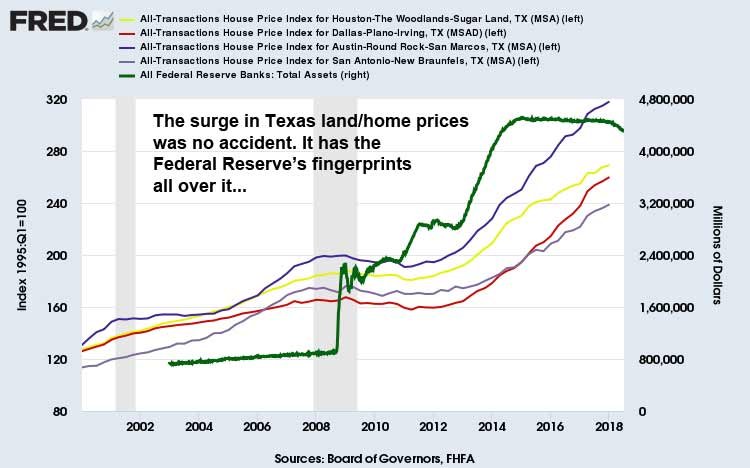

October New Home Sales Collapse, Near Three-Year Low

The Census Bureau numbers for October new home sales posted at a seasonally adjusted annual rate (SAAR) of 544,000 units. This was way below expectations of a 575,000 print, and near a three-year low. As I have been detailing for much of the year, much of that "pent-up demand" that you hear real estate industry mouthpieces talking about is a giant work of fiction, a tired marketing ploy that the media, economists and Realtors have been using in attempt to justify grossly inflated home prices across the U.S. Well, it appears the cat is officially [...]