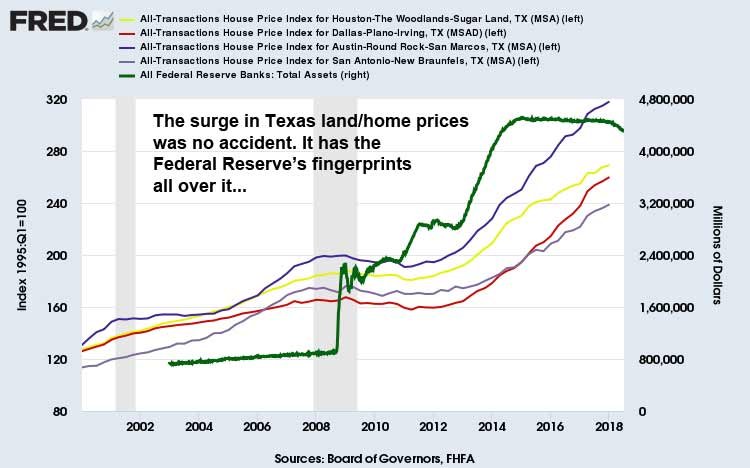

housing policy

Hoisington Q3 Update – Deflationary Wave Of Debt Will Stifle Yields

The deflationary wave of debt growing within multiple facets of the U.S. economy will stifle yields. That's the gist of Van Hoisington and Lacy Hunt's latest third quarter Review and Outlook. As the market was puking on the latest surge in Treasury yields above 3%, I couldn't help but notice that the publicly traded homebuilders were getting crushed yet again. With the Freddie Mac 30-year mortgage rate touching 4.9 percent this week (levels not seen in 7 years), things were getting even uglier for the housing sector. There was nowhere to hide this week if [...]