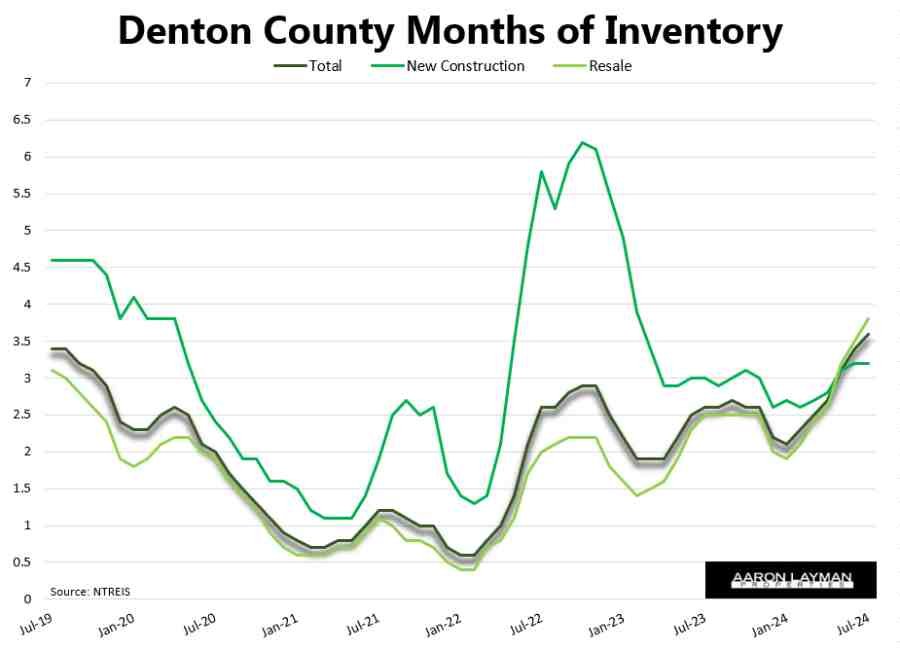

North Texas home inventory has experienced a sharp rebound in 2024. The savagely unhealthy housing market and a buyers’ strike have helped to replenish available housing stock this year. The key has been a dramatic turnaround in existing home inventory. Across the DFW area, existing home supply has rebounded sharply this year.

Here’s a county-level summary of the resale inventory increases in the Dallas-Fort Worth area through July 2024:

- Dallas County – Up 63.6% Year-over-Year (3.6 months of supply)

- Tarrant County – Up 59.1% (3.5 months of supply)

- Collin County – Up 69.6% (3.9 months of supply)

- Denton County – 48.0% (3.7 months of supply)

Simply Unaffordable

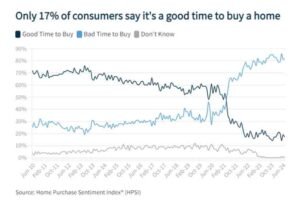

A slowing economy, weakening labor market and still-elevated home prices have created a toxic mix of unaffordability in the housing market. Fannie Mae Home Purchase Sentiment Index (HPSI) sums up the predicament for most prospective buyers. Yes, there are plenty of available homes. The problem is that many Americans can simply no longer afford the prices. Only 17 percent of July survey respondents thought it was a good time to buy a home in July. In contrast, 65 percent of survey respondents believed it was a good time to sell.

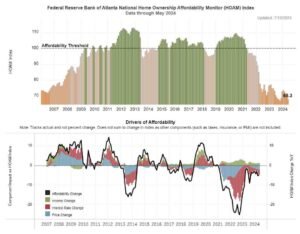

The Atlanta Fed’s Home Ownership Affordability Monitor just confirms what prospective buyers are facing. Despite a slight drop in mortgage rates into the six percent range, home affordability remains a major hurdle for many Americans. The latest reading with lagged May data showed a median payment for the median U.S. home at $2,977. That payment represents nearly 44 percent of the median monthly U.S. income, and well above the conservative ratios for debt-to-income limits.

Stagnating Employment Cools Demand for Expensive Homes

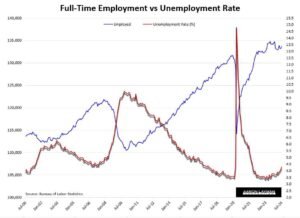

With the U.S. unemployment rate rising to 4.3 percent in July, it appears we are getting closer to the breaking point for the labor market. For most of the year the job market was hanging tough. The July employment report revealed things might not be as good as the massaged data were advertising.

It’s no secret the Bureau of Labor Statistics does some pretty weird stuff to normalize the data. The real question is whether the BLS headline numbers reflect the true health of U.S. labor market. Does the rise of multiple job holders make up for the loss of normal full-time employed Americans? We could soon find the answer to that question. Mike Green posited some thoughts on that subject along with a good discussion of market volatility. It’s well worth a watch if you have the time.

More Sellers Competing for a Smaller Buyer Pool

If you are in the market to sell a home, the recent rise in inventory demands your attention. Not only are you competing against professional home sellers in the form of new home builders, you now face competition from other existing sellers. Existing resale inventory has been largely absent for the past few years. That has allowed many sellers to push the envelope on pricing.

Fiscal and monetary stimulus are finally beginning to cool as we head into the fall. It will be interesting to see what happens with home prices in the DFW area as typical seasonality sets in. Sharply higher inventory and more price cuts from sellers could certainly lead to softer home prices heading into the end of the year. I am keeping a close eye on submarkets where inventory is already approaching 4 months of supply. Collin County Texas looks like it’s firmly in correction mode.

Suburban sellers are probably more at risk of a market correction. DFW saw some pretty wild spikes in prices and activity in the North Texas burbs over the past few years.

2022 Vintage Buyers Find Themselves in a Pickle

Some buyers who dove into the pool in 2022 throwing caution to the wind are discovering the risks of new construction in Texas. When development is active, it’s easy to find yourself surrounded by a bunch of sellers when market conditions change.

This scenario is playing out all across DFW. I’m seeing a lot of 2022-vintage buyers who are now trying to unload their homes for the inflated prices they think they are worth vs the real lower market value. If you bought a new home in North Texas during the 2022 mania, there’s a good chance that home currently worth less than what you paid for it. This is particularly true for some of the recent out-of-state transplants who aren’t familiar with Texas housing market dynamics.

If you are surrounded by more new homes in subsequent sections of your community your potential buyers will be gravitating toward the new-build options with the generous incentives and a new home warranty.

In this scenario selling is no easy task. To make matters worse, there are plenty of agents who will overpromise to get your listing only to slow walk you to the inevitable conclusion of a significant price cut and capitulation. Your gently used home with eye candy may be adorable. That postage stamp lot you compromised on is not. Previously-overlooked deficiencies will bite you in the butt in a more competitive resale market.

When the Rate Cuts Arrive, You Might Wish They Hadn’t

This is probably worth a reminder that we haven’t officially seen the recession yet. The soft landing already happened. What follows will be interesting. Some seriously unserious crony capitalists are already crying for a bailout, begging for emergency Fed rate cuts to protect their precious paper portfolios.

The Fed is in a pickle of their own making. Jerome and Janet have tag-teamed the economy into a frothy mess. This is doubly true for the housing market. When the Fed does finally succeed in breaking the labor market, it will be interesting to see how many people are willing to jump in and buy homes at current market prices.

That’s the thing about fundamentals. They don’t matter…until they suddenly do.

Leave A Comment