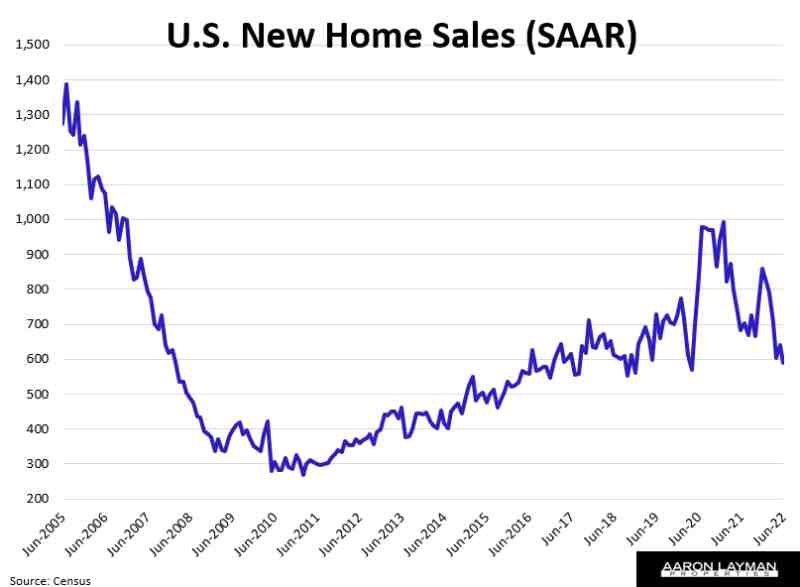

The Census Bureau reported new home sales for June at a seasonally adjusted annual rate of 590,000 units. This was below expectations. The three previous months were revised lower as well. New home sales in June were 8.1 percent lower than May and 17.4 percent lower than the same time last year. The median price of a new home dropped to $402,400. The average sales price posted at $456,800. Those were the lowest prices for 2022. Average new home prices just crashed 19.8 percent ($112,500) from the April blow-off top this year according to Census figures.

The unfortunate truth for the homebuilding industry is that far fewer people can afford a $500,000 new home with mortgage rates above 5 percent. When rates hit 5 percent this year, that was akin to pressing your foot on the breaks. When rates hit 6 percent, that was like slamming your foot on the breaks for the housing market.

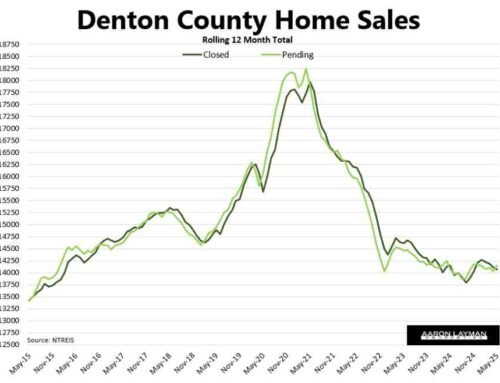

Buyer sentiment has taken a nosedive now that affordability of homes has been crushed. Home builders were some of the first to experience the slowdown because they ramped prices to the moon during the pandemic boom. The latest earnings reports from major builders pretty much say it all.

The country’s largest home builder, D.R. Horton, saw a 1% drop in closings and a 7% decline in Q3 net sales orders. Horton’s cancellation rate jumped to 24%.

“In June, we began to see a moderation in housing demand as mortgage interest rates increased substantially and inflationary pressures remained elevated.”

PulteGroup experienced a sharp slowdown with net orders dropping 23% for the quarter ending in June. PulteGroup’s cancellation rate more than doubled to 15%.

Tri Pointe Homes was also hit by the pullback in new home demand. New home orders fell 16% for the quarter ending in June. Tri Pointe Homes cancellation rate jumped to 16%, up from 7% last year.

Taylor Morrison posted a 7.2% decrease in closings and a 25.4% decline in home orders for the quarter ending in June. Taylor Morrison’s CEO described the sharp reversal in the new home market:

“Housing market conditions evolved quickly during the second quarter as the impact of higher interest rates collided with home price appreciation, stock market volatility and geopolitical tensions. The rapid deterioration in affordability and consumer confidence cooled homebuying demand as shoppers faced significant uncertainty, related as much to the sheer speed of change as to the shock of higher costs. These headwinds became most pronounced in the latter weeks of the quarter and have continued thus far in July.”

Meritage Homes experienced a 2 percent slide in closings for the quarter ending in June. Orders for new homes fell 20 percent when adjusting for their higher community count.

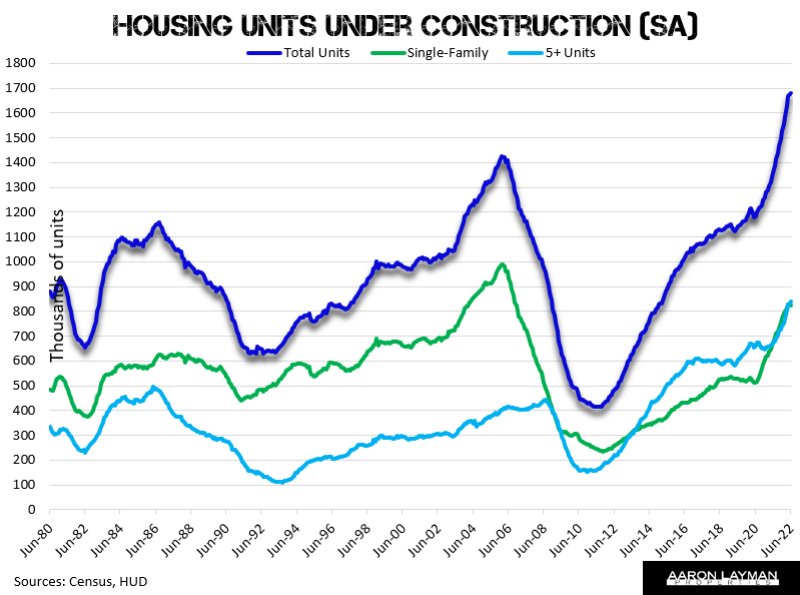

The number of housing units under construction is at an all-time high. The latest report from the Census Bureau pegs the number of new homes under construction at a record 6.22 months supply. That breaks the previous record set back in 1980. Total supply for sale at the end of the period in June jumped to 9.3 months. This is worth mentioning because there are still industry charlatans talking about a shortage of homes in the U.S.

Builders are now being forced to ratchet down their pandemic-inflated pricing to bring affordability back into line with the market. As new construction inventory continues to normalize, it should not be surprising to see lower new home prices in the months ahead. The liquidity tide is rolling out, and the housing market correction is underway regardless of whether the experts acknowledge it.

New home builders across the DFW area are now offering generous closing cost and/or financing incentives and commission bonuses to selling agents. That’s a stark reversal from just 12 months ago when builders were pretending agents didn’t exist because they had customers lining up at the door.

When the incentives fail to move the amount of inventory piling up in builders’ backlogs, the price cutting will likely pick up steam. Many of the Fed apologists and industry experts are finally realizing there’s actually plenty of inventory waiting in the wings.

In terms of the new home market, much of this inventory wasn’t visible on public databases because it hadn’t been listed for sale in the MLS. Guess what’s happening now! That huge pipeline of under-construction inventory is finally coming back to the MLS and showing up as available inventory because builders are being forced to “sell” it rather than just taking orders.

It should be readily apparent now to all of the “experts” that the pandemic housing bubble was just that. If you are in the market to buy a new home, your choices will be improving and prices should be coming back down. That’s a good thing if we hope to have a sustainable housing market which is accessible to more American families.

The fake housing “shortage” story has now been exposed as a glorious lie with the June data.

The number of new completed homes for sale (39,000) and homes under construction (308,000) hit a high for the year in June. There are now 463,000 homes under construction which are available for sale (not seasonally adjusted). That’s something you definitely don’t see in a real housing shortage.

Leave A Comment