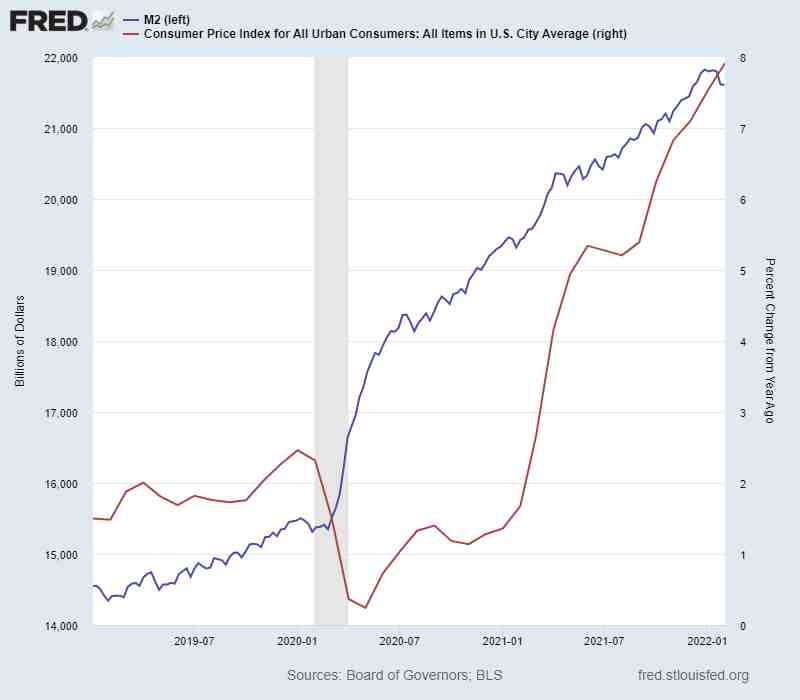

Collateral damage in the North Texas housing market is beginning to reveal itself. Inflation is at a fresh 40-year high. Homes have never been more expensive, and interest rates are on the rise. Official consumer price inflation just printed at an annual pace of 7.9 percent. This is with many of the official CPI metrics understating actual inflation. This is also before the spike in global energy markets with the tragedy unfolding in Ukraine.

While many housing industry pundits were clinging to the slight drop in mortgage rates last week, that blip is now a distant memory. Mortgage rates will end the week back above 4 percent. They will be heading higher, possibly much higher. A friendly reminder is probably in order here. Quantitative easing (QE) officially ends this week. All of that massive liquidity stimulus that fueled an insane ramp in home prices during the last 12 months is now heading in the opposite direction.

The Covid Crime Scene

The U.S. housing market is now essentially a Covid crime scene. While pretending to offer stability to the markets under the guise of stable prices and maximizing employment, Federal Reserve officials blew another asset bubble. By throwing massive amounts of liquidity at a finite supply of homes, the Fed orchestrated huge demand-pull inflation. This is not rocket science, although you will find plenty of industry economists who pretend not to understand it.

“It’s difficult to get a man to understand something, when his salary depends upon his not understanding it” Sinclair

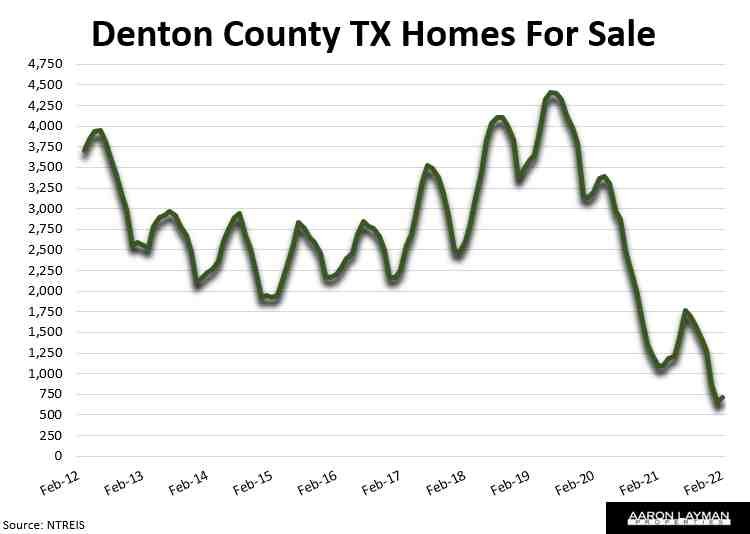

Official NTREIS stats show that the number of homes for sale in Denton County bottomed last month at 20-year low. The impressive plunge in home inventory is a testament to the power of liquidity flows.

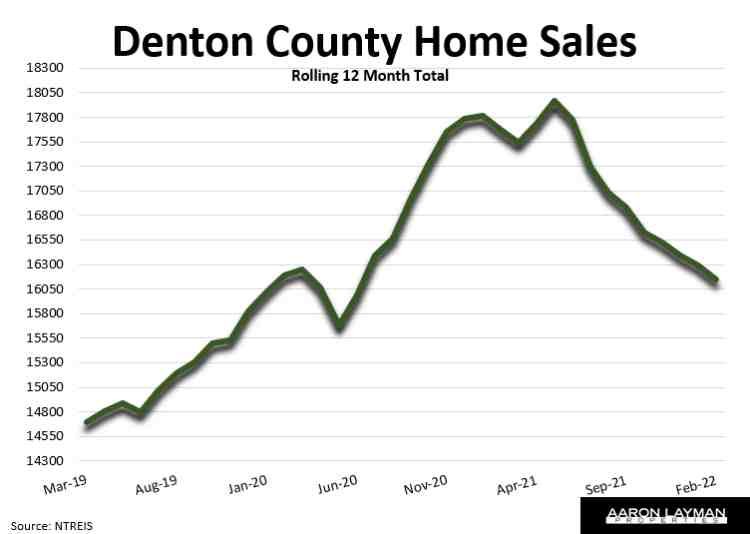

Inventory is already perking up at the margins. It will likely perk up a lot more once the reality of rising rates sets in on prospective buyers. Home sales in Denton County have been trending down for months. Months of spiraling home prices and shrinking inventory have exacted a toll on activity. Sales were off 13 percent compared to February of last year. Pending sales were 18 percent lower.

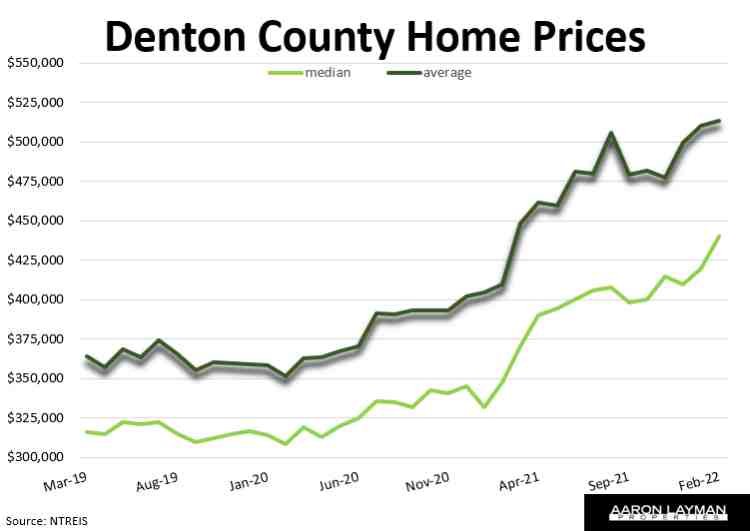

Did you hear the joke about shelter inflation being 4.7 percent? That was the official measure for the 12-month change in CPI shelter inflation published by the Bureau of Labor Statistics.

Back in the real world February saw fresh record highs for Denton County home prices. With the astonishingly low inventory levels, there were still enough buyers willing to take the plunge. Median prices in Denton County were 26.5 percent hitting a record $440,000. Average home prices hit a new high of $513,326. That was an increase of 25.2 percent from the same time a year ago.

Many of the recent buyers are investors looking to cash in on the red-hot housing market. Call it late-stage euphoria. The percent of list received in February jumped back to near record levels (103.5%) as buyers threw caution to the wind. Flippers and wanna-be Airbnb millionaires have been riding this real estate ramp assuming it will never end. Many will be collateral damage as the Fed pulls the rug on their latest policy error.

The Pain Trade

The equity markets have been sniffing out this asset bubble for several months. You can already see the collateral damage in housing related stocks. Those companies are highly interest-rate sensitive. ibuyers like Opendoor, Offerpad and and Redfin have been taken to the woodshed this year. These internet darlings and “disrupters” of the real estate industry have found it difficult to turn a profit buying homes and selling them back to end-users. Flipping homes is tough to begin with. Flipping at scale is even more difficult when you are overpaying for the homes to begin with.

Investors likely see what’s coming, and they have been turning their nose at the narrative of endless growth. I can see why. Builders have continued to talk about impressive and “resilient” demand. New homes have been “selling” before they can even put a foundation down. You probably noticed I put “selling” in quotes. That was intentional. Pouring through the listings here in North Texas it is painfully obvious there are plenty of new home sales that aren’t going to make it to the closing table this year.

The only question is how many deals fall apart this year as buyers realize they can’t (or don’t want to) qualify for a mortgage at these inflated prices. For now housing industry types are still pretending we’ll arrive at a soft landing. The projections from most of the “experts” is that we’ll still end the year with more home price growth, potentially even double-digit home price growth.

I wish I could say I had more confidence in our policy leaders to support this thesis. Unfortunately I am constrained by the bounds of reality and data. The data says the Fed is woefully behind the curve. The Fed has a miserable track record when it comes to orchestrating soft landings. That means there is a lot of pain yet to be inflicted upon the housing market before things get anywhere close to normal. I have no idea how much pain Powell and his merry band of FOMC misfits are willing to inflict upon the market before they cry uncle again. Anyone who says they do is lying. This is all a moving target.

What we do know is that the trend is no longer your friend in terms of liquidity flows. If you are in the market to buy or sell a home, this is immensely important. Prices are formed at the margins. We’re about to find out what the breaking point is for prospective home buyers and investors in this warped, flipped manipulated housing market.

With gas prices at record highs across the country it’s apparently now fashionable for nitwit economists to dismiss the concerns of Americans as a “money illusion”. You know, adjusted for inflation those fuel prices are really more affordable than you think. The economists in the housing industry are just as bad. They’re throwing up ridiculous charts & dubious narratives of affordability, all to keep the credit spigot and sales volumes up.

Apparently it hasn’t dawned on the genius experts lauding these double-digit home price increases that real estate is a cost input for virtually everything. The same fools who’ve been telling you that inflation is transitory have also failed to grasp the reality that housing inflation is just beginning to find its way into the official CPI measurements.

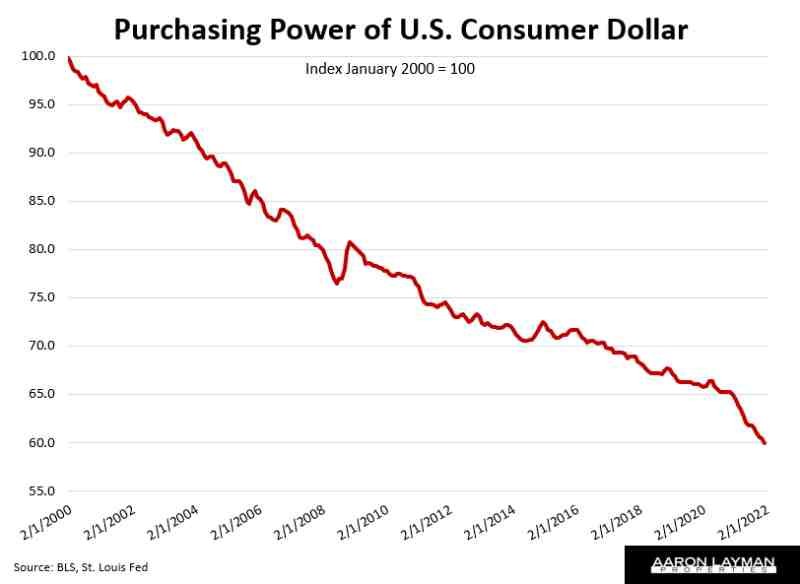

If you feel like your wallet is getting stretched a little thin, that’s not a money illusion. That’s real currency debasement staring you in the face. Welcome to the Fed’s monetary mayhem.

The real federal funds effective rate shows how reckless the Jerome Powell Fed has been. Taking the effective federal funds rate minus the current rate of inflation shows how the FOMC has been deliberately juicing the economy…and how far they may need to go to tame the inflationary monster they created.

Leave A Comment