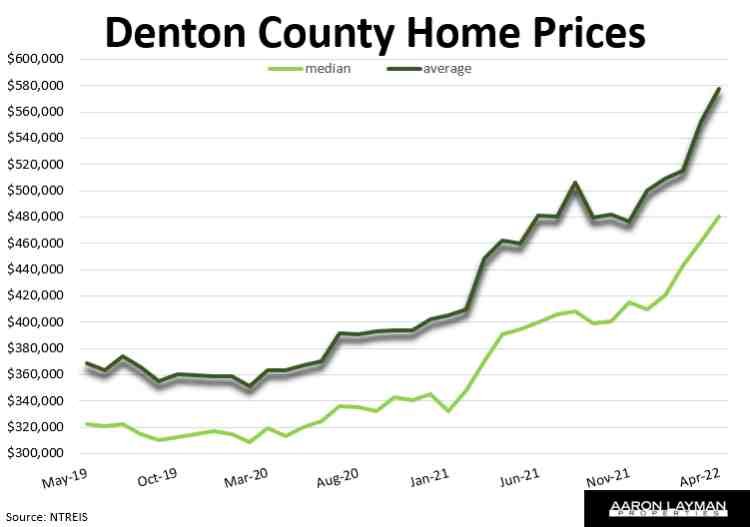

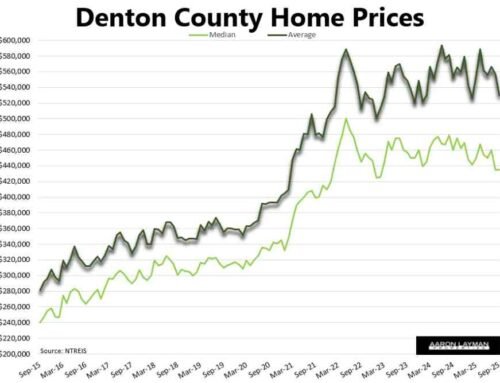

The North Texas housing market is looking like a bubble waiting to burst. Home prices continued to melt up in April. Median and average home prices hit new all-time highs across the Dallas-Fort Worth area. The median home price in Denton County hit a new record high of $480,000, an increase of 22.9 percent from last year. Average prices hit $577,607. That was up 25.1 percent year-over-year.

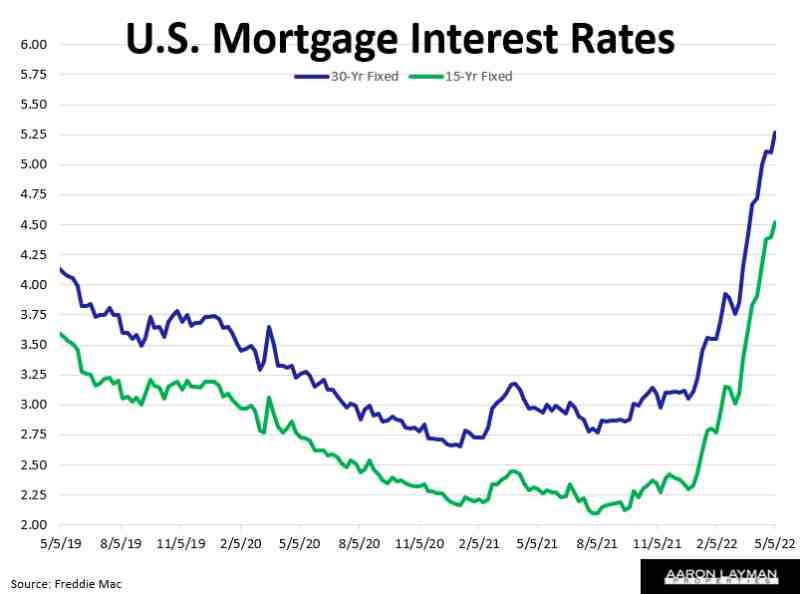

The melt-up in prices is pretty astounding considering mortgage interest rates are now solidly above 5 percent. Monthly payments for a prospective home buyer in North Texas have never been more expensive. Buyers have been willing to jump in head-first despite the obvious signs of a housing bubble.

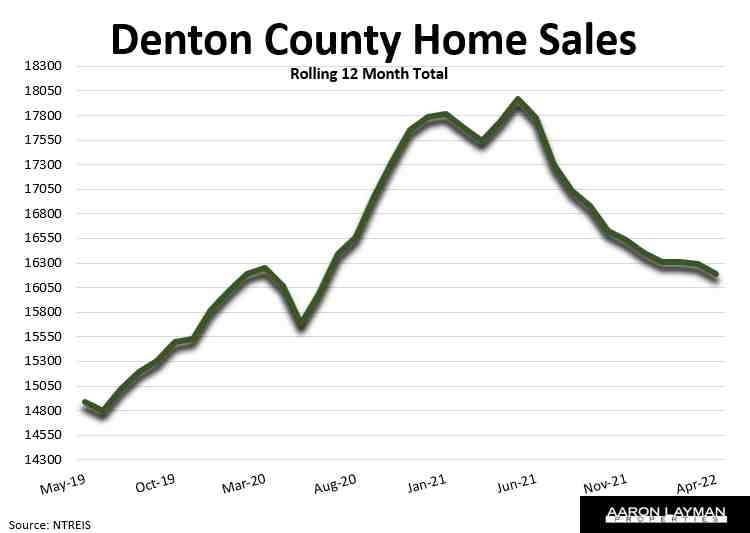

While the market has definitely started turning at the margins, we still don’t have an indication that buyers have capitulated. Closed home sales were down roughly 6 percent from the same time a year ago. Pending sales (contracts) were only down a few percentage points in April.

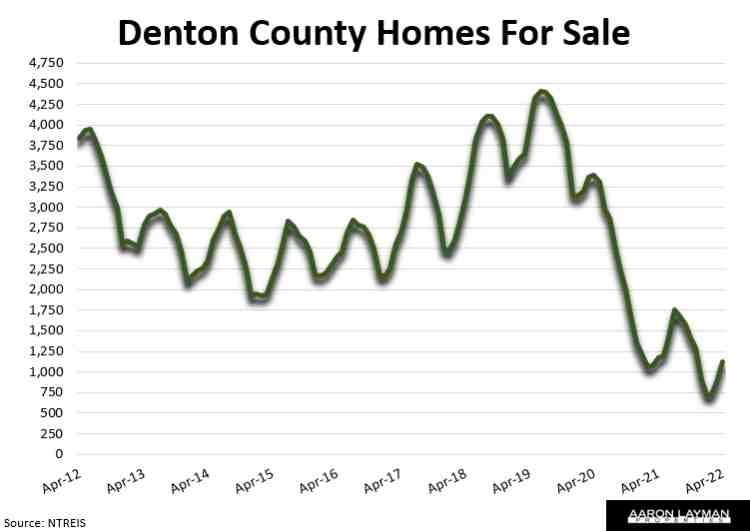

Available home inventory in Denton County is up 57 percent from the February lows, but it’s still far below normal. This has allowed the market to melt up like it has in recent months. We would need to see inventory double from current levels before we get back to something approaching a more normal market.

The equity markets are sounding alarms just about everywhere you look. The plunge in stock prices during the past week has caused many speculators and Bitcoin™ dreamers to re-evaluate their early retirement plans. The stock market has come close to breaking several times this year already. Bitcoin is down over 50 percent from its highs last year. I mention these market movements because they are intricately tied to the housing market at this stage of the cycle.

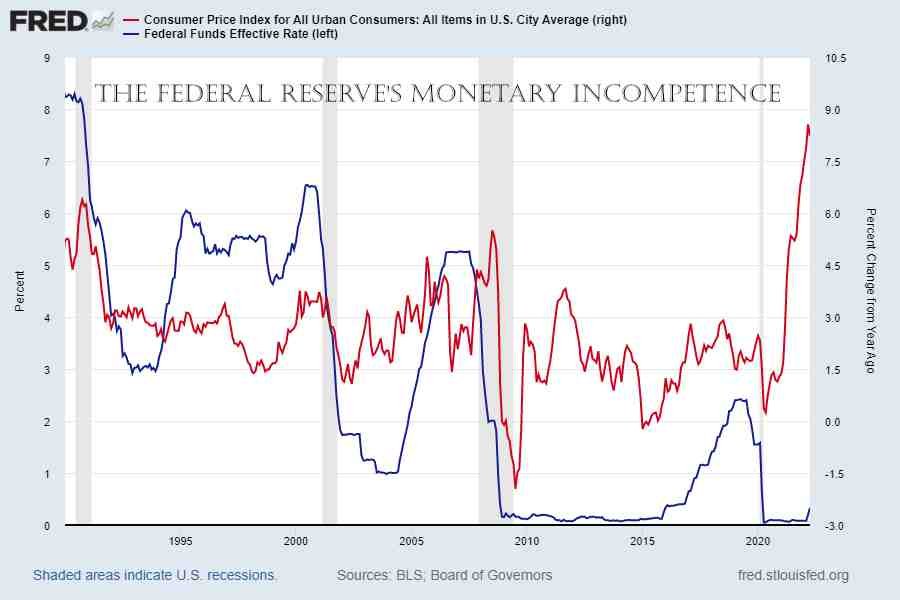

With the Federal Reserve having facilitated all manner of asset price bubbles, a stock market correction is likely going to play a key role in the normalization of the housing market. No one knows how this is all going to play out exactly. A lot depends on how far the Fed is really willing to go in its efforts to tame spiraling inflation. We’re still looking at a market that is over-saturated with liquidity, and the U.S. central bank has barely started with the normalization process.

The balance sheet roll-off begins in a few weeks. The summer selling season could be a big disappointment for many. For sellers with realistic expectations there are still huge windfalls to be captured. With home prices at current levels and inventory still historically low sellers continue to enjoy a favorable backdrop. That’s assuming they don’t get too greedy.

The Federal Reserve has already fired the warning shot. Jerome Powell can talk up the prospects of a soft landing all he wants. In the history of market cycles and recessions the Federal Reserve has an extremely poor track record on actually achieving those soft landings. There are plenty of real estate industry pundits and spin artists looking for home prices to just flatten from here or soften to smaller, more sustainable increases.

That’s not how markets work, especially with the kind of bubbles we are currently experiencing in the correlation crisis of 2022. Denton County home prices are up 64 percent from the prices we saw in February 2020. As we learned (or should have learned) during the Great Recession, home prices can and do sometimes fall. By encouraging the melt-up in home prices, the Federal Reserve has all but guaranteed there will be some chaos in the housing market in the near future as they attempt to normalize policy.

The Bureau of Labor Statistics is still gaslighting America when it comes to housing inflation. The Consumer Price Index for April came it at 8.3 percent. That was a bit higher than expectations. The 12-month change for shelter inflation was 5.1 percent according to the BLS. The consensus has been consistently wrong this year when it comes to the amount of pent-up inflation in the U.S. economy. It doesn’t help when the government continues to dole out misinformation on the real inflation that people are experiencing.

Even after a 50 basis point increase to the Federal Funds rate, the Powell Fed remains woefully behind the curve. Jerome has a lot more work to do if he hopes to tame the inflation which is now firmly embedded in the U.S. economy.

Economists and real estate industry pundits continue to talk about the housing inventory shortage. Most agents keep regurgitating whatever spin the industry is selling like the need to build our way out of this inventory shortage. It’s really entertaining to watch some of the commentary.

It should go without saying that the industry (especially the home building industry) loves the idea of more homes and higher prices. The answer is almost always more of this, or more of that. Lower home prices is something you rarely see offered as a solution to the current affordability crunch.

As I have said before, the current shortage of inventory (which has grown sharply in the past month or two) is really a reflection of bad housing policies and perverse incentives. Financialization of the U.S. housing stock remains a huge problem. Lower home prices might actually help to correct many of the imbalances.

Leave A Comment