Denton County’s housing market was still searching for that soft landing in November. Home sales were down 2 percent year-over-year. Pending sales fell by nine percent. Median home prices were steady at $450,000. Ironically enough that’s exactly where prices stood in November of last year. Average prices slid for the fourth consecutive month, putting them down 1 percent lower than last year. The average price of a Denton County home is $68,000 (eleven percent) lower than the bubble peak of last spring.

The North Texas housing market is currently caught between The Federal Reserve’s need for quantitative tightening and the Biden administration’s desire for a quick resolution to the inflation problem. The most recent quarterly refunding announcement from the U.S. Treasury basically erased a good portion of the Fed’s work this year by loosening financial conditions in a big way. U.S. financial conditions are now the most accommodative they’ve been since the Federal Reserve began hiking rates in 2022.

The December 2023 FOMC meeting was the icing on the asset-inflating cake. The Powell Fed did not push back on the easing of financial conditions as expected. Instead, Powell did the opposite, priming the pump for higher asset prices. Market participants interpreted the talk of multiple rate cuts next year as a green light to push stocks to all-time highs. The danger is that this could ignite inflationary expectations all over again next year. The top 1% of U.S. income earners now hold more wealth than the entire middle class. It appears the Federal Reserve’s unstated mandate has finally been achieved. It should not go unnoticed that president Biden is also taking a victory lap for the new highs in the stock market.

Election cycle politics are now directly affecting the housing market. The good news for prospective home buyers is that mortgage rates have cooled from the recent 8 percent high. Rates have come down a full percentage point. Mortgage rates are the lowest we’ve seen in six months. The flip side of this scenario is that the market has not fully cleared the excesses and rampant speculation, particularly in the residential real estate space. Commercial real estate is still reeling from major issues caused by higher rates. The residential market is still stretched.

Lower mortgage rates are a double-edged sword if you’re looking for a normal, healthy housing market. To get back to something approaching normal (with more normalized inventory levels and affordable prices) the Fed needs time for higher rates to do their work. As we saw in the fall of 2022, higher rates lead to more inventory and less speculation.

More inventory and less speculation are exactly what the housing market needs at this point. Many industry participants don’t want to see that happen. The industry in general favors higher prices. More new home construction is generally the boilerplate answer to all of housing market’s supply issues. The elephant in the room (massive levels of financialization and speculation) is not to be discussed in polite circles.

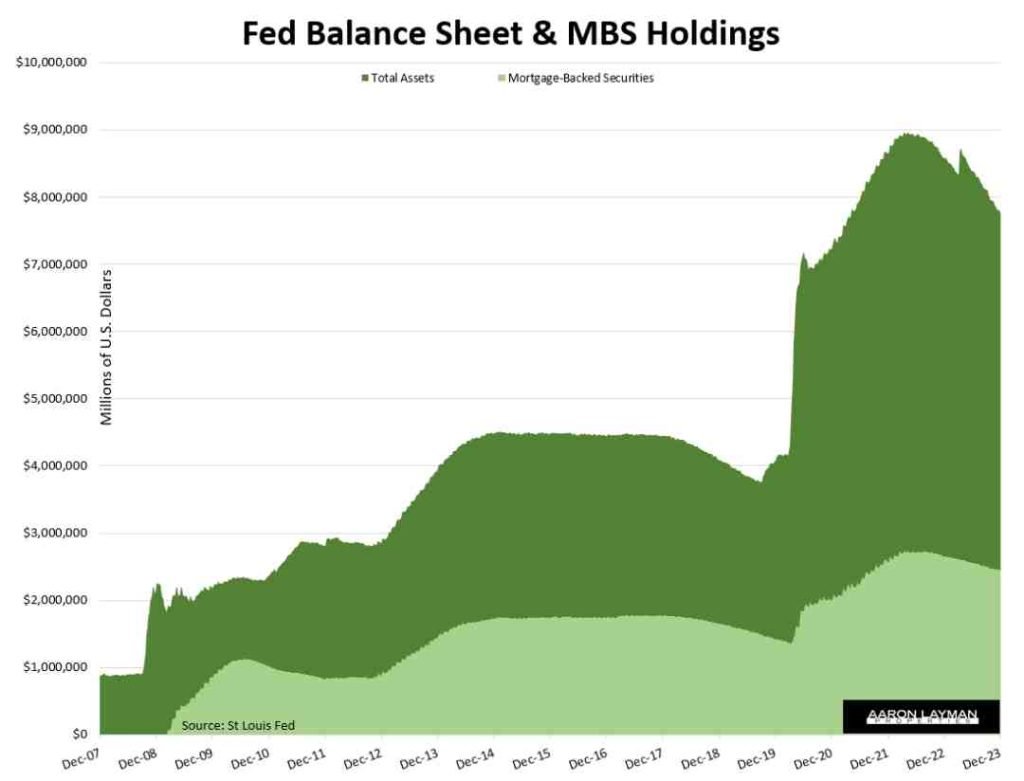

Some very prominent voices in financial and real estate circles floating the idea that the Fed overhiked on rates. That’s blatantly preposterous. They don’t want to discuss is the years of zero-bound rates and $trillions in quantitative easing (aka bailouts) which helped them build their wealth. The problem isn’t that the Fed overhiked in 2022. The problem is that the Fed has been engaged in a multi-decade crusade of interest rate suppression and boom/bust cycles which exacerbate wealth inequality and the misallocation of capital. This is why the housing market is so dislocated and distorted.

New home builders are still minting money in 2023 as they capitalize on the fake supply narratives. The United States still has close to record number of housing units under construction, but apparently we need even more. More supply is the only answer to industry apologists who continue to ignore the financialization and hoarding of homes. If we just build more housing, there will be enough for all of the Airbnb speculators, the institutional investors gobbling up hundreds of thousands of single-family homes, and even those borrowers committing occupancy fraud so they can obtain preferential financing terms for their next short-term rental.

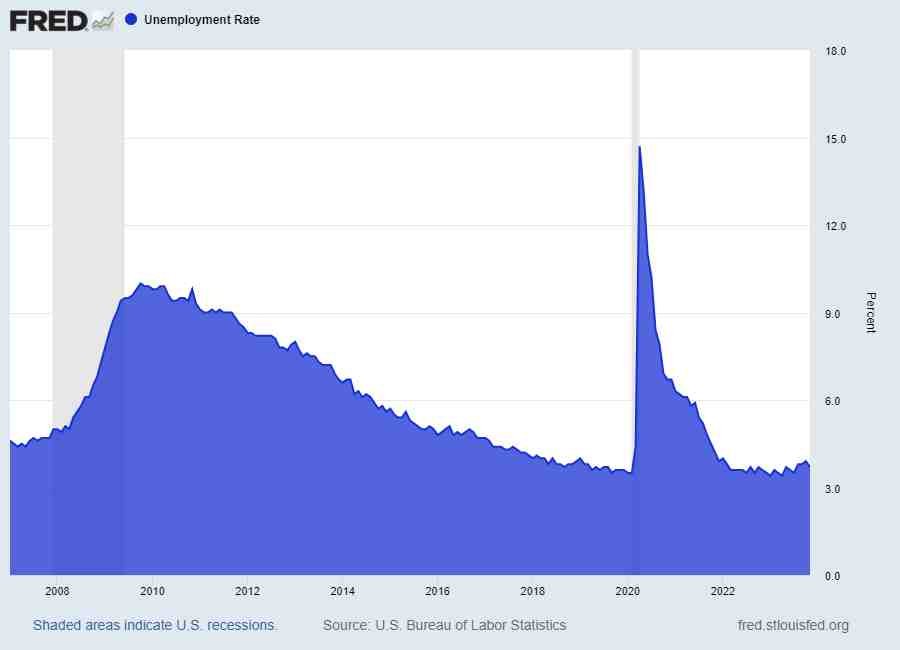

The November employment report showed the unemployment rate dipping back to 3.7 percent. Americans are still finding jobs. Both hourly and weekly earnings also rose in November. That’s good news for workers, but bad news for those housing industry apologist hoping for lower rates. The labor market has remained resilient. Core inflation is still growing at 4 percent according to the November CPI data. The Fed proclaims it is data dependent, but the actual data doesn’t justify rate cuts in the near term. Loosening financial conditions too soon risks an even more dangerous bout of inflation next year.

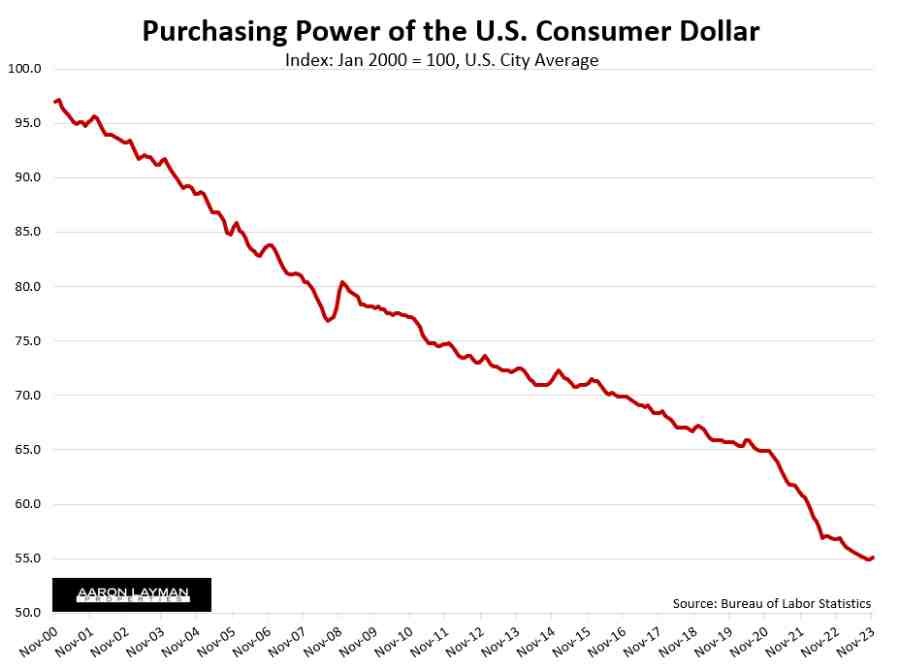

While many politically-motivated economists talk up the “disinflation” narrative, this is what the core CPI inflation index is actually doing…

It appears the housing market will remain in limbo for the time being as the Fed and Treasury play with fire. The only thing we know for sure at this point is that the government will still be running a massive deficit in 2024. Interest on that debt will continue to eat up big portion of the annual budget. With the Fed and Treasury backed into a corner, the only real option for those in charge is to inflate the debt away.

Most Americans still feel that the economy isn’t working for them. They aren’t misinformed or suffering from data overload. They are simply realizing their purchasing power is getting dismantled as inflation continues to eat it away.

If you are in the market to buy or sell a home, be careful of agents and loan officers promising lower rates next year. Buying the home and dating the rate can be a very enticing pitch, but it can also be very costly in a higher rate environment like we are currently experiencing. No one has a crystal ball for the coming year, and anyone who says they do is lying. For anyone still under the delusion that we’re back to a normal housing market, I will leave you this.

The Federal Reserve is still holding $2.45 trillion (that’s trillion with a “T and 12 zeros) of market-distorting mortgage-backed securities. The Powell Fed has managed to shed less than a third of the Treasury holdings it piled on during the pandemic stimulus. There is still a lot of liquidity sloshing around the financial system for those with access to it. This is a big reason why inflation has remained so sticky.

Keep your seatbelt fastened. The road will probably remain bumpy while Jerome and Janet try to sort this one out.

Leave A Comment