New home sales rose 1.6 percent in December according to Census estimates. The seasonally adjusted annual rate of 842,000 translates into a 15.2 percent increase from December of 2019. The median price of a new home sold in December 2020 was $355,900. The average price was $394,900. The median price of a new U.S. home rose $26,400, or 8 percent in the middle of a global pandemic even as millions of Americans were losing their jobs.

If that’s not a testament to the power of central bank liquidity, I don’t know what is. The inventory of new homes inched up to 4.3 months in December, but was still down 18.9 percent from a year ago. The inventory of new homes available in Denton County Texas has plummeted 64 percent from last year, now sitting at just 1.4 months of supply. The entire DFW area has just 1.9 months of supply, down 54 percent from a year ago.

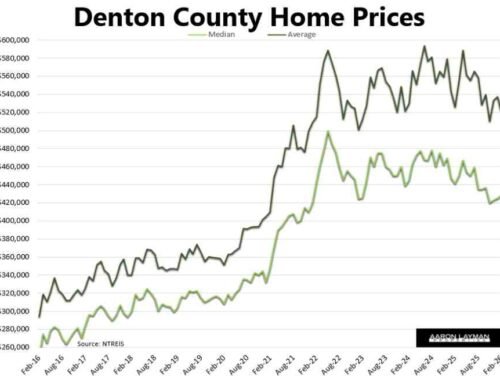

While still off their record highs set in 2018, median and average new home prices in the Dallas-Fort Worth area have continued to shoot higher in recent months. We could break those previous peaks this spring or summer if the Federal Reserve keeps their foot on the throttle. The Fed’s bloated balance sheet is back above $7.4 trillion and poised to jump even higher. In case you missed the news, markets have been behaving a bit unusually lately. Of course anyone paying attention knows the Federal Reserve has unleashed all sorts of speculative insanity across multiple asset classes. Just ask any millennial home buyer what it’s like trying to buy a median priced home in the DFW area, and you are sure to get an earful.

Stock jockeys chatting on the WallStreetBets Reddit thread and Robinhood traders bidding up some of the most shorted stocks certainly received an eye opening education on the casino we call Wall Street this week. It has been one epic roller coaster ride with hedge funds like Melvin Capital blowing up, stocks being halted multiple times and now class action lawsuits. A Congressional investigation into what seems to be illicit behavior is likely just a matter of time. With Citadel getting order flow from Robinhood traders, it’s probably not a good look for Robinhood to be putting many of their their customers in lockdown mode. The saga playing out this week literally screams for a ‘Big Short’ sequel.

There’s not a big difference between what’s currently happening on Wall Street vs what’s happening in the U.S. housing market. The only real difference is that we’re probably going to see looser restrictions on mortgages and potentially even some tax credits for home buyers so they can lever up and reach for the American dream at these inflated prices. Instead of halting the trading of overpriced homes, the U.S. government is likely going to pursue multiple strategies to keep mortgage credit growth flowing, even if that means risking the stability of the entire financial system and Fannie and Freddie along with it.

We’ve seen this movie before. We know the ending is ugly, but the show goes on anyway. Uncle Jay is here to save us and tell us to remain calm. This week he offered up another round of central banker humor worthy of a Ben Bernanke award. According to Powell, the public’s perception of central bank liquidity is all wrong. All of that trickle-down stimulus poured into a corrupt financial system isn’t what’s causing those distortions in the housing market or the price-distorting shenanigans on Wall Street.

“If you look at what’s really been driving asset prices, really in the last couple of months, it isn’t monetary policy… The connection between low interest rates and asset values is probably something that’s not as tight as people think.” Jerome Powell – January 27 2021

That’s almost as asinine as Ben Bernanke telling us the subprime housing crisis was contained right before it blew up the entire global financial system.

Leave A Comment