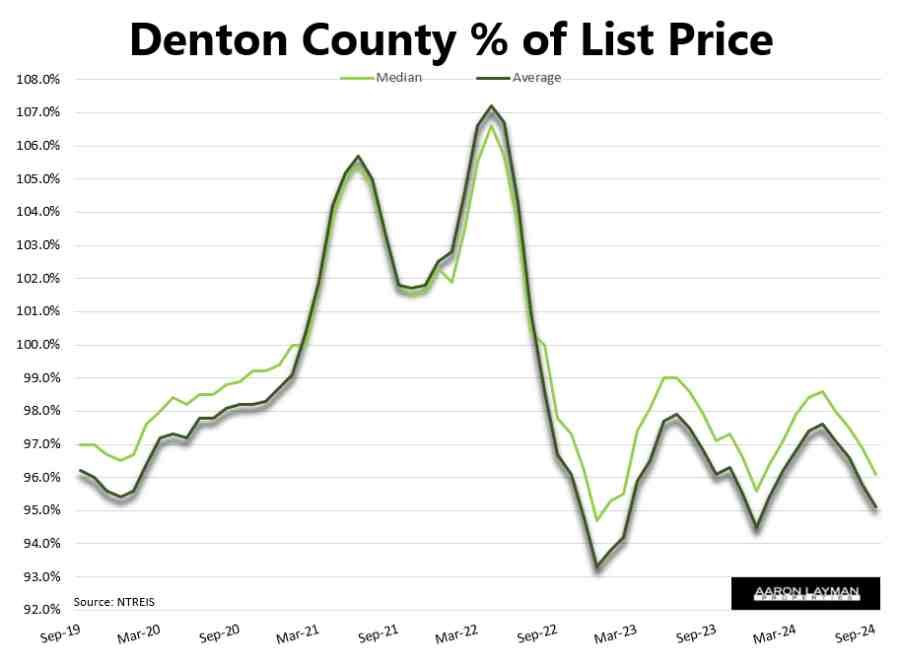

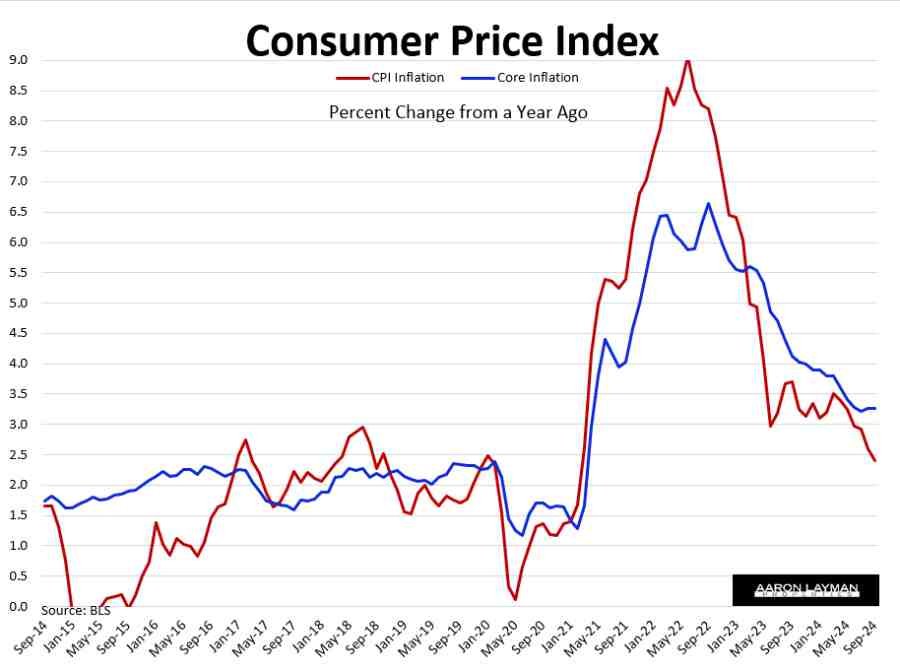

Something’s gotta give in terms of mortgage rates or home prices. While many agents and loan officers were cheering a 50 basis point rate cut from the Federal Reserve in September, the bond markets smelled a rat. Mortgage rates responded by actually rising by a half point since the Fed’s announcement. This halted recent improvement in sales activity. It will also have an effect on home prices now that forward expectations are receiving a dose of reality. The reality is that inflation isn’t dead, not by a long shot.

Some real estate industry practitioners were using the Fed announcement to encourage clients to jump into the market. That’s a shame, but not entirely surprising in a sell-side industry. Every day’s a great day to buy a home, originate a mortgage or write a title policy. For those working on commission, there’s an incentive to ignore the evidence staring you in the face.

Inflation Is Alive and Well

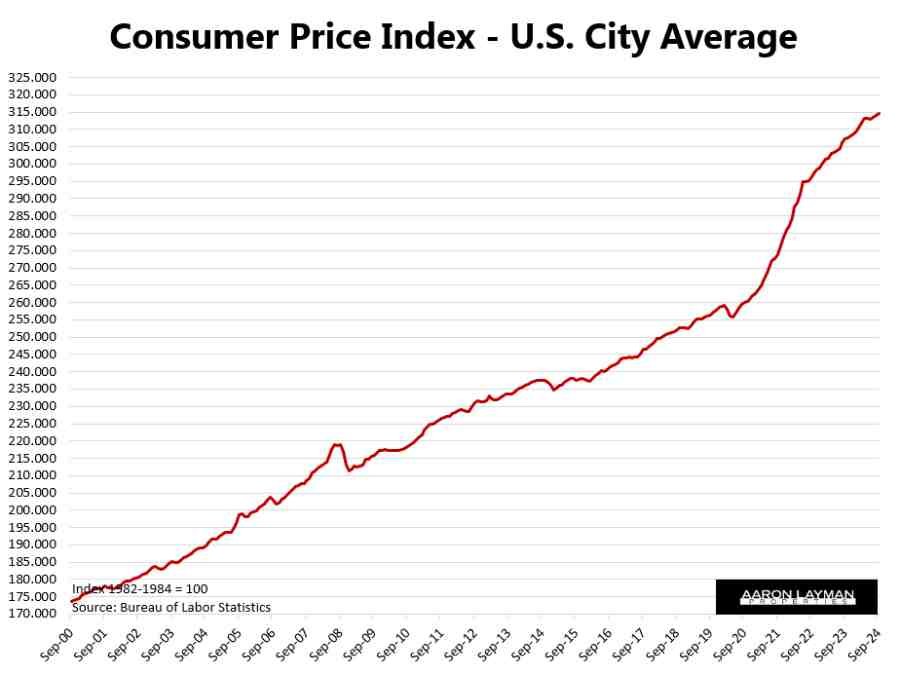

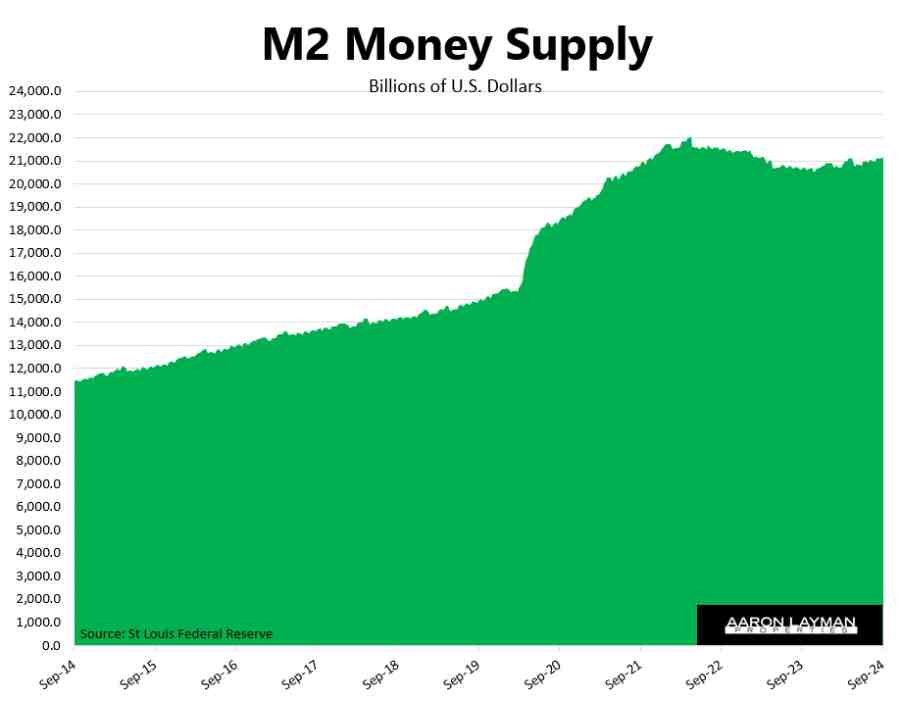

The reality is there’s still too much liquidity in the system chasing real estate and pushing up embedded inflation. This is why the Powell Fed is trapped in a box. Wealthy investors and Wall Street crony capitalists don’t care about inflation. They want access to cheap liquidity and lower rates. The sooner the better. They can’t get their next bailout fast enough.

Folks like Barry Sternlicht of Starwood Capital would love to see lower rates to stem the bleeding in the commercial real estate sector. There’s a lot of commercial real estate debt which still needs to be refinanced. Many U.S. homeowners are sitting comfortably on two and three percent mortgages. They don’t need to refi, and probably have no plans to move.

Under the surface of CPI, it’s easy to see inflation is still percolating in the U.S. economy. Housing inflation, services inflation and automobile expenses continue to take a huge bite of consumers’ pockets. Something’s gotta give, but inflation refuses to die. Owners equivalent rent is running hotter than the rent CPI component. That is likely a reflection of actual expenses incurred by homeowners in this inflationary environment. It’s important to remember the CPI no longer factors interest rates into the housing expense equation.

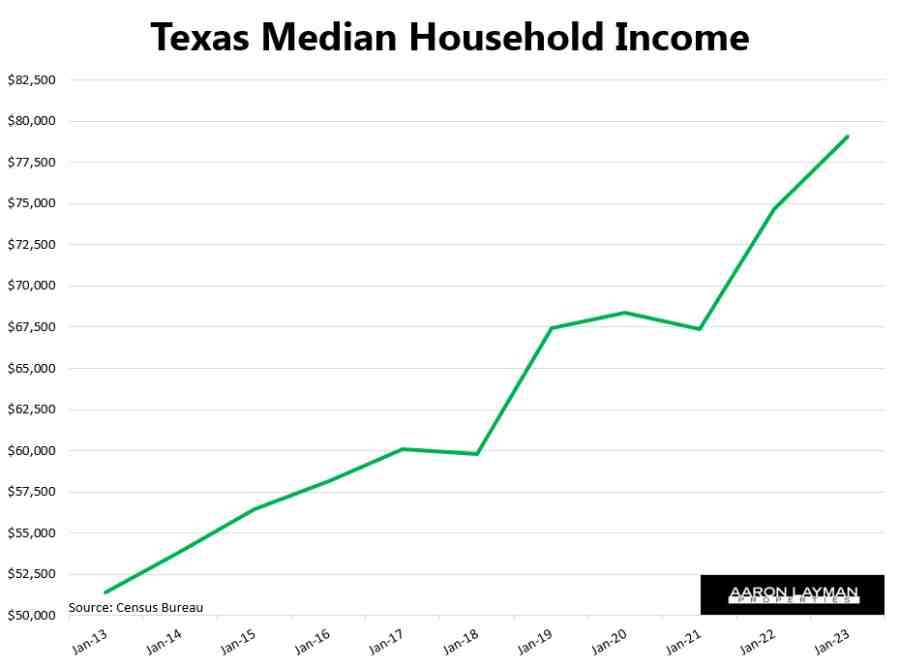

Home Price Increases Outpace Wage Gains

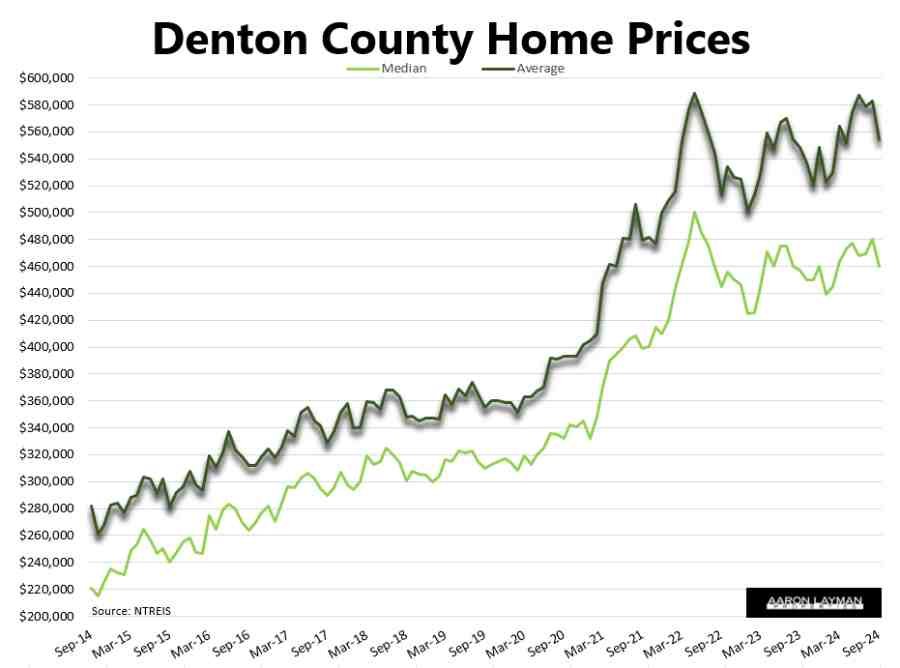

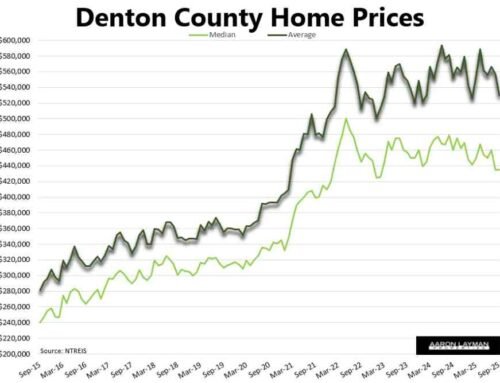

North Texas Home prices are still expensive when looking at traditional metrics like income. It’s true that incomes are higher than where they stood prior to the pandemic, but home prices, have increased dramatically more. A look at median incomes for the state of Texas shows a 54 percent increase over the latest 10-year period.

That pales in comparison to Denton County home prices. Median home prices in our area are up by 121 percent over the latest 10-year period. That’s an incredible testament to the power of liquidity. As investors and other buyers searched for yield, the frenzy for residential real estate created a spectacular rise in area home values. The disconnect is obvious, so something’s gotta give.

Low Rates & Demand Stimulus Distort Asset Values

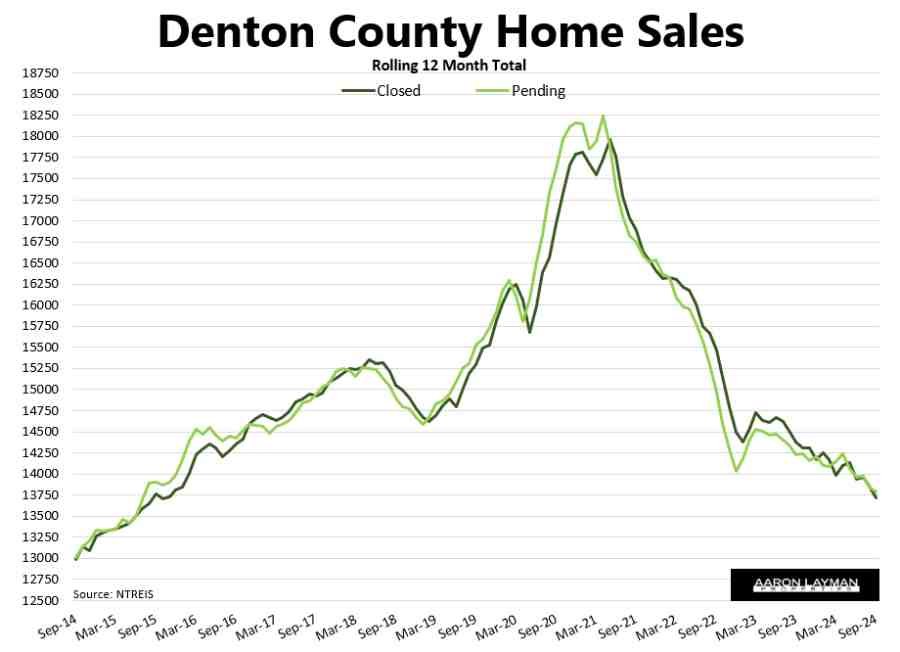

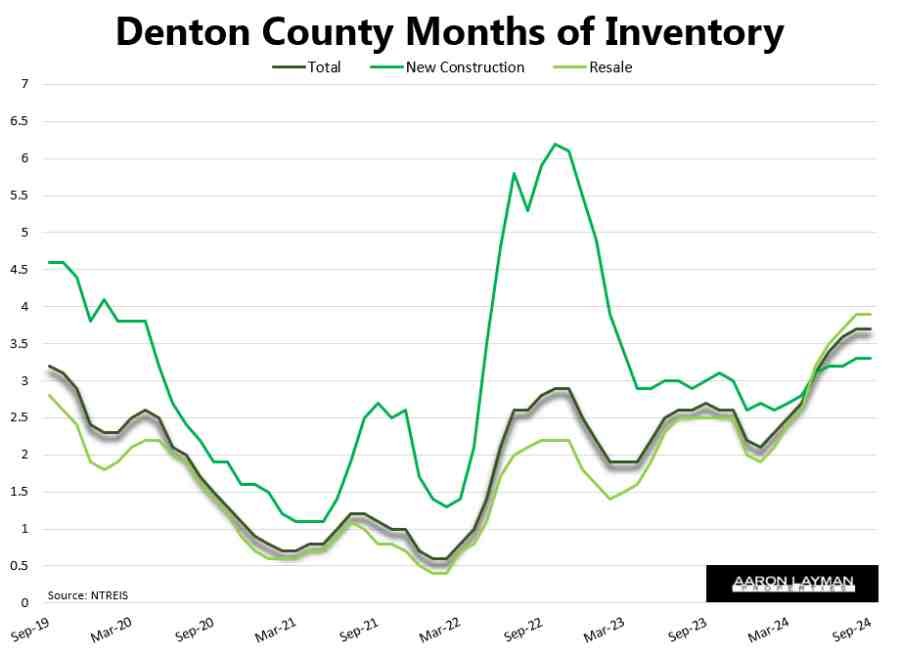

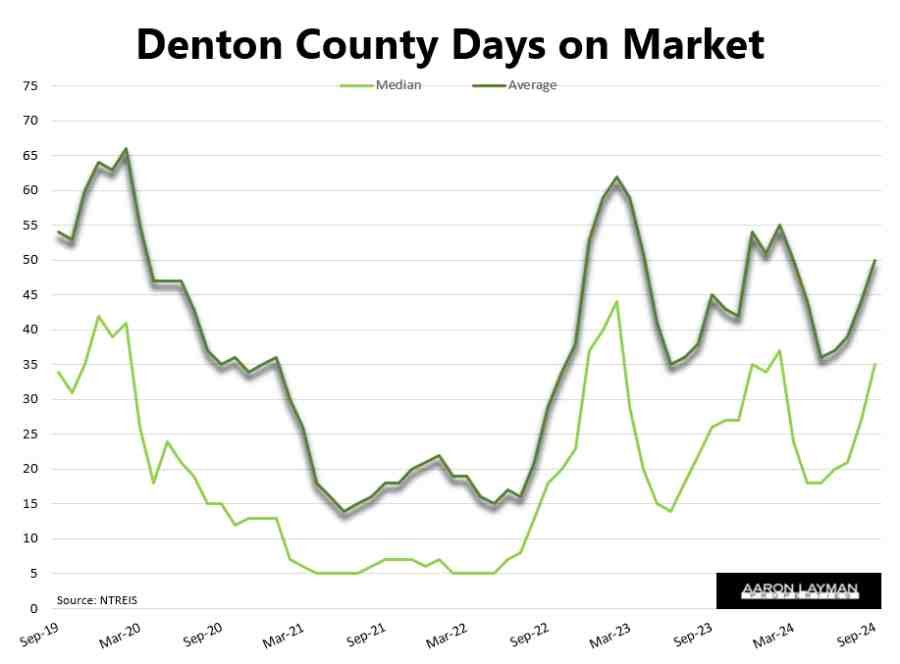

There’s a reason Denton County home sales volume is standing at 10-year lows. Plenty of real estate and mortgage professionals will tell you it’s because interest rates are too high. That’s complete nonsense, but it’s nonsense that sells to consumers. Who doesn’t love lower rates right? There are still plenty of people buying real estate for investment and asset appreciation. Shelter has taken a back seat to financialization in the current housing market.

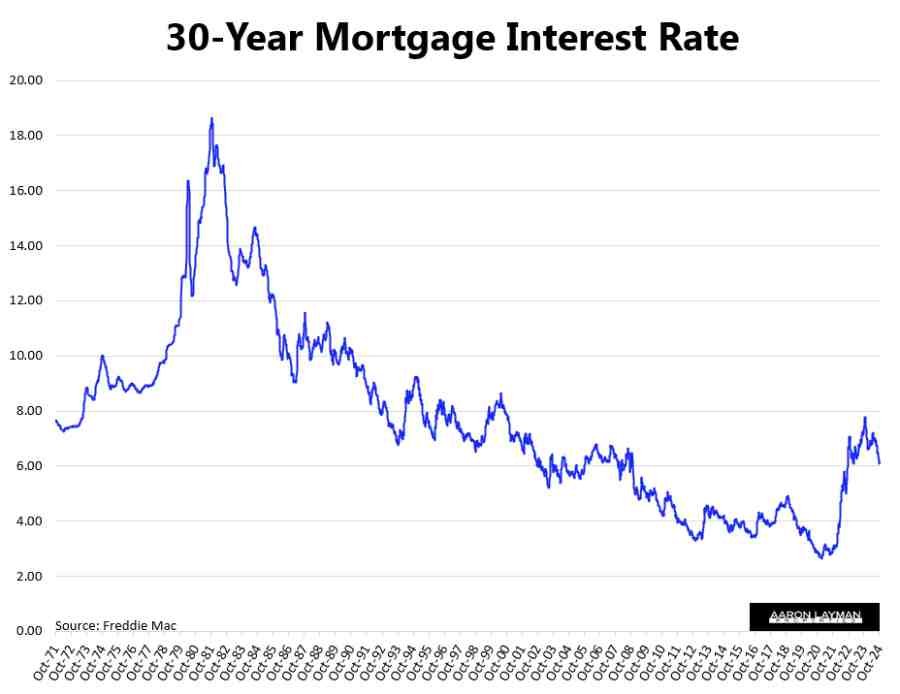

A longer-term view of mortgage interest rates tells a slightly different picture of where rates currently stand. Rates aren’t that high at all looking at historical trend. In fact, they are probably right where they need to be. The problem is getting industry professionals who have been spoiled by the last 20 years of market interventions and bailouts to understand that a healthy housing market needs normal market interest rates.

The Fed’s Fingerprints on Home Price Inflation

The Federal Reserve deserves plenty of scrutiny for fomenting the home price to income disconnect. America’s central bank has been using the housing market like a pinata for the last few decades. Continuous boom-bust cycles have left home buyers and sellers dazed and confused. The continuous bailouts and asset inflation have also made a lot of people rich. If you own the assets, inflation has been your friend.

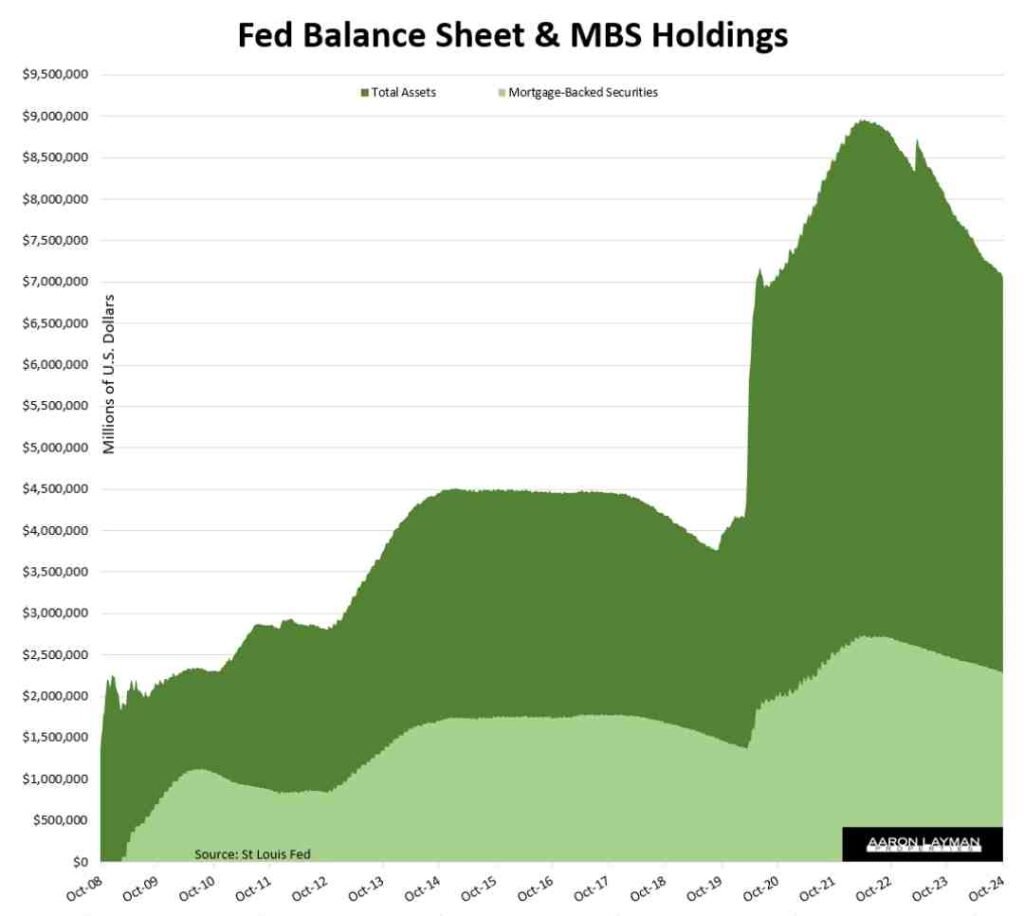

While the Fed is still sitting on a $2.28 trillion portfolio of mortgage-backed securities they are also creating more housing inequality and wealth inequality. This is the moral hazard of their continuous tinkering in the markets. It’s the Cantillon effect on a grand scale with real estate as a centerpiece. Something’s gotta give, but the Federal Reserve refuses to let the normal business cycle function.

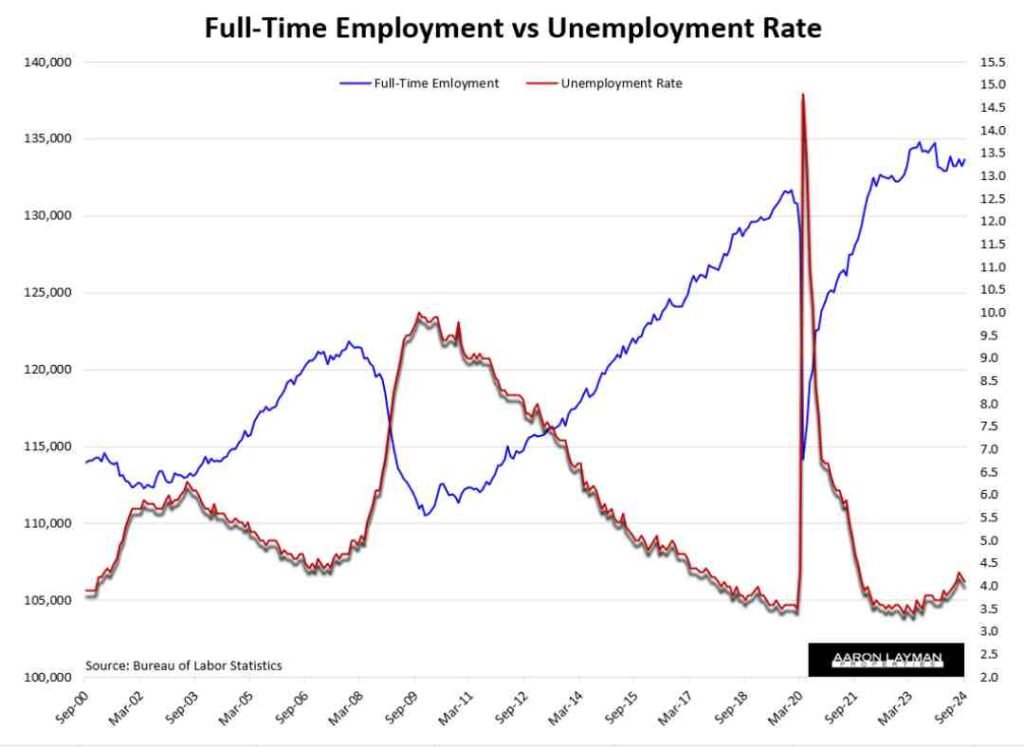

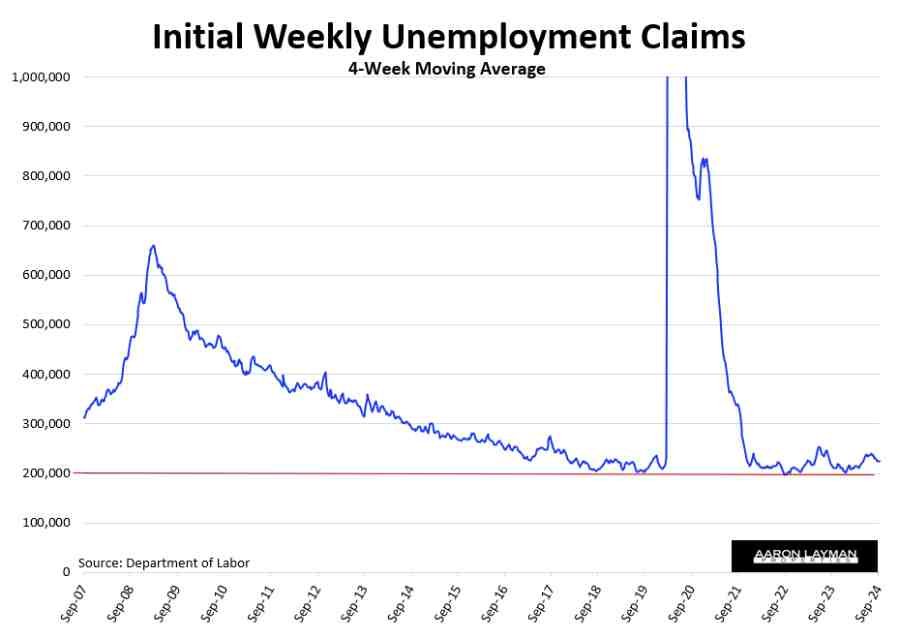

The Labor Market Refuses to Crack

The labor market refuses to crack. Recent data on employment shows the labor market is hanging tough. Initial weekly unemployment claims are still withing the lower trend. Job growth is still pretty solid by historical standards. The question is how much of the “growth” in recent years is sustainable.

We will eventually find out, but for now the labor market is not flashing a recession sign. It looks like more demand destruction will be needed to tame the American consumer.

If you are in the market to buy or sell a home, remember that our central bank is making it up as they go along. The “experts” running the U.S. financial system are just as confused as you are. There’s no guarantee we’ll see meaningfully lower rates absent a recession. That’s the entire point of a normal business cycle. There needs to be some pain to wash out the malinvestment and over-leveraged speculators.

The Fed is trying to bail those crony capitalists out before that happens.

Leave A Comment