North Texas home prices continued to fall in August. The post-pandemic housing bubble in the DFW area continues to deflate. The Fed is actively pushing for a housing reset. After facilitating reckless asset price inflation during the pandemic, taming inflation is now priority number one for the Powell Fed. Powell told us this week they will keep at it until the job is done.

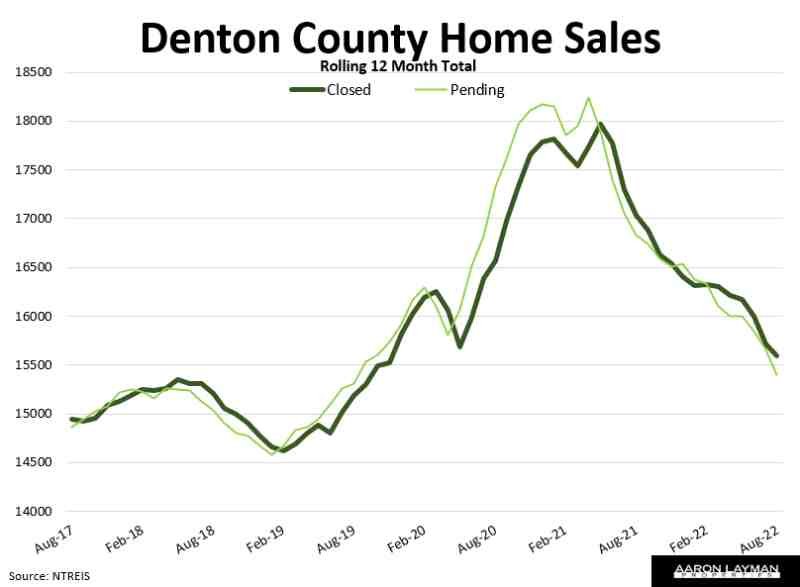

Denton County home sales were down 6 percent compared to August of last year. Pending sales slide even further, dropping 12 percent. With rates heading back toward 6 percent, activity and demand will likely remain in the deep freeze through the rest of the year. The median price of a home in Denton County slid for a third consecutive month, falling to $460,000. The average price cooled to $545,810. Average prices remained 7.8 percent higher than a year ago. Home prices are shrinking faster than many would like. Denial is long river.

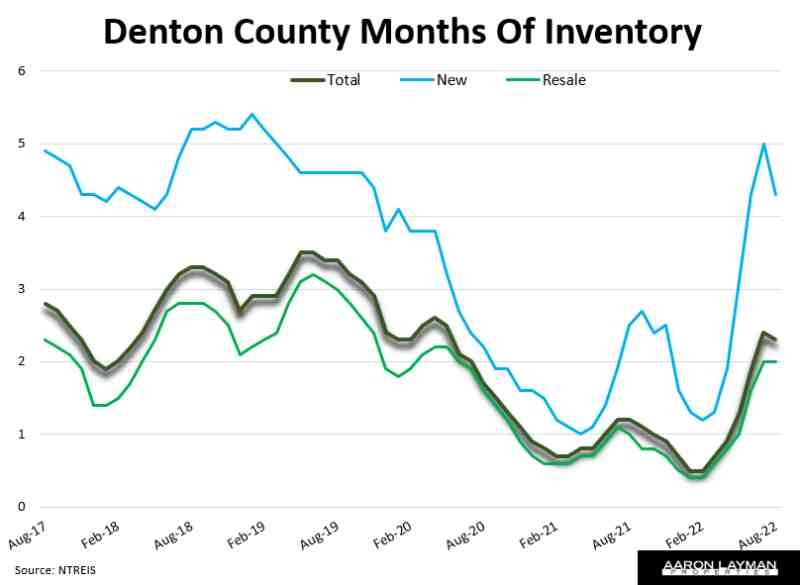

The supply of homes in Denton County leveled off in August as the sharp rise in new listings tapered off. Some sellers pulled their listings after unsuccessful fishing expeditions. New home builders have also pulled back new starts. They are simply managing their rather large backlog and pipeline in the wake of sharply lower demand. The incentives and price cuts for new homes will continue as we head into the beginning of 2023.

There is a still a huge amount of backlogged construction in the DFW area. Recent data show that the bubbly market of Phoenix has already seen new home prices go year-over-year negative in August. It’s easy to see a scenario where new home prices in North Texas go negative in the months ahead. Average new home prices in Denton County were up 5.4 percent in August, while resale prices were still up 8.2 percent from last year. Both will be dragged lower as liquidity (and therefore demand) are drained from the market.

For context, Average new home prices in Denton County are still $140,000 higher than where they stood before Covid started. New home prices rose from $398,000 in January 2020 to $566,000 in July 2022. The drop last month to $538,000 was just the beginning of the mean reversion.

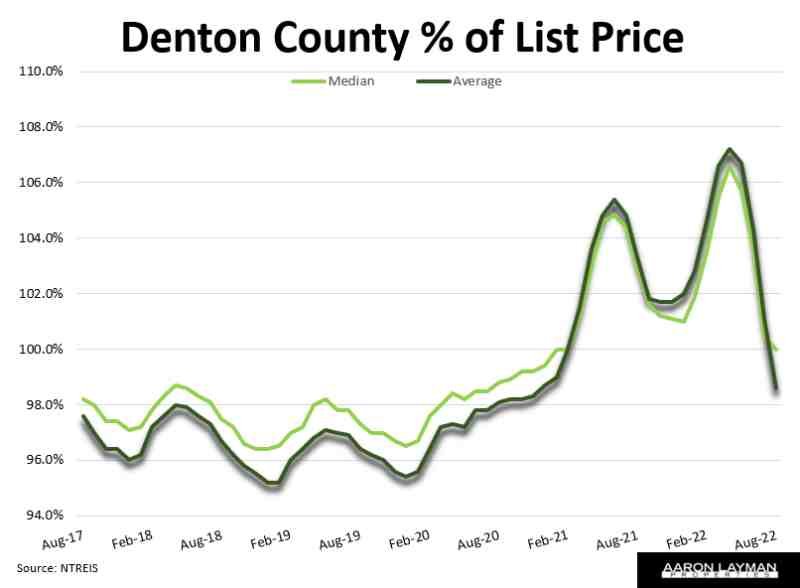

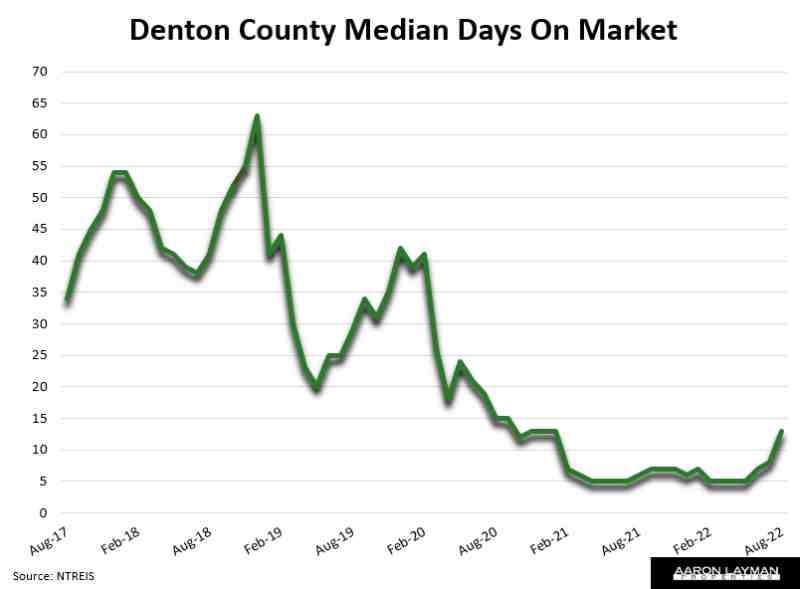

Days on market and percent of original list price confirm the slowdown for the North Texas housing market. Days on market for Denton County have doubled from the May low. Median percent of original list price has now fallen back to parity. Average percent of list has fallen below 100 percent, dropping to 98.6 percent. FOMO frenzy in the first quarter of the year pushed it to a record 107.2 percent in April. It has been falling like a rock for the last four months.

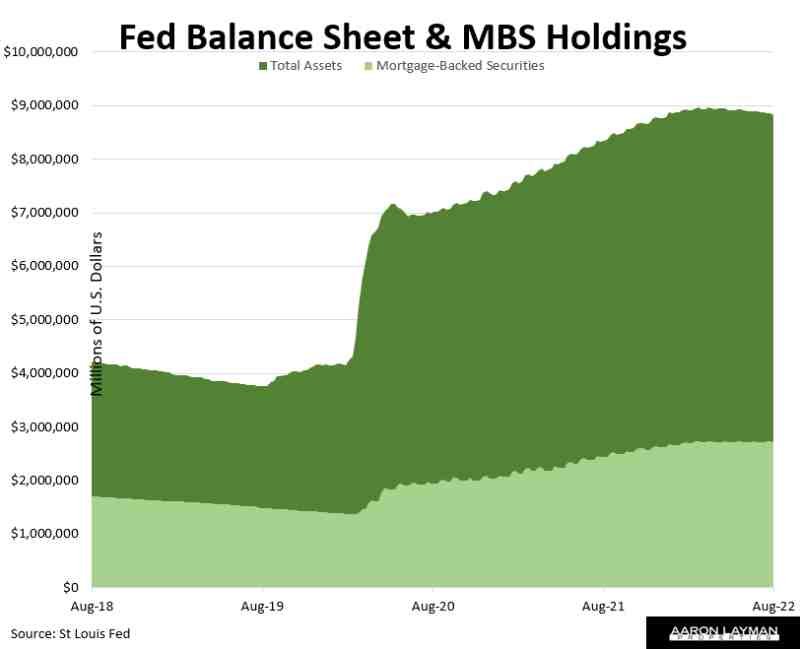

Earlier in the year I offended plenty of real estate pundits and clueless agents when I said home prices were going to fall. This was an easy call. The mania in the local housing market was off-the-charts absurd. Many of the agents in the area were absolutely clueless about what was driving the housing market euphoria. It is and always was the liquidity. A correction in the local housing market was baked in the cake the minute the Fed announced they could no longer continue pumping $120 billion per month into the financial system.

After facilitating all manner of reckless behavior, along with spiraling home prices and rents, the Powell Fed is now super serious about taming inflation. They should be. They created a colossal mess in the housing market, stoking the flames of inflation which is now embedded in the economy. Bringing prices back down won’t be easy. As Rick Palacios put it, a quick escape from the housing slowdown is unlikely.

Home affordability hit the worst levels in history in many U.S. markets this summer. It was inevitable that something was going to give. With mortgage rates near 6 percent that “something” is inflated home prices.

The Bureau of Labor Statistics readings for August inflation came in higher than analysts were expecting. The lagged effect of the CPI’s poorly constructed shelter inflation measurements caught many of the “experts” by surprise again. Services inflation is still running very hot as well. Official headline inflation for August registered at 8.3%. The 12-month change for CPI housing inflation looked like this:

- Shelter up 6.2%

- Rent of primary residence up 6.7%

- Owners’ Equivalent Rent (OER) up 6.3%

Those were the highest readings this year. Inflation in the housing market is still far too hot for the Fed to get anywhere near their 2 percent inflation target. Anyone who has tried to rent a home or apartment in North Texas knows this. NTREIS stats show the median lease price for a Denton County home up 10.6 percent in August. Rents for many apartments are at east double the official CPI estimates for shelter inflation. The Fed still has a lot of work to do, and that means more demand destruction for the housing market.

As the saying goes…Don’t fight the Fed! The Federal Reserve’s caps for balance sheet reduction reach $95 billion this month. There are some Fed apologists pretending that inventory won’t continue to normalize. News flash! Real quantitative tightening is just beginning. The summer spike in new home inventory was just the first round of the process via rising rates. Now we get higher rates with record balance sheet shrinkage.

New construction generally leads the broader housing market. The next piece of the puzzle (the proverbial shoe to drop if you will) is likely going to be the recession that follows quantitative tightening. The real inventory normalization will come when existing home inventory comes back to the market along with that rather large backlog of new homes. That could easily happen if speculative investors who helped drive inventory to record lows during the pandemic start exiting the market in significant numbers. That shadow inventory will be important to watch.

The good news is that mortgage lending standards are much better than the last downturn. Homeowners are sitting on a lot of equity, so a huge spike in foreclosures seems unlikely. Unfortunately, the speculative activity from investors is just as bad if not worse. There a lot of moving parts to the picture and multiple asset bubbles this time, so no one knows for sure how this will play out.

True cost of capital has a funny way of changing sentiment.

Leave A Comment