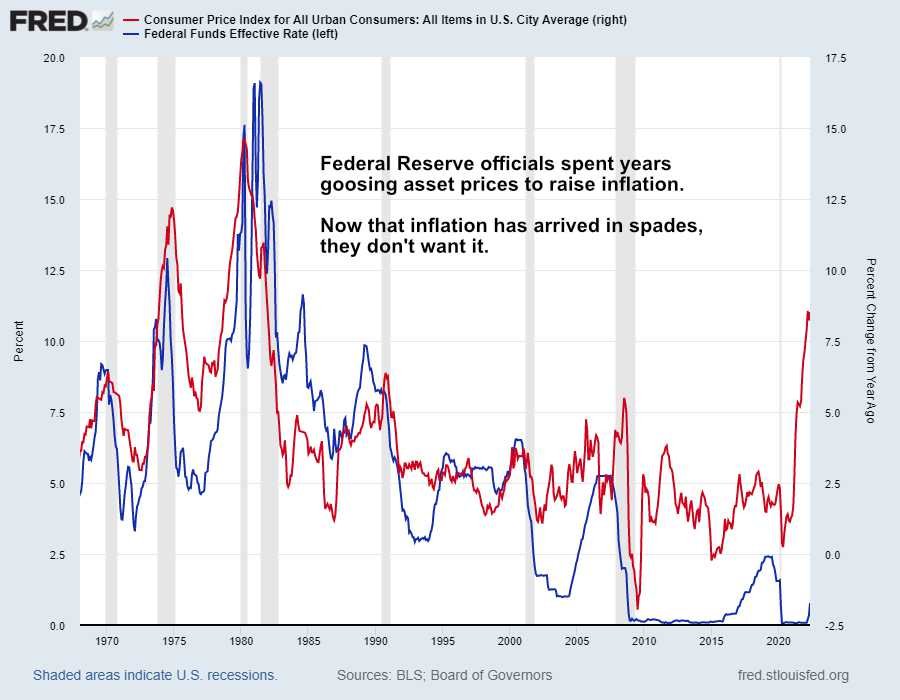

Inflation is raging, and consumers are losing patience. If they aren’t already priced out of the market, many buyers are hitting the pause button. Home affordability has been absolutely crushed the last few months as the Powell Fed tries to make up for lost time and wasted opportunities to curtail inflation. Today’s FOMC meeting will certainly be interesting. It won’t really matter if the Fed hikes 50 basis points or 100. Either way, Jerome is going to be behind the curve. The Fed let the markets boil far too long and ignored the consequences. The bubble is now begging to be burst.

If you are in the market to buy a home, here are some tips to navigate this housing bubble as it unwinds.

Tip #1 – Be Patient

The housing bubble is unraveling as the Federal Reserve drains liquidity and demand out of the markets. Let the markets sort this out while you are finding the right home that fits your needs. The Fed spent years juicing asset prices and fueling outsized demand. It could take years for them to unwind the inflationary monster they created.

No one knows for certain how long and how deep the correction will be. This was a liquidity -driven policy error of epic proportions. It was years in the making. It’s going to take time and effort to sort everything out. Don’t get in a rush. The panic buying is coming to an end. Inventory is coming back to the market, though it may take a while to completely normalize. Wait for your opportunity, and be ready to capitalize when you see it.

Tip # 2 – Find Competent Representation

Remember the agents who encouraged buyers to do foolish things like waiving inspections and getting into bidding wars. You should avoid these people like the plague. There were plenty of sell-side charlatans who encouraged reckless behavior during the pandemic. They don’t deserve your business.

I can show you countless examples of Realtors, economists and industry apologists who denied the bubble was brewing last year. Jerome Powell wasn’t the only con artist pretending that inflation was transitory. The sell-side real estate industry was happy to sell the comfortable lie of organic economic growth, even while the Federal Reserve was pumping $120 billion per month in stimulus to prop up the charade.

Find a professional buyer rep who appreciates the concept of fiduciary duty. Find a partner who understands why this pandemic-driven boom took place and why it is now unraveling. You’ll find that’s a much smaller pool of licensed real estate agents.

Tip # 3 – Know Your Limits

Higher mortgage rates have completely changed the landscape. Your purchase price limit may need to be-recalibrated with rates now above 6 percent. Find a good lender and know what you qualify for. Obtain a legitimate prequalification. That involves more than a phone conversation. You will need to submit a full application and documentation to back it up. Understand your financing options and your loan limits with various products. This could include fixed-rate or variable-rate loan products. Even if you are paying cash, it helps to have a budget in mind so you don’t stretch yourself beyond your means.

Tip # 4 – Be Rational, Not Emotional

This is no time to fall in love with a home. Don’t get emotional. Many sellers are still in denial, so don’t take the bait. That eye candy make look fabulous, but you want to evaluate the entire package. Forget the love letters to the seller. You might as well stamp the word “sucker” to your forehead if you want to go that route.

Focus on what matters. Look at things which add value to the equation like location, floor plan and structural features. And don’t forget the dirt. They call it real estate for a reason. What are you actually getting for your money? What is your threshold for breaking even on the purchase? Those are important questions you need to answer when the market is correcting.

Tip # 5 Consider All Your Options

You may have been set on a single-family home in the perfect master-planned community. Maybe that’s not the ideal fit for you. There may be better options if you look at different neighborhoods or property types. The pandemic housing bubble and work-from-home dynamic were interesting developments. The bid for the burbs was intense, sparking some seriously crazy activity. WFH appears to have some staying power, but markets are still adjusting to find the new normal.

Tip # 6 – Tread Cautiously with New Construction

There are a record number of housing units under construction in the U.S. The housing “shortage” story made for some great headlines, but it was mostly a sell-side narrative facilitated by the real estate industry to spur more sales.

There are tens of thousands of developed lots coming to the North Texas housing market. Some of it is still backlogged, but 6 percent mortgage rates are an entirely new dynamic for builders trying to unload their inventory at all-time high prices. When I spoke with a local builder rep recently regarding flexibility on pricing, her response was memorable. She told me she would get the pricing as low as she could without getting fired.

Builders are finally starting to get motivated again, but we’re early in the game. The motivation will improve as the housing bubble unwinds and they have to compete for buyers again.

Tip # 7 – Consider Renting

Renting may not be your ideal alternative, but it beats locking in record high prices in a Fed tightening cycle. Would you rather pay a temporary monthly premium for 6-12 months, or catch a falling knife and possibly lose your shirt? There will be plenty of people experiencing buyer’s remorse this year, especially if they didn’t have a sizeable down payment for an equity cushion. You don’t have to be one of those buyers. Renting could be the better option, particularly in the short term. Be sure to factor your moving and storage costs into the equation if you are going to compare renting vs buying.

I hope you found these tips to be helpful. If you need professional buyer representation, I’m just a phone call away. For more information on North Texas homes and real estate give me a call.

You can also listen to this post in podcast form here…

Leave A Comment