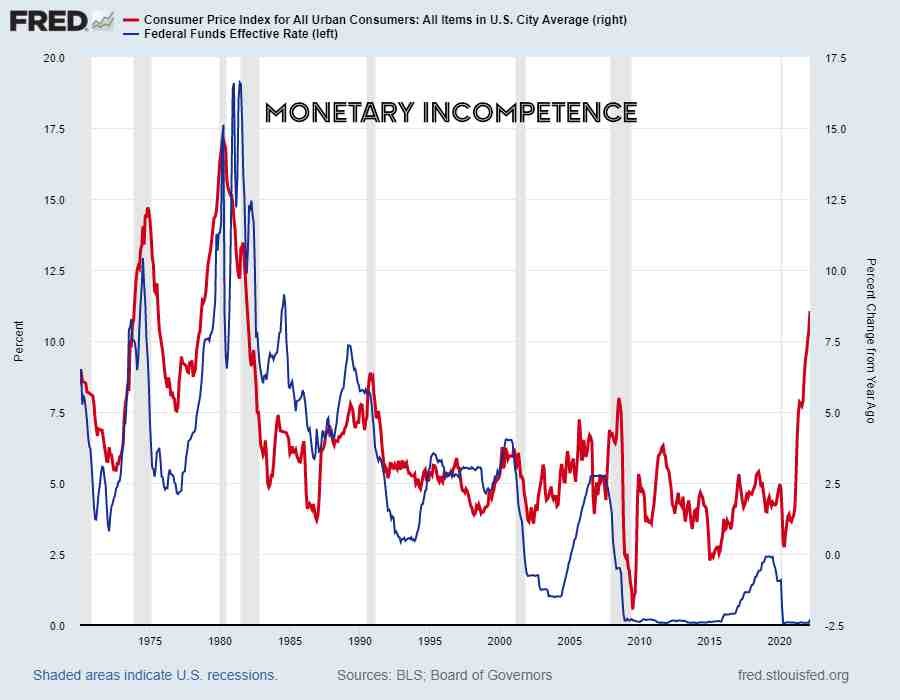

Powell Fires Warning Shot at the Housing Market

This is a rough transcript of Jerome Powell's remarks on housing during this week's post-FOMC press conference. I apologize for any errors. Powell's remarks on housing come around the 1:51 mark toward the end of the press conference. See video below. It appears Jerome has finally figured out housing inflation is a serious headwind to the Fed's efforts to curtail raging inflation. It makes you wonder what they were looking at for the entirety of 2021 when the Powell Fed was pretending inflation was transitory. Question from Bankrate's Mark Hamrick: I Wonder what your assessment [...]